The stock market, a bustling financial arena where rates fluctuate like waves in a vast ocean, is a realm of opportunity and risk. Investors and traders navigate its turbulent waters, deciphering the language of rates to ride the currents of profit. In this article, we delve into the intricate world of stock market rates, unraveling the mysteries that shape economies and fortunes alike. Join us on this journey of discovery as we uncover the secrets behind the numbers that fuel the heartbeat of global finance.

Table of Contents

- Exploring the Dynamics of Stock Market Rates

- Unraveling the Impact of Economic Indicators on Stock Market Rates

- Strategies to Navigate Volatility in Stock Market Rates

- Unlocking Opportunities Through Informed Decisions on Stock Market Rates

- Q&A

- To Conclude

Exploring the Dynamics of Stock Market Rates

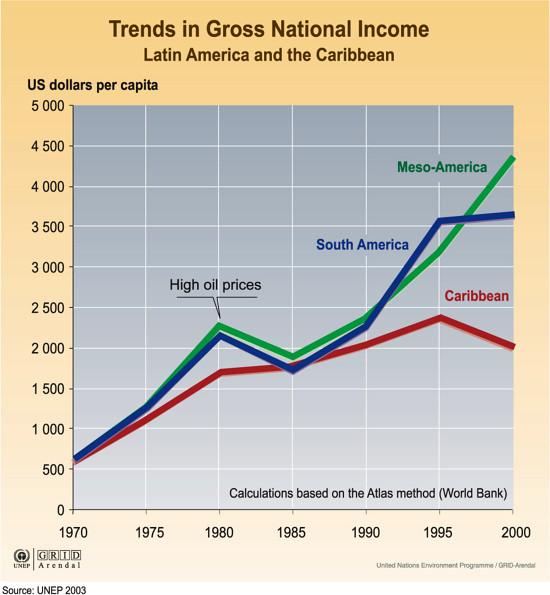

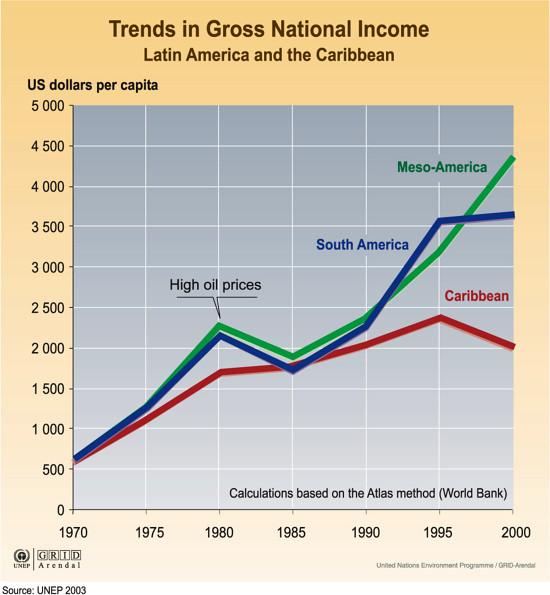

Understanding the intricate dance of stock market rates requires a keen eye for patterns and a willingness to dive into the ebbs and flows of financial data. Investors are constantly seeking insights into the ever-changing landscape of stock prices, where a blink of an eye can make the difference between profit and loss. Analyzing historical trends and staying abreast of current market conditions are vital for making informed decisions in the tumultuous world of stocks.

<p>From bullish rallies to bearish downturns, the stock market is a volatile arena where fortunes can be made or lost within moments. Keeping a watchful eye on key indicators such as price-earnings ratios, market capitalization, and industry trends can help investors navigate the labyrinth of stock market rates. Building a diversified portfolio and staying informed about global economic events are essential tools for weathering the storm of market fluctuations.</p>

Unraveling the Impact of Economic Indicators on Stock Market Rates

Understanding the intricate dance between economic indicators and stock market rates is like deciphering a complex puzzle with ever-changing pieces. These indicators, ranging from GDP growth and inflation rates to unemployment figures and consumer sentiment, have a profound impact on the mood and behavior of the stock market.

**Key factors to consider:**

– GDP Growth: A strong GDP growth rate often correlates with rising stock prices.

– Inflation Rates: High inflation can erode purchasing power, affecting stock market performance.

– Unemployment Figures: Lower unemployment rates generally signal a healthy economy, buoying stock market sentiment.

– Consumer Sentiment: Positive consumer outlook can drive spending, influencing stock market trends.

Strategies to Navigate Volatility in Stock Market Rates

In the realm of investing, the ever-changing landscape of stock market rates can often feel like a turbulent sea to navigate. However, with the right strategies in place, investors can weather the storm and even thrive amidst the volatility. One key approach is to **diversify** your portfolio across various asset classes to spread risk and minimize exposure to market fluctuations.

Moreover, staying informed and conducting thorough research are essential tools in your arsenal. By keeping a close eye on market trends, economic indicators, and company performance, you can make well-informed decisions that are grounded in data rather than emotions. Remember, in the world of stock market rates, knowledge is power, and foresight is your compass towards financial stability.

| Strategy | Benefits |

|---|---|

| Asset Diversification | Minimize Risk |

| Research & Analysis | Make Informed Decisions |

Unlocking Opportunities Through Informed Decisions on Stock Market Rates

Are you ready to delve into the dynamic world of stock market rates? Making informed decisions in the stock market can unlock a myriad of opportunities for investors, from maximizing profits to diversifying portfolios and mitigating risks. By staying abreast of the latest market trends and conducting thorough research, investors can position themselves strategically to capitalize on market fluctuations.

One key strategy for navigating stock market rates effectively is to keep a watchful eye on industry-specific news and financial reports. Utilizing reliable sources of information and leveraging analytical tools can provide valuable insights into market dynamics, helping investors make data-driven decisions. Additionally, staying informed about economic indicators and global trends can offer a broader perspective on market movements, enabling investors to adapt their strategies proactively. Embracing a disciplined approach and staying informed about stock market rates can pave the way for investors to seize opportunities and achieve long-term financial goals.

Q&A

Q: What are stock market rates and why are they important?

A: Stock market rates refer to the current prices at which stocks are bought and sold in the financial markets. These rates are crucial as they reflect the supply and demand dynamics of various securities, providing investors with real-time information on the value of their investments.

Q: How do stock market rates impact investors?

A: Stock market rates directly impact investors by determining the value of their holdings. Fluctuations in rates can lead to either gains or losses for investors, making it essential for them to stay informed and adapt their investment strategies accordingly.

Q: What factors influence stock market rates?

A: Several factors can influence stock market rates, including economic indicators, company performance, geopolitical events, and investor sentiment. These variables can cause rates to rise or fall, creating opportunities for investors to capitalize on market trends.

Q: How can investors navigate fluctuating stock market rates?

A: To navigate fluctuating stock market rates, investors are advised to conduct thorough research, diversify their portfolios, and stay informed about market trends. It’s essential to adopt a long-term investment approach and seek professional guidance when needed to navigate the complexities of the stock market effectively.

To Conclude

As we conclude our exploration of stock market rates, it becomes evident that these numbers hold within them the pulse of the financial world. Whether they rise with ambition or fall with uncertainty, they embody the dynamic nature of investments and the intricate dance of supply and demand. Remember, behind every fluctuation lies an opportunity for growth, a chance to delve deeper into the fascinating realm of trading. Let the rates guide your decisions, but let your intuition steer your journey through the ever-evolving landscape of the stock market. Stay curious, stay informed, and may your investments yield abundant returns. Here’s to navigating the volatility with wisdom and embracing the possibilities that each rate unveils. Thank you for joining us in this insightful exploration – until next time, happy trading!

0 Comments