Table of Contents

- Understanding Stock Market Performance Trends

- Key Indicators Influencing Market Movements

- Analyzing Sector Performance for Investment Opportunities

- Strategies for Navigating Volatile Markets

- Long-term Investment Approaches for Sustainable Growth

- Q&A

- Closing Remarks

Understanding Stock Market Performance Trends

Analyzing stock market performance trends involves understanding various factors that influence market fluctuations. These trends can indicate overall economic health and investor confidence. Common signals to monitor include corporate earnings reports, interest rates, and geopolitical events. For investors, recognizing these patterns can help in making informed decisions about when to buy or sell stocks. Key trends to consider include:

- Market Cycles: Stock markets tend to move in cycles, comprising expansion, peak, contraction, and trough phases.

- Sector Performance: Different sectors perform variably under changing economic conditions; for example, technology may thrive during booms while consumer staples hold steady during downturns.

- Volume Trends: High trading volume often signals strong investor interest, while decreasing volume can indicate market exhaustion.

Another critical aspect is the concept of bull and bear markets. A bull market is characterized by rising prices, encouraging buying, while a bear market features falling prices, prompting selling. Historical data illustrates these cycles, where investor sentiment significantly impacts the market direction. Below is a simplified table showing the average duration of bull and bear markets over the last century:

| Market Type | Average Duration | Percentage Gain/Loss |

|---|---|---|

| Bull Market | 5 years | 150% |

| Bear Market | 1.5 years | -35% |

Ultimately, understanding these trends requires continuous observation and analysis of various market indicators. Economic calendars detailing corporate earnings announcements, interest rate decisions, and significant economic reports can be valuable resources for investors. By keeping track of these trends, investors can better position themselves and make strategic choices, enhancing their potential for success in the stock market.

Key Indicators Influencing Market Movements

The stock market is profoundly influenced by a multitude of indicators that help traders and investors gauge its potential direction. Economic indicators, such as GDP growth, unemployment rates, and inflation levels, provide insights into the overall economic health. Rising GDP often signals robust market conditions, encouraging investment, while high unemployment can lead to bearish sentiment, as consumer spending tends to slow down. Inflation, when unchecked, erodes purchasing power and may prompt central banks to adjust interest rates, directly impacting stock valuations.

Another critical category of indicators encompasses market sentiment and investor behavior. Metrics such as the Volatility Index (VIX) reflect market fear or confidence. When the VIX rises, it typically indicates increased fear among investors, often leading to sell-offs. Conversely, measures like relatively high trading volume can indicate strong investor confidence, suggesting a bullish market phase. The Put/Call Ratio, which compares the trading volume of put options to call options, also serves as a useful barometer; a high ratio might signal bearish sentiment, while a low ratio might indicate bullish projections.

Lastly, geopolitical events and policy changes are pivotal in influencing market movements. For example, trade agreements or tariffs can dramatically sway investor confidence in specific sectors. Furthermore, central bank decisions regarding interest rates can lead to significant capital inflows or outflows, ultimately affecting stock prices. Monitoring developments in these areas can provide savvy investors with a tactical edge in making timely and informed investment decisions.

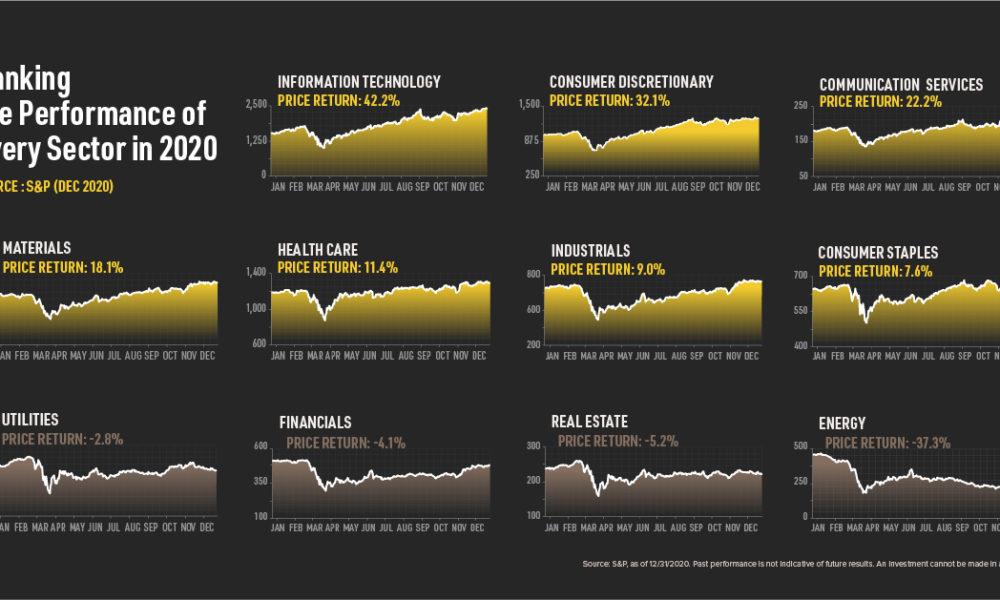

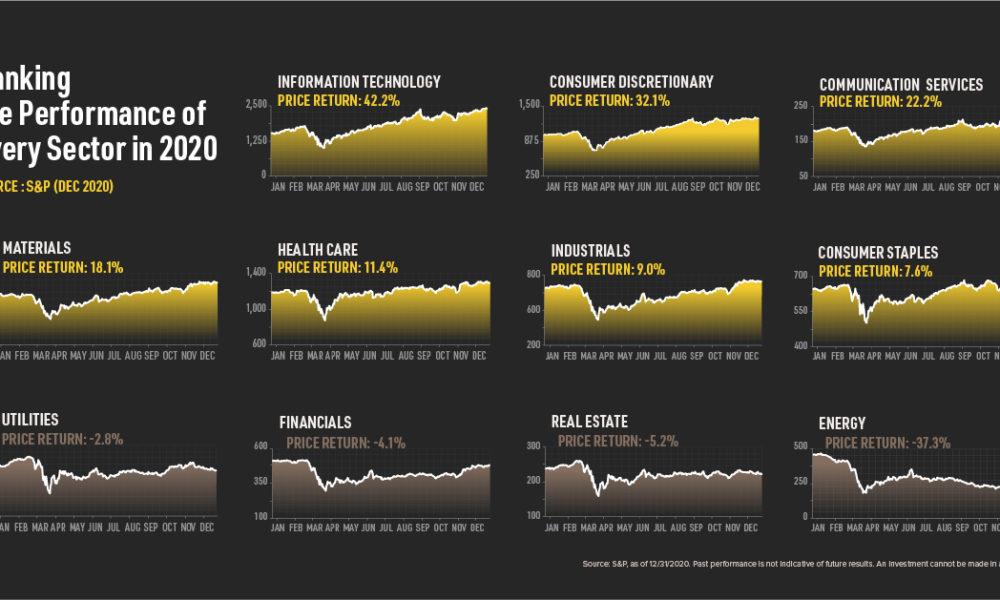

Analyzing Sector Performance for Investment Opportunities

Investors looking to maximize their returns need to delve into sector performance. By evaluating various sectors and understanding their trends, one can uncover lucrative investment opportunities. Consider factors such as economic indicators, regulatory changes, and technological advancements, which can significantly impact the performance of different sectors. An analytical view often reveals potential winners and losers in the marketplace.

To facilitate a clearer comparison among sectors, utilizing key performance metrics is essential. Metrics such as price-to-earnings ratios, market capitalization, and dividend yields can provide insightful benchmarks. Analyzing these can help investors recognize which sectors are thriving and which are struggling. Look out for:

- Growth Rate: Assess how fast a sector is expanding.

- Volatility: Examine how much the sector’s prices fluctuate.

- Correlation: Identify how sectors move in relation to broader market trends.

For a more structured understanding, the following table outlines the current performance of various key sectors, providing a quick reference for potential investors:

| Sector | 1-Year Growth (%) | P/E Ratio | Dividend Yield (%) |

|---|---|---|---|

| Technology | 25 | 35 | 1.5 |

| Healthcare | 15 | 20 | 3.0 |

| Financials | 10 | 12 | 2.5 |

| Consumer Discretionary | 8 | 18 | 1.0 |

By closely monitoring these indicators and sector-specific dynamics, investors can better position themselves for future growth. The constant evolution within sectors, influenced by global trends and market sentiment, creates a fertile ground for informed investment decision-making. Engaging in robust sector analysis will pave the way towards identifying viable opportunities that align with one’s investment strategy.

Strategies for Navigating Volatile Markets

Volatile markets can seem daunting, but strategic planning can turn uncertainty into opportunity. One effective approach is to diversify your investment portfolio. This involves spreading your investments across various asset classes, sectors, and geographies to mitigate risks. Instead of investing solely in equities, consider including fixed-income securities, commodities, and alternative investments. This strategy helps cushion the impact of market volatility on your overall returns.

Another important strategy is to maintain a long-term investment perspective. While short-term fluctuations may tempt you to change your strategy, keeping your focus on long-term goals can yield better results. Historical data shows that investments tend to rebound over time, providing significant returns despite transient market downturns. Emphasizing fundamentals over daily market noise allows investors to make more informed decisions without falling prey to emotional reactions.

cultivating a disciplined approach to asset allocation is critical in unpredictable markets. Regularly review and adjust your portfolio to remain aligned with your risk tolerance and financial objectives. Examples of effective asset allocation models include the following:

| Asset Class | Percentage |

|---|---|

| Equities | 50% |

| Bonds | 30% |

| Real Estate | 10% |

| Commodities | 5% |

| Cash | 5% |

Using these strategies can create a more resilient investment framework, allowing you to weather the ups and downs while pursuing your financial goals effectively.

Long-term Investment Approaches for Sustainable Growth

Investing with a long-term perspective can be a game changer in navigating the stock market effectively. This approach does not merely focus on quick gains but emphasizes patience and a well-thought-out strategy, aligned with one’s financial goals. By adopting a long-term mindset, investors can weather the volatility that comes with market cycles, reduce the risks associated with market timing, and benefit from compound interest over time.

Key considerations when choosing a long-term investment strategy include:

- Diversification: Spreading investments across various sectors can mitigate risks. A balanced portfolio might include stocks, bonds, mutual funds, and real estate.

- Regular Contributions: Consistent investment, often referred to as dollar-cost averaging, helps in buying more shares when prices are low and fewer shares when prices are high.

- Review and Adjust: While maintaining a long-term focus, it’s crucial to periodically evaluate your portfolio to ensure alignment with changing market conditions and personal goals.

Another essential aspect is understanding the financial health and future potential of the companies one chooses to invest in. Utilizing metrics such as P/E ratios, earnings growth, and market trends can provide insights into a stock’s viability for the long run. Below is a simplified comparison table of two potential investment options to demonstrate how different companies measure up:

| Company | P/E Ratio | Forecasted Growth (5 Years) | Dividend Yield |

|---|---|---|---|

| Tech Innovations Inc. | 25 | 20% | 1.5% |

| Sustainable Solutions Ltd. | 18 | 15% | 2.0% |

Assessing these factors not only aids in making informed decisions but also promotes a deeper understanding of market dynamics. By focusing on sustainable growth, investors can cultivate a portfolio that not only thrives in diverse market conditions but also supports a broader vision of economic resilience and responsibility.

0 Comments