Picture this: a bustling marketplace filled with the hustle and bustle of traders, the chime of the opening bell signaling the start of a new day. The stock market, a dynamic entity that ebbs and flows with the passage of time, reflects the heartbeat of the global economy. In this article, we delve into the fascinating journey of the stock market over time, unraveling its historical significance and exploring its evolution into the digital age. Join us as we embark on a captivating exploration of how the stock market has shaped and been shaped by the world around it.

Table of Contents

- – Evolution of Stock Market Trends: From Historical Patterns to Future Projections

- – Harnessing Long-Term Investment Strategies for Sustainable Growth

- – Navigating Market Volatility: Tips for Weathering Economic Storms

- – Diversification: Key to Building a Resilient Stock Portfolio

- Q&A

- To Conclude

– Evolution of Stock Market Trends: From Historical Patterns to Future Projections

In the vast landscape of financial markets, stock trading has witnessed a fascinating evolution, blending historical insights with futuristic projections that shape the investment world we know today. The stock market, like a living entity, breathes with the rhythms of time, reflecting economic shifts, technological advancements, and human behaviors that influence its ever-changing trends.

Exploring the intricate tapestry of stock market trends reveals a mosaic of patterns and cycles that guide investor decisions and market strategies. From the classic bull and bear markets to the emergence of disruptive trading technologies, each era leaves its unique imprint on the financial canvas. Investors navigate through waves of volatility, adapting to the ebb and flow of market sentiment while seeking opportunities for growth and stability in a dynamic landscape. Embracing both the legacy of the past and the innovation of the future, the stock market continues to captivate minds and shape the financial destinies of those who dare to venture into its realm of possibilities.

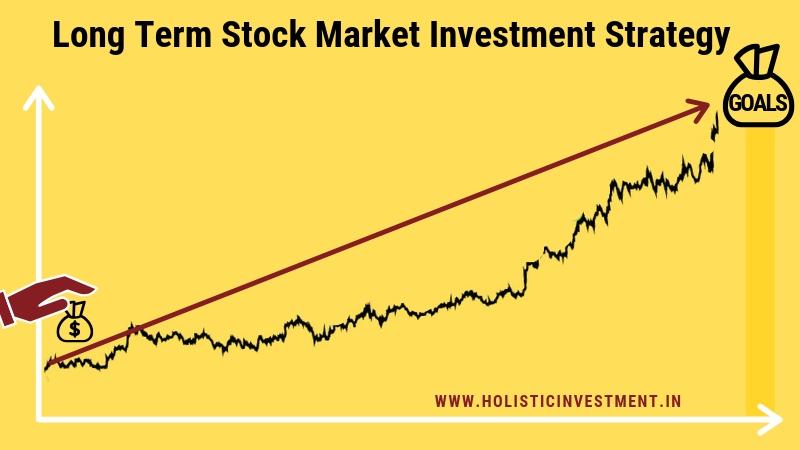

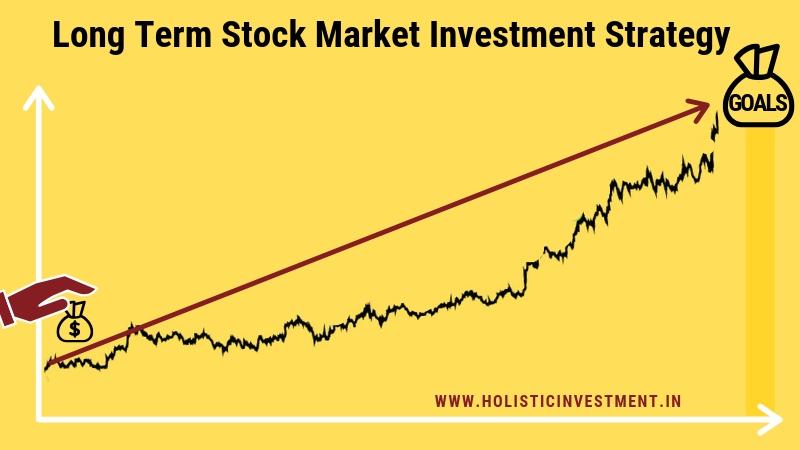

– Harnessing Long-Term Investment Strategies for Sustainable Growth

Efficiently utilizing long-term investment strategies is like planting seeds in a well-tended garden – the yields may not be immediate, but they promise sustainable growth over time. In the context of the stock market, adopting a patient and strategic approach can significantly amplify your investment returns. By diversifying your portfolio across various sectors and industries, you mitigate risks and position yourself to benefit from market upswings.

Key Points to Consider:

- Consistency is key: Regularly investing a fixed amount can leverage the power of compounding.

- Research diligently: Conduct thorough analysis before making investment decisions to align with your financial goals.

- Harness the potential: Identify undervalued stocks with strong growth prospects for long-term wealth accumulation.

When approaching long-term investments, envision a marathon, not a sprint. By focusing on sustainable growth rather than quick wins, you pave the way for a more stable financial future. Embrace the journey of wealth creation through thoughtful planning and prudent decision-making. Remember, successful investors think in decades, not days.

– Navigating Market Volatility: Tips for Weathering Economic Storms

In this unpredictable financial landscape, knowing how to navigate market volatility is crucial for investors looking to weather economic storms successfully. One key strategy is to diversify your investment portfolio, spreading your assets across different industries and asset classes to minimize risk. By avoiding putting all your eggs in one basket, you can better protect your investments from the ups and downs of the market.

Another essential tip is to stay informed and educated about market trends and economic indicators. Take the time to conduct thorough research and analysis before making investment decisions. Consulting with financial advisors or professionals can also provide valuable insights and guidance in making informed choices during turbulent times. By staying proactive and adaptable, investors can position themselves to not only survive but thrive in the face of market volatility.

| Investment Type | Recommended Allocation (%) |

|---|---|

| Stocks | 40% |

| Bonds | 30% |

| Real Estate | 20% |

| Commodities | 10% |

By carefully selecting a mix of stocks, bonds, real estate, and other assets, investors can create a resilient portfolio that can withstand the ebb and flow of the market. Embracing diversification not only cushions the impact of market downturns but also opens up opportunities for growth in different sectors or industries. Remember, the key lies in spreading your investments wisely, balancing risk and reward to achieve long-term financial objectives effectively.

Q&A

Q: How has the stock market evolved over time?

A: The stock market has undergone significant transformations throughout history, from its humble beginnings in the 17th century to the digital age of today. Initially, stock trading started in coffeehouses where merchants gathered to buy and sell shares of East India Company. Fast forward to the modern era, where stock exchanges operate electronically, enabling global trading in real-time.

Q: What are some key events that shaped the stock market over the years?

A: Various events have left an indelible mark on the stock market. From the Wall Street Crash of 1929 that led to the Great Depression to the dot-com bubble burst in 2000, these events redefined market dynamics and investor sentiment. Additionally, regulatory reforms like the establishment of the Securities and Exchange Commission (SEC) in the U.S. have improved transparency and investor protection.

Q: How do economic cycles impact the stock market?

A: Economic cycles play a crucial role in driving stock market trends. During economic expansions, stock prices generally rise as companies experience growth and profitability. Conversely, during recessions, stock prices may decline as businesses face challenges. Understanding these cycles is key for investors to navigate market volatility and make informed decisions.

Q: Can individuals benefit from long-term investments in the stock market?

A: Long-term investments in the stock market have historically yielded favorable returns. While short-term fluctuations are common, staying invested over the long run can help individuals benefit from compounding returns and weather market downturns. Diversification, patience, and a strategic investment approach are essential for long-term success in the stock market.

Q: How has technology impacted stock market trading?

A: Technology has revolutionized stock market trading, making it more accessible and efficient than ever before. The advent of online trading platforms and algorithmic trading has increased market liquidity and speed of transactions. Moreover, advancements like artificial intelligence and big data analytics have enabled sophisticated trading strategies and risk management techniques in the digital age.

To Conclude

As we journeyed through the evolution of the stock market over time, we peeled back the layers of history to uncover its fascinating growth and transformation. From the humble beginnings of trading under a buttonwood tree to the intricate web of global financial exchanges today, one thing remains constant – the market’s ability to adapt, evolve, and shape our world. We hope this exploration has shed light on the intricate tapestry of market forces that have shaped economies and influenced our lives. Remember, the stock market is not just numbers and graphs; it’s a reflection of human ingenuity, ambition, and resilience. Let’s continue to watch, learn, and participate in this ever-evolving saga of the stock market. Until next time, may your investments be prosperous and your insights be enlightening.

0 Comments