Table of Contents

- Market Momentum and Economic Indicators Driving Stock Prices Higher

- Strategies for Investors to Capitalize on a Rising Market

- Sector Performances: Where to Focus Your Investments

- Risk Management in an Upward Trend: Balancing Opportunities and Cautions

- Long-Term versus Short-Term Gains: Crafting Your Investment Plan

- Q&A

- The Way Forward

Market Momentum and Economic Indicators Driving Stock Prices Higher

The rising stock prices are largely fueled by a mix of market momentum and a series of encouraging economic indicators that investors are closely monitoring. Some of the critical factors contributing to this positive trend include:

- Strong Corporate Earnings: Companies are reporting earnings that surpass analyst expectations, which boosts investor confidence.

- Low Unemployment Rates: As the job market remains robust, consumer spending increases, leading to higher revenues for businesses.

- Interest Rate Stability: The Federal Reserve’s decision to maintain current interest rates has created a favorable environment for investment.

One of the defining aspects of the current market environment is the influx of capital. Investors are not just buying stocks; they are also diversifying their portfolios with various asset classes. This diversification is evident in the gradual rise of sectors that were previously undervalued. Key sectors driving this momentum include:

- Technology: With innovative breakthroughs and increasing demand, tech stocks have consistently outperformed.

- Renewable Energy: The global shift toward sustainability is rewarding investors in this expanding market.

- Consumer Discretionary: As disposable incomes rise, spending on non-essential goods also increases, benefiting this sector.

To put it simply, the synergy between market momentum and positive economic indicators creates a compelling case for continued growth in stock prices. Investors are leveraging these trends, and it reflects in their trading patterns. The table below summarizes essential indicators that keep the market upbeat:

| Indicator | Current Status | Impact on Market |

|---|---|---|

| GDP Growth Rate | 4.5% | Positive |

| Inflation Rate | 2.1% | Stable |

| Interest Rate | 3.0% | Supportive |

Strategies for Investors to Capitalize on a Rising Market

As the stock market trends upward, investors have a unique opportunity to leverage this momentum for greater financial gains. One effective approach is to diversify your portfolio across various sectors. This strategy not only mitigates risk but also increases the potential for returns by allowing investors to tap into different growth areas. Consider allocating funds to sectors such as technology, healthcare, and renewable energy, all of which have shown resilience and strong growth prospects.

Another key strategy is to focus on growth stocks, which typically outperform the broader market during bull runs. Look for companies with strong earnings growth, innovative products, and robust business models. These stocks can provide substantial returns as investor confidence grows. Additionally, keeping an eye on small-cap stocks can be beneficial, as they often experience rapid growth and may yield higher returns compared to their larger counterparts. Establishing a watchlist of promising growth companies can help streamline your investment decisions.

consider implementing a dollar-cost averaging strategy. In a rising market, investors may feel inclined to time their entry, but this can lead to missed opportunities. By consistently investing a fixed amount at regular intervals, you can capitalize on the upward trend while avoiding the pitfalls of market timing. This method not only allows you to benefit from priced fluctuations but also builds a disciplined investment habit, contributing to long-term growth.

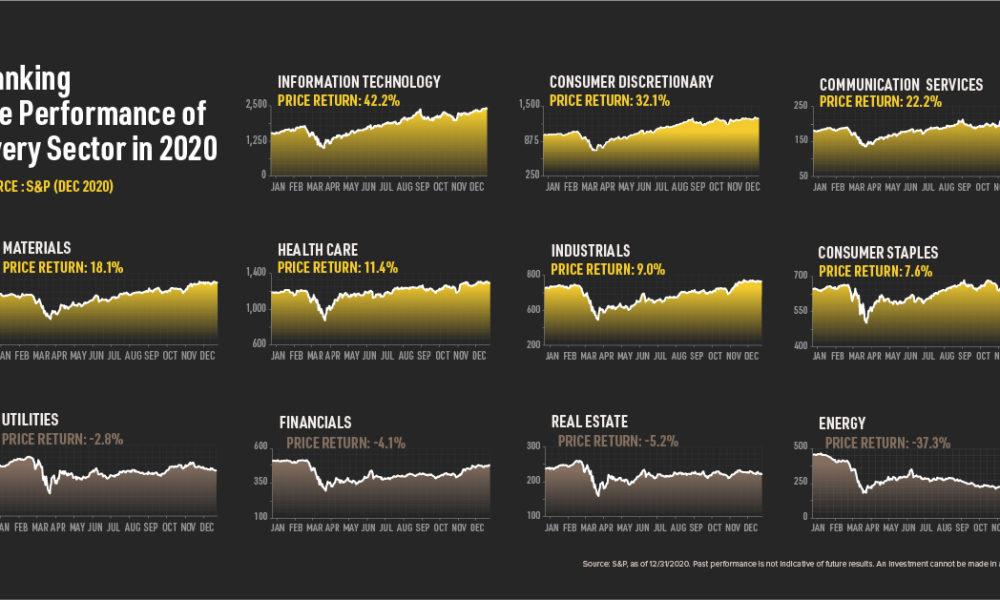

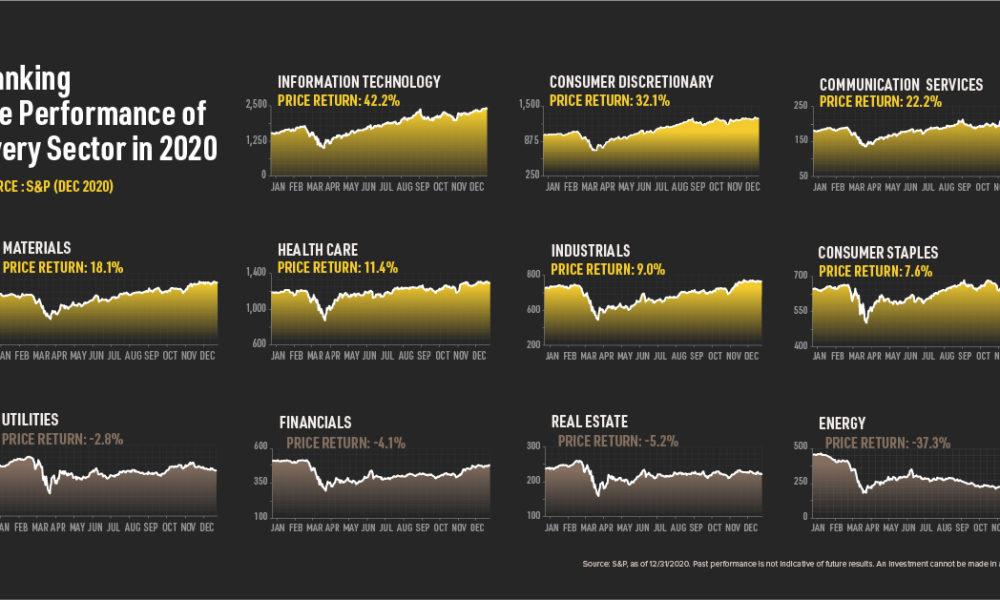

Sector Performances: Where to Focus Your Investments

As the stock market continues its upward trajectory, investors are keenly assessing which sectors are poised to deliver the best returns. Technology remains a dominant player, leveraging advancements in artificial intelligence, cloud computing, and cybersecurity to drive growth. Companies in this sector are not only maximizing their profits but also maintaining robust consumer demand, making technology stocks a compelling addition to any portfolio.

In addition to technology, the renewable energy sector is gaining momentum. With increasing awareness around climate change and a global push for sustainability, investments in solar, wind, and other green technologies have become more attractive. Government incentives and innovations are fueling this growth, offering opportunities for investors interested in supporting a sustainable future while also seeing favorable returns. This sector is expected to expand significantly over the coming years, making it a noteworthy focus area.

Furthermore, the healthcare sector continues to show resilience, especially as the world adapts to post-pandemic conditions. With advancements in biotech and pharmaceuticals coupled with an aging population, healthcare stocks can provide stability and growth potential. Investors should consider companies that specialize in telehealth services and personalized medicine, as these innovations are becoming increasingly relevant. Balancing a portfolio with stocks from these thriving sectors can enhance diversification while capitalizing on current market trends.

Risk Management in an Upward Trend: Balancing Opportunities and Cautions

As the stock market continues its upward trajectory, investors are presented with a unique blend of opportunities and challenges. The rising tide can inspire a sense of optimism, yet it is essential to navigate this landscape carefully. With the potential for substantial gains, many are eager to seize the moment. However, the risk of overextending or becoming overly reliant on bullish trends can lead to significant drawbacks. Balancing your investment strategy is critical during such periods of expansion.

Effective risk management involves identifying potential pitfalls that can accompany a market rally. It’s crucial to maintain a diversified portfolio to mitigate risks associated with individual stock volatility. Consider the following strategies for maintaining a balanced approach:

- Diversification: Spread investments across various sectors to reduce exposure to any single market downturn.

- Regular rebalancing: Adjust portfolio allocations periodically to align with risk tolerance and market conditions.

- Set stop-loss orders: Utilize stop-loss orders to protect against unexpected declines.

Furthermore, monitoring external indicators, such as economic data and industry trends, can provide important insights into when to be cautious. Below is a simple table outlining some key indicators to watch during uptrends:

| Indicator | Significance |

|---|---|

| Interest Rates | Affects borrowing costs and can influence investor sentiment. |

| Inflation Rates | Higher inflation can lead to increased volatility and potential corrections. |

| Earnings Reports | Positive or negative earnings can drastically shift market perceptions. |

Long-Term versus Short-Term Gains: Crafting Your Investment Plan

When investing in the stock market, understanding the distinction between long-term and short-term gains is critical for shaping your investment strategy. While short-term gains can provide quick wins and immediate liquidity, they often come with increased volatility and risk. Traders frequently engage in rapid buying and selling, driven by the market’s daily fluctuations. It’s essential to develop a clear risk tolerance and decide whether you are comfortable with the potential for sudden losses that can accompany these fast-paced transactions.

On the other hand, long-term investing focuses on the gradual accumulation of wealth over time, allowing investors to ride out the market’s ups and downs. This strategy typically involves holding onto investments for several years or even decades. Benefits of long-term investing include:

- Compounding returns that grow your initial investment exponentially over time.

- Reduced transaction costs due to fewer trades.

- A holistic view of the market, enabling you to capitalize on broader economic trends.

To tailor an investment plan that aligns with your financial goals, consider creating a diversified portfolio that balances both strategies. This approach can mitigate risks associated with market volatility while allowing for opportunities in various time frames. Here’s a simple breakdown highlighting factors to consider when crafting your plan:

| Factor | Short-Term Strategy | Long-Term Strategy |

|---|---|---|

| Investment Horizon | Less than 1 year | 1 year or more |

| Risk Level | High | Moderate to Low |

| Returns Expectation | Quick profits | Steady growth |

Q&A

Q&A: Understanding the Stock Market’s Rise

Q1: What does it mean when we say the stock market is going up? A1: When we refer to the stock market going up, we typically mean that the overall prices of stocks are increasing. This is often measured by market indices such as the S&P 500 or the Dow Jones Industrial Average. A rising market usually indicates investor confidence and can reflect positive economic indicators.Q2: What factors contribute to the stock market’s upward movement? A2: Several factors can drive the stock market higher, including strong corporate earnings, low unemployment rates, and favorable economic data. Additionally, government policies, low-interest rates, and global market trends also play crucial roles in influencing stock prices.

Q3: Is a rising stock market always a good sign for the economy? A3: Not necessarily. While a rising stock market can signal a healthy economy, it does not always reflect the economic situation for all demographics. Sometimes, stock prices may rise due to speculative trading or can be disconnected from underlying economic fundamentals.

Q4: How should investors react when the stock market is climbing? A4: Investors should remain level-headed and evaluate their investment strategies. While a rising market can present opportunities for profit, it’s essential to consider diversification and long-term goals rather than making impulsive decisions based on market trends.

Q5: Can the stock market continue to rise indefinitely? A5: Markets operate in cycles, including periods of growth and decline. While periods of growth can last for a significant time, there’s no guarantee that a bull market will continue without interruption. It’s crucial for investors to prepare for potential downturns and have a balanced approach to their portfolios.

Q6: How do international events affect the stock market in these times of growth? A6: International events, such as geopolitical tensions, trade agreements, and economic reports from abroad, can significantly impact investor sentiment. While a strong domestic market is encouraging, global events can create volatility that influences stock prices, reminding investors of the interconnectedness of the world economy.

Q7: What strategies can investors use to capitalize on a rising market? A7: Investors can consider strategies such as dollar-cost averaging (investing a set amount regularly), investing in index funds, or pursuing growth stocks. However, it’s crucial to conduct thorough research and ensure alignment with personal investment goals and risk tolerance, as market dynamics can shift rapidly.

Q8: What should individual investors keep in mind when the stock market goes up? A8: Individual investors should focus on their long-term investment strategy rather than getting swept up in short-term market trends. It’s vital to regularly reassess their portfolios and investment priorities, ensuring they remain grounded in their financial objectives. Consistency and patience generally yield the best results in investing.—With these insights, investors can navigate the ebbs and flows of the stock market, understanding that its upward trajectory is just one piece of the larger economic puzzle.

0 Comments