In the unpredictable realm of the stock market, where fortunes rise and fall on the whims of investors, the concept of “stock market edges” emerges as a beacon of strategic advantage. These unique edges provide a window into the elusive world of financial success, offering a glimpse into the power of data, analysis, and informed decision-making. Join us as we delve into the intricate web of stock market edges, exploring the hidden strategies and insights that set savvy investors apart in the quest for profitable opportunities.

Table of Contents

- Unveiling Unique Strategies for Gaining Stock Market Edges

- Analyzing Data-Driven Approaches to Enhance Trading Performance

- Exploring Behavioral Finance Techniques to Maximize Market Opportunities

- Implementing Tactical Asset Allocation for Sustainable Investment Growth

- Q&A

- Wrapping Up

Unveiling Unique Strategies for Gaining Stock Market Edges

In the dynamic world of the stock market, gaining an edge is crucial for investors looking to outperform the market. To stay ahead of the curve, consider incorporating unique strategies that can provide you with a competitive advantage. One effective approach is to diversify your portfolio across various sectors and asset classes to minimize risk and maximize returns.

Another strategy to consider is technical analysis, which involves studying past market data to identify trends and patterns that can help predict future price movements. By combining fundamental analysis with technical indicators, you can make more informed investment decisions. Embracing unconventional methods like social sentiment analysis and algorithmic trading can also offer fresh perspectives and potentially uncover hidden opportunities in the market.

| Strategy | Description |

|---|---|

| Portfolio Diversification | Spread investments across different sectors and asset classes. |

| Technical Analysis | Use historical market data to predict future price movements. |

| Social Sentiment Analysis | Analyze social media trends to gauge market sentiment. |

| Algorithmic Trading | Automate trading decisions based on predefined algorithms. |

Analyzing Data-Driven Approaches to Enhance Trading Performance

When delving into the realm of stock market strategies, it is imperative to explore the various data-driven approaches that can significantly enhance trading performance. Through meticulous analysis of market trends, historical data, and statistical models, traders can uncover valuable insights to gain a competitive edge in the ever-evolving financial landscape. Employing sophisticated algorithms and advanced tools can empower traders to make informed decisions backed by data-driven strategies.

Embracing quantitative analysis and harnessing the power of machine learning algorithms can provide traders with a systematic framework to identify potential trading opportunities, mitigate risks, and optimize portfolio performance. By leveraging historical data to detect patterns, correlations, and anomalies, traders can fine-tune their trading strategies and capitalize on market inefficiencies effectively. Incorporating data-driven approaches not only enhances decision-making processes but also fosters a more disciplined and analytical approach to navigating the complexities of the stock market.

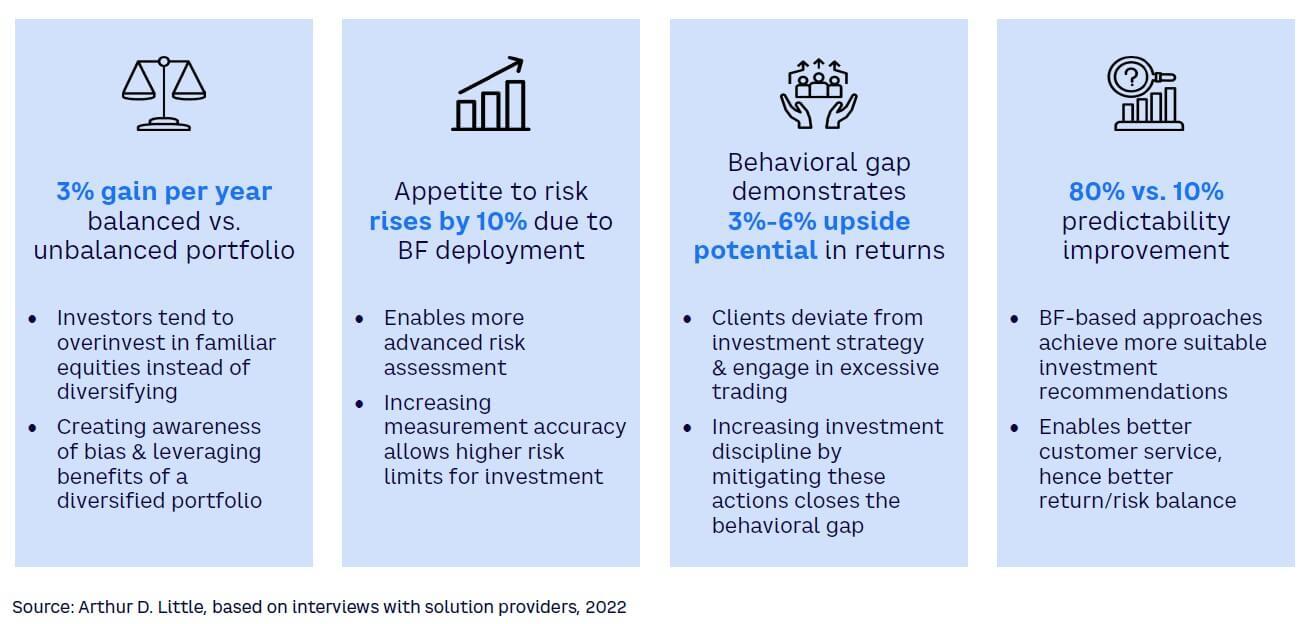

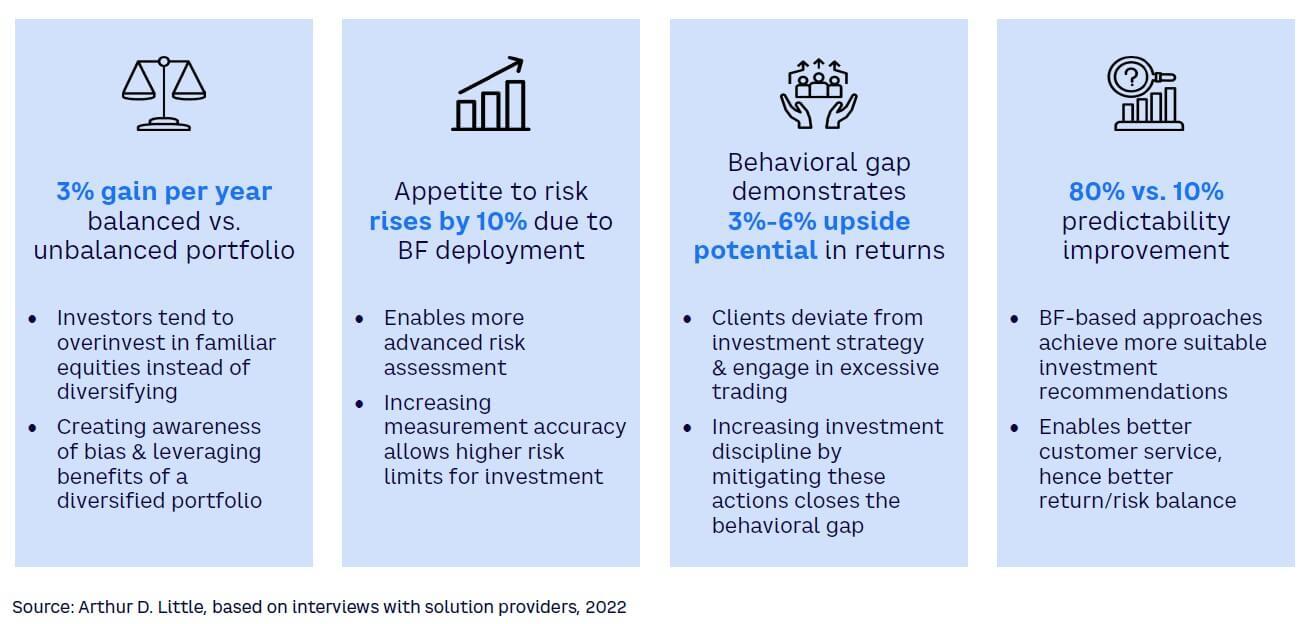

Exploring Behavioral Finance Techniques to Maximize Market Opportunities

In the dynamic world of stock market trading, gaining valuable insights and leveraging behavioral finance techniques can provide you with the edge needed to navigate through market uncertainties. By delving into the behavioral aspects of investing, traders can better understand market psychology and make informed decisions to capitalize on emerging opportunities.

Key elements of behavioral finance techniques include:

- Anchoring Bias: Recognizing and avoiding the tendency to rely heavily on initial information.

- Herd Mentality: Understanding the impact of group behavior on market trends.

- Loss Aversion: Managing the fear of losses to prevent rash decision-making.

- Confirmation Bias: Being aware of seeking information that confirms existing beliefs, which may cloud judgment.

Incorporating these techniques into your trading strategy can enhance your ability to interpret market signals, anticipate shifts, and optimize your investment decisions. By embracing a behavioral finance mindset, you can unearth hidden patterns, mitigate risks, and position yourself to maximize your market opportunities effectively.

| Behavioral Finance Techniques | Benefits |

|---|---|

| Anchoring Bias | Avoiding overreliance on initial data |

| Herd Mentality | Understanding market behavior trends |

| Loss Aversion | Managing fear of losses |

| Confirmation Bias | Guarding against biased decision-making |

<p>Looking to gain an advantage in the dynamic world of investments? Exploring stock market edges can be a strategic approach to enhancing your portfolio. By understanding and implementing tactical asset allocation, investors can navigate market fluctuations with a focus on sustainable growth.</p>

<p>**Benefits of incorporating tactical asset allocation:**</p>

<ul>

<li>Opportunity to capitalize on short-term market inefficiencies</li>

<li>Flexibility to adjust investment positions based on current market conditions</li>

<li>Diversification across asset classes to manage risk effectively</li>

</ul>

<table class="wp-block-table">

<thead>

<tr>

<th>Stock Market Edges</th>

<th>Key Points</th>

</tr>

</thead>

<tbody>

<tr>

<td>Technical Analysis</td>

<td>Identifying patterns and trends for informed decision-making</td>

</tr>

<tr>

<td>Behavioral Finance</td>

<td>Understanding investor psychology to anticipate market movements</td>

</tr>

<tr>

<td>Quantitative Models</td>

<td>Utilizing data-driven strategies for optimized portfolio management</td>

</tr>

</tbody>

</table>

0 Comments