Table of Contents

- Analyzing the Stock Market Close Understanding Key Indicators

- Navigating Post-Close Trends for Informed Decisions

- How to Leverage Closing Data for Future Investments

- Strategies for After-Hours Trading Success

- Interpreting Market Close Reports for Enhanced Portfolios

- Q&A

- The Conclusion

Analyzing the Stock Market Close Understanding Key Indicators

Each trading day, evaluating how stocks end can provide valuable insights for investors and analysts alike. There are several key indicators that are often scrutinized to gauge market trends and investor sentiment. Closing prices offer a snapshot of a stock’s value at the end of the trading day, serving as a barometer for daily performance. Another essential metric is the volume of shares traded; a substantial increase in trading volume, compared to the average, might indicate a significant market event, suggesting that investors are actively buying or selling based on recent news or expectations.

Examining moving averages is also crucial for understanding market momentum. The 50-day and 200-day moving averages often signal whether a trend is temporary or indicative of a longer-lasting shift. For instance, when a stock’s closing price crosses above its 200-day moving average, it might signal a bullish trend. Conversely, dropping below this average could indicate bearish tendencies. Investors frequently use these signals to strategize their entry and exit points in the market.

Another important tool for analysis is the market indices such as the S&P 500, Dow Jones Industrial Average, and NASDAQ Composite. These indices represent broad segments of the stock market and can shed light on general market health. Here’s a quick comparison of recent index trends:

| Index | Closing Value | % Change |

|---|---|---|

| S&P 500 | 4,118.63 | -0.20% |

| Dow Jones | 33,301.87 | +0.15% |

| NASDAQ | 12,564.91 | -0.30% |

Using these indices, investors can ascertain whether declines are localized or part of a broader market downturn, helping them formulate more informed investment decisions. Together, these indicators create a comprehensive view of market activity, driving strategic choices in portfolios and broader market investments.

Navigating Post-Close Trends for Informed Decisions

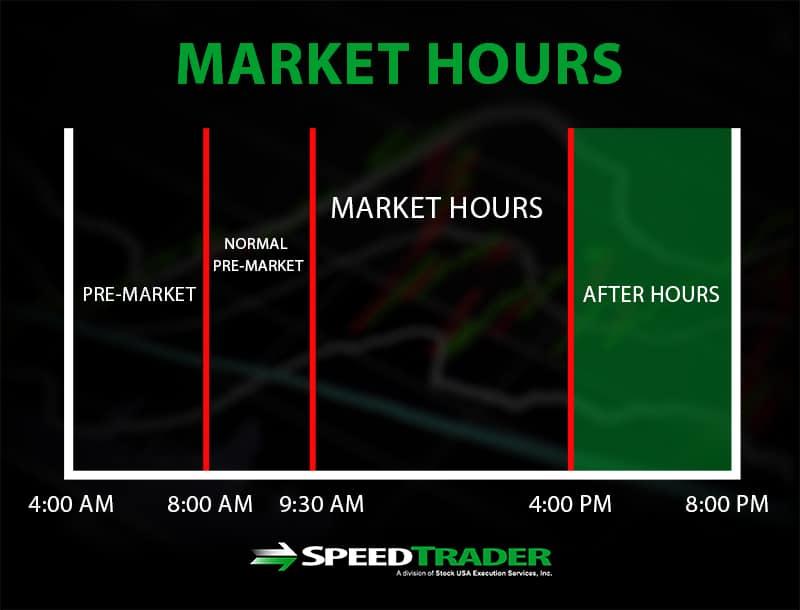

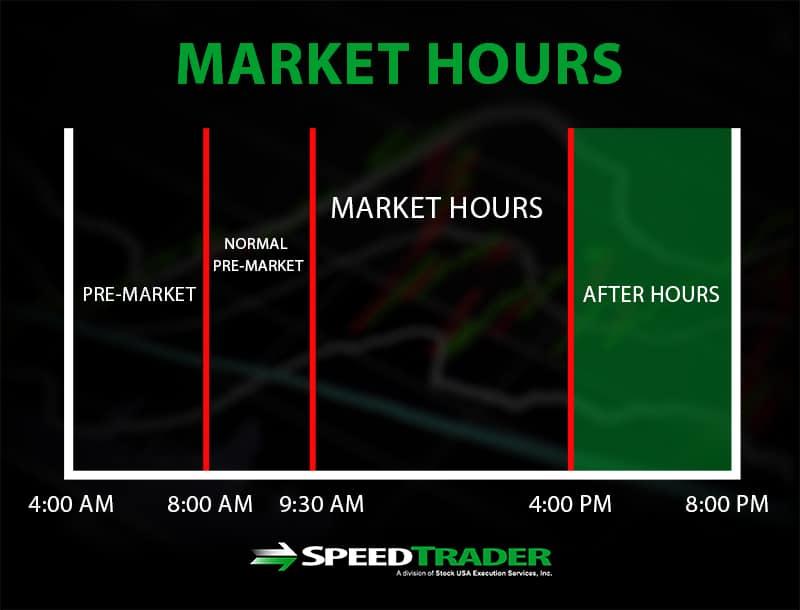

In the dynamic realm of stock markets, the moments following the closing bell are just as critical as the trading hours themselves. Post-close trends hold invaluable insights for making informed financial decisions. Investors and analysts scrutinize this period for signals that could influence the opening of the next trading day. Key activities such as after-hours trading and earnings reports can present a clearer picture of market sentiment and potential shifts.

- After-hours trading offers a lens into ongoing trader activities

- Company earnings and announcements often surface in this period

- Market sentiment analysis can provide strategic insights

Another significant aspect to consider is the trend of global market interactions. As U.S. markets close, many international markets are just beginning their trading day. This overlap provides investors with early insights into potential impacts on their own stocks driven by international developments. Observing these global patterns enables traders to be proactive rather than reactive, aligning their strategies with evolving global economic indicators.

| Event | Impact |

|---|---|

| After-Hours Trading | Provides liquidity and insight into market trends |

| Global Market Open | Influences domestic opening prices |

Staying attuned to these post-market signals requires both diligence and a strategic approach. Applying analytical tools that track market patterns and utilizing AI-driven data analyses can enhance decision-making processes. Incorporating such strategies equips traders and investors with the agility needed to adapt to rapid changes, leading to better forecasting and improved portfolio management. As the stock market environment continues to evolve, mastering the art of interpreting post-close trends remains a critical component of successful investing.

How to Leverage Closing Data for Future Investments

Analyzing daily closing data from the stock market can provide invaluable insights for identifying profitable future investments. Closing prices offer a snapshot of market sentiments, revealing trends that might not be apparent during intraday transactions. By plotting these data points across a timeline, investors can identify upward or downward trajectories and discern whether they coincide with broader market trends or are isolated anomalies. Such analysis not only guides where to allocate resources but also enables investors to gauge risk levels associated with particular stocks or sectors.

- Spot trends over time by comparing historical closing prices.

- Use technical analysis tools, such as moving averages, to confirm these trends.

- Identify patterns, such as head and shoulders, to predict potential reversals.

Furthermore, closing data can be instrumental in benchmarking against indexes like the S&P 500 or Dow Jones. This comparative approach informs investors about relative performance, aiding in better decision-making. Here’s a simplified example:

| Company | Closing Price | % Change (Week) |

|---|---|---|

| XYZ Corp | $45.67 | +3.4% |

| ABC Inc | $123.78 | -1.2% |

| LMN Ltd | $89.56 | +0.8% |

Such data integration sharpens investment strategies by offering clearer perspectives on high and low performers. Incorporating historical closing data with other financial metrics like P/E ratios or dividend yields further enhances decision-making processes, ensuring that choices are informed, calculated, and timely.

Strategies for After-Hours Trading Success

Understanding the dynamics of after-hours trading is crucial to leveraging opportunities that lie beyond the regular stock market hours. Volatility can be more pronounced in this timeframe, offering potential gains as well as risks. Monitoring relevant news releases and financial reports is essential, as these can dramatically influence stock prices during this period. Many investors utilize economic calendars to track scheduled announcements, ensuring they’re prepared to act swiftly based on new data.

Another effective strategy is to set limit orders instead of market orders when trading after-hours. The lower liquidity and higher volatility mean that prices can fluctuate rapidly. By placing limit orders, you can control the price you are willing to accept, thus protecting yourself from unexpected price spikes. Additionally, this approach allows traders to maintain discipline, reducing emotional decision-making in the face of sudden market shifts.

Seasoned traders may also benefit from correctly identifying after-hours patterns using technical analysis. This involves studying historical price movements and trading volumes to forecast trends. The table below highlights some common tools used in technical analysis:

| Tool | Description |

|---|---|

| Moving Averages | Smooths out price data to identify trends over time. |

| MACD | Tracks momentum changes, helping to spot potential buy/sell signals. |

| RSI | Assesses overbought or oversold conditions in a security’s price. |

Interpreting Market Close Reports for Enhanced Portfolios

To truly harness the potential of market close reports, investors must analyze key metrics that offer insights into trends and anomalies. Essential indicators include closing prices, trading volumes, and market capitalization. These elements serve as vital signposts for astute investors aiming to anticipate market shifts. By paying close attention to these details, you can uncover patterns that may not be immediately apparent, providing a deeper understanding of potential opportunities and risks.

Delving deeper, understanding the nuances of after-hours trading can provide an edge. After-hours sessions often reflect the impact of breaking news or earnings reports released post-traditional closing times. Investors should monitor the following:

- Significant price fluctuations: Sharp changes can indicate investor sentiment shifts.

- Volume spikes: High volumes may suggest broader interest or insider movements.

- Sector-specific trends: Identify if changes are isolated or part of a broader sector movement.

Ultimately, making informed decisions relies on interpreting various elements collated in a cohesive way. Consider integrating technology for enhanced data visualization and analysis. Here’s a simplified view of how different data points might impact your portfolio decisions:

| Data Point | Potential Impact |

|---|---|

| Closing Price | Gauge company stability and market sentiment |

| Trading Volume | Assess investor interest and liquidity |

| Market Capitalization | Understand company size and value |

By effectively interpreting these reports, investors can fine-tune their strategies, leading to potentially more lucrative portfolio choices.

0 Comments