Imagine strolling through the bustling streets of the financial district, where whispers of “Stock Market Apple” seem to echo from every corner. What secrets lie behind this intriguing phenomenon that merges the world of technology with the complexities of investments? Join us on a journey to unravel the mystique surrounding Stock Market Apple, where innovation meets speculation in the ever-evolving landscape of finance.

Table of Contents

- – Unveiling the Impact of Apple’s Product Launch Events on the Stock Market

- – Analyzing Apple’s Financial Performance and Its Influence on Stock Market Trends

- – Understanding Investor Sentiment Surrounding Apple Stock and Key Considerations

- – Expert Tips for Navigating the Stock Market with Apple as a Focal Point

- Q&A

- Wrapping Up

– Unveiling the Impact of Apple’s Product Launch Events on the Stock Market

Apple’s highly anticipated product launch events have become major highlights within the tech industry, captivating audiences worldwide. Beyond the excitement of new gadgets and features, these events can have a profound impact on Apple’s stock performance. Investors keenly observe these events as announcements of innovative products and services often influence market trends and investor sentiment.

During and after Apple’s product unveilings, stock prices may experience fluctuations based on factors such as consumer response, sales projections, and competitive landscape shifts. Positive reviews and strong demand for newly launched devices can boost investor confidence and drive stock prices up. Conversely, any unexpected product issues or underwhelming releases may lead to temporary dips in Apple’s stock value. It’s fascinating to witness the interconnected relationship between Apple’s product launches and the dynamic reactions of the stock market, showcasing the intricate dance between technological innovation and financial markets.

– Analyzing Apple’s Financial Performance and Its Influence on Stock Market Trends

Analyzing Apple’s Financial Performance and Its Influence on Stock Market Trends

Apple’s financial performance is a pivotal factor influencing stock market trends worldwide. As one of the most valuable companies globally, the tech giant’s quarterly earnings reports often sway investor sentiment and impact market movements. Investors closely monitor metrics such as revenue growth, profit margins, and product sales to gauge Apple’s financial health and its potential impact on stock prices.

Additionally, Apple’s strategic decisions, such as product launches, acquisitions, and innovations, play a crucial role in shaping market trends. The company’s ability to adapt to changing consumer demands and technological advancements directly influences its stock performance. Understanding the intricate relationship between Apple’s financial data and stock market dynamics is essential for investors seeking to make informed decisions in the ever-evolving financial landscape.

– Understanding Investor Sentiment Surrounding Apple Stock and Key Considerations

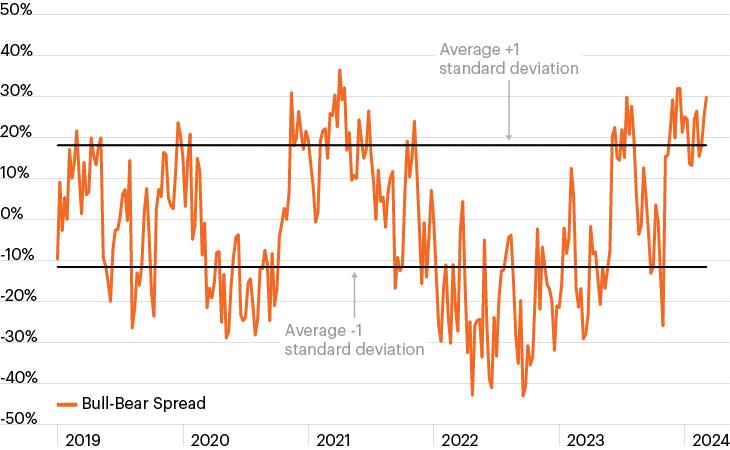

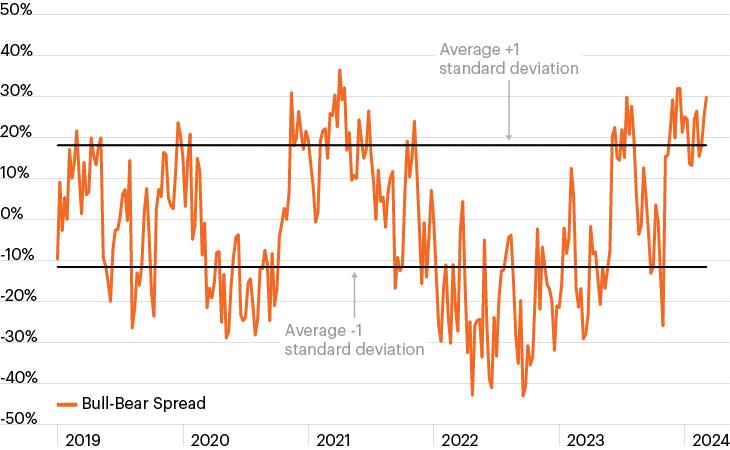

Investor sentiment plays a pivotal role in shaping the stock market landscape, especially when it comes to a tech giant like Apple. Understanding the various factors that influence investor sentiment surrounding Apple stock can provide valuable insights for both seasoned investors and newcomers to the market. By monitoring key indicators and staying abreast of the latest developments in the tech industry, investors can make more informed decisions regarding their Apple stock holdings.

When delving into the realm of investor sentiment, it’s essential to consider both the internal and external factors that impact Apple stock’s performance. Factors such as product launches, financial performance, market trends, and macroeconomic conditions can all sway investor sentiment in different directions. Keeping a close eye on analyst reports, consumer feedback, and industry news can help investors gauge the prevailing sentiment and adjust their strategies accordingly. Staying informed and adaptable is key to navigating the dynamic world of stock market investments, particularly when it comes to a high-profile company like Apple.

| Key Considerations | Impact on Investor Sentiment |

|---|---|

| Diversification of Product Portfolio | Boosts Confidence |

| Market Competition | Creates Uncertainty |

| Regulatory Developments | Can Cause Volatility |

– Expert Tips for Navigating the Stock Market with Apple as a Focal Point

Investing in the stock market can be both exciting and challenging, especially when focusing on a powerhouse like Apple. To navigate successfully, consider diversifying your portfolio beyond just Apple stock. **Diversification** helps spread risk and can potentially lead to more stable returns over time. Look into other tech companies, industries, or even index funds to create a well-rounded investment strategy.

Moreover, staying informed about Apple’s latest developments, products, and market trends is crucial. Set up alerts for Apple news, follow reliable financial news sources, and monitor key performance indicators. Remember, the stock market can be volatile, so always be prepared to ride out fluctuations and make informed decisions based on thorough research and analysis. Keeping a long-term perspective is key to weathering the ups and downs of the market.

Q&A

Q&A: Decoding the Relationship Between the Stock Market and Apple

Q: How does the stock market impact Apple’s performance?

A: The stock market plays a significant role in influencing Apple’s performance as a company. Fluctuations in the market can impact Apple’s stock price, market capitalization, and investor confidence.

Q: What factors can affect Apple’s stock price in the stock market?

A: Several factors can influence Apple’s stock price, including company performance, product releases, economic conditions, industry trends, competitive landscape, and overall market sentiment.

Q: Should investors consider investing in Apple in the current stock market environment?

A: Investors should carefully evaluate Apple’s financial health, growth prospects, competitive position, and market conditions before making investment decisions. Consulting with financial advisors and conducting thorough research is advisable.

Q: How does Apple’s performance in the stock market affect its business strategy?

A: Apple’s performance in the stock market can impact its strategic decisions related to product development, marketing initiatives, acquisitions, capital allocation, and overall corporate governance.

Q: What are some key trends to watch for regarding Apple in the stock market?

A: Investors should keep an eye on Apple’s innovation pipeline, competitive positioning, global market expansion, regulatory developments, consumer demand trends, and macroeconomic indicators to gauge potential opportunities and risks.

Q: How does Apple navigate challenges in the stock market to sustain growth and profitability?

A: Apple employs a combination of financial planning, risk management strategies, operational efficiency, product diversification, R&D investments, and customer-focused initiatives to navigate challenges in the stock market and maintain its market leadership.

Q: What role does investor sentiment play in shaping Apple’s stock market performance?

A: Investor sentiment, influenced by factors such as earnings reports, product launches, macroeconomic conditions, industry trends, and geopolitical events, can impact Apple’s stock price movement and overall market valuation.

Q: How can individuals stay informed about Apple’s stock market performance and related news?

A: Individuals can stay updated on Apple’s stock market performance by monitoring financial news sources, following analyst reports, tracking key performance indicators, attending investor conferences, and utilizing online platforms for real-time data and insights.

Q: What long-term prospects does Apple have in the stock market landscape?

A: Apple’s long-term prospects in the stock market are closely tied to its ability to innovate, adapt to changing market dynamics, capitalize on emerging technologies, expand its ecosystem, leverage its brand strength, and deliver value to shareholders and customers alike.

Wrapping Up

As we wrap up our exploration of the exciting world of Apple in the stock market, we hope this article has provided you with valuable insights and knowledge. Whether you’re a seasoned investor or just starting to dip your toes into the financial landscape, understanding how Apple performs in the stock market can be both fascinating and rewarding. Remember, the stock market is ever-evolving, so staying informed and adaptable is key to success. Keep a keen eye on Apple’s stock performance and innovative developments to make informed decisions and potentially reap the benefits of this tech giant’s journey on the market. Thank you for joining us on this financial odyssey, and may your investments always bear fruit!

0 Comments