Table of Contents

- Understanding the Role of 401k in Stock Market Investments

- Maximizing Your 401k Contributions for Optimal Growth

- Diversification Strategies for a Healthy 401k Portfolio

- The Impact of Market Trends on Your 401k Performance

- Navigating Fees and Costs in Your 401k Plan

- Q&A

- Final Thoughts

Understanding the Role of 401k in Stock Market Investments

The 401(k) is more than just a retirement savings plan; it serves as a crucial player in the realm of stock market investments. By offering a disciplined approach to saving for retirement, a 401(k) encourages participants to set aside a portion of their salary into a tax-advantaged account. This not only fosters a habit of saving, but also allows for growth through various investment options, including stocks, mutual funds, and ETFs. The tax benefits associated with a 401(k) make it an attractive option for those looking to build wealth over time, as contributions are made before taxes are deducted, essentially lowering taxable income in the current year.

Within a 401(k), employees often have the flexibility to choose their investment strategy. This can include a range of options such as:

- Stocks: Directly invest in individual companies.

- Mutual Funds: Pool resources with other investors to purchase a diverse selection of stocks.

- ETFs: Exchange-traded funds that offer exposure to broad market indices.

This choice empowers participants to align their investment strategy with their financial goals, risk tolerance, and time horizon. A well-diversified portfolio within a 401(k) can potentially lead to greater returns, as it lessens the impact of volatility in the market.

To highlight the impact of contributions and compounding over time, consider the following example for different contribution scenarios:

| Annual Contribution | Years Invested | Estimated Total Value |

|---|---|---|

| $5,000 | 20 | $202,000 |

| $10,000 | 20 | $404,000 |

| $15,000 | 20 | $606,000 |

This table illustrates how even modest contributions can accumulate significantly over two decades due to the power of compound interest, underscoring the importance of starting early. Therefore, leveraging a 401(k) not only promotes long-term savings but also provides an opportunity to strategically engage with the stock market, setting the foundation for a financially secure retirement.

Maximizing Your 401k Contributions for Optimal Growth

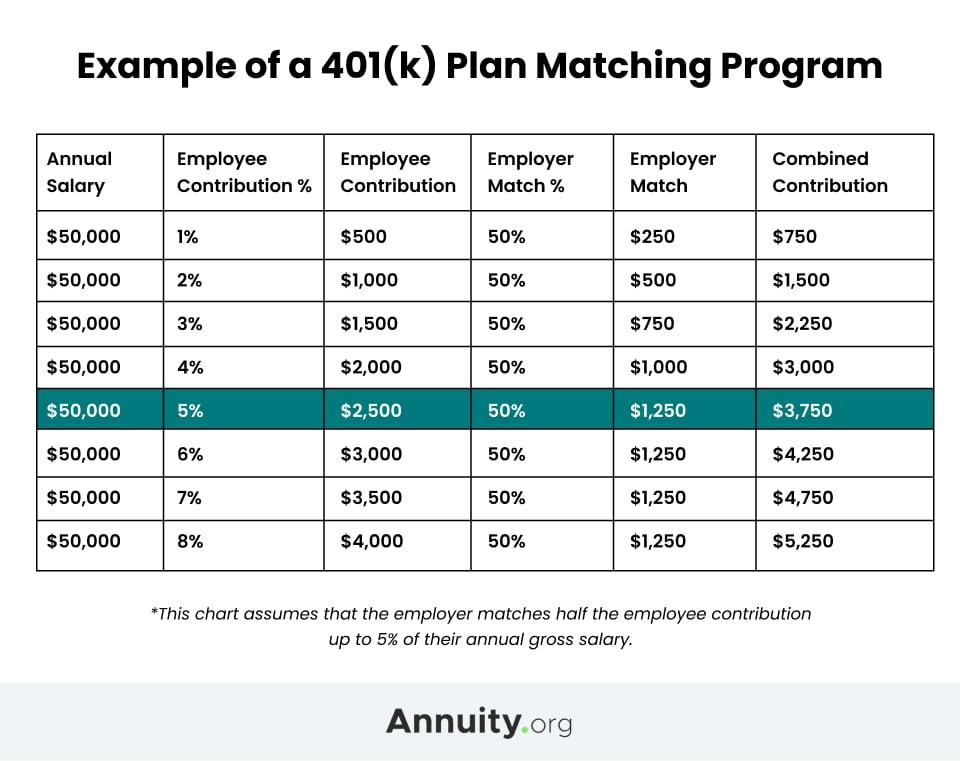

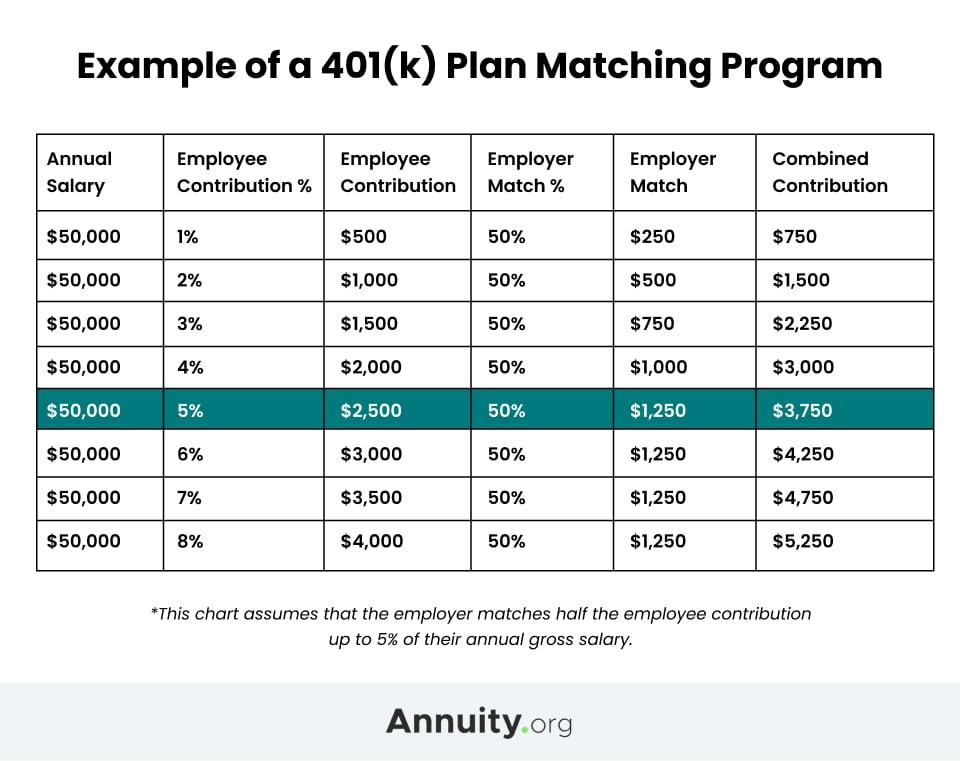

To really make your 401k work for you, it’s essential to understand the importance of maximizing contributions. Many employers offer a matching contribution, which is essentially “free money.” By contributing at least enough to get the full match, you’re ensuring that you’re not leaving any potential growth on the table. Take the time to analyze your employer’s policy and determine the maximum amount they’re willing to match; typically, it’s a fixed percentage of your income.

Besides maximizing employer contributions, consider making the most of your personal contributions. The IRS allows a significant contribution limit each year, which can be increased in your catch-up contributions as you near retirement age. It’s advisable to reach or even exceed these limits if your budget allows. Here are a few strategies to boost your contributions effectively:

- Automate your savings: Set up automatic deductions from your paycheck directly into your 401k.

- Increase contributions gradually: Use raises or bonuses to incrementally increase your contributions without affecting your current standard of living.

- Take advantage of windfalls: Whenever you receive unexpected money, such as a tax refund or inheritance, consider funneling a portion into your 401k.

be aware of the investment options within your 401k plan. Many plans offer a mix of actively managed funds, index funds, and other investment vehicles. Diversifying your investments can help to mitigate risk and enhance growth potential. Educate yourself about the various asset classes available and consider consulting a financial advisor to tailor an investment strategy that aligns with your long-term goals.

| Contribution Type | Max Contribution Limit (2023) |

|---|---|

| Employee Contribution | $22,500 |

| Catch-Up Contribution (Age 50+) | $7,500 |

| Total Contribution Limit (including employer match) | $66,000 |

Diversification Strategies for a Healthy 401k Portfolio

Building a robust 401k portfolio requires balancing risk and reward, which is best achieved through diversification. By spreading your investments across various asset classes, you can mitigate the impact of market volatility while taking advantage of different growth opportunities. A common strategy is to allocate your funds between stocks, bonds, and alternative investments. Each asset class reacts differently to market conditions, providing a cushion during downturns and amplifying gains during uptrends.

When considering the structure of your 401k, you might opt for a blend of large-cap stocks, small-cap stocks, international stocks, and different categories of bonds. This combination can enhance your portfolio’s resilience and potential for growth. Additionally, you can incorporate alternative investments like real estate or commodities. Here’s a simplified allocation strategy to consider:

| Asset Class | Percentage |

|---|---|

| Large-Cap Stocks | 40% |

| Small-Cap Stocks | 20% |

| Bonds | 30% |

| Alternative Investments | 10% |

It’s essential to regularly review and adjust your 401k allocation as you approach retirement. Your investment strategy should evolve with your changing risk tolerance, investment goals, and market conditions. For example, as you near retirement, gradually increasing your bond holdings can help preserve capital while ensuring stability. This dynamic approach to asset allocation ensures that your portfolio remains aligned with your financial objectives while navigating the complexities of market fluctuations.

The Impact of Market Trends on Your 401k Performance

The fluctuations in the financial markets have a direct influence on the performance of your retirement savings, particularly within your 401(k) plan. When the stock market experiences a bull run, the value of stocks in your portfolio generally rises, leading to increased account balances and more substantial gains over time. Conversely, during bear markets, stock values may drop, adversely affecting the overall performance of your 401(k). Understanding how these cycles impact your investments is crucial for long-term financial planning.

Another factor to consider is the diversification of your portfolio. A well-balanced 401(k) typically includes a mix of assets, such as stocks, bonds, and cash equivalents, which can insulate your savings from market volatility. By allocating your investments wisely, you can mitigate risks associated with market downturns. Here are some key strategies to bolster the resilience of your portfolio:

- Regularly Rebalance: Maintain your desired asset allocation by adjusting your portfolio periodically.

- Invest in Different Sectors: Embrace a broader market approach by considering various industries.

- Include International Funds: Diversifying globally can offset losses in the domestic market.

Additionally, the timing of your contributions can also affect your retirement savings. When you invest consistently, particularly during a market downturn, you can use dollar-cost averaging to your advantage, purchasing more shares at lower prices. This approach can lead to greater potential returns as the market rebounds. Keeping track of market trends is an essential component of effective 401(k) management, as it empowers you to make informed decisions that align with your long-term financial goals.

Navigating Fees and Costs in Your 401k Plan

Understanding the various fees and costs associated with your 401(k) plan can significantly influence your investment growth over time. These expenses, often overlooked, can erode your savings if not managed wisely. It’s essential to be aware of the different types of fees that may apply, including:

- Administrative Fees: Costs for recordkeeping, customer service, and compliance.

- Investment Fees: Expenses related to the mutual funds or investment options available within your plan.

- Transaction Fees: Charges for buying or selling investments in your account.

When evaluating fees, don’t just focus on the total costs but also consider how they align with your long-term financial goals. A slightly higher fee on a fund with stronger performance may still yield better returns. It’s beneficial to compare plans, looking for those with lower fees or superior investment options. You can also calculate the impact of fees over time—a small percentage, when compounded over years, can lead to substantial differences in your retirement savings.

To help illustrate the potential impact of these fees, consider the example below:

| Account Balance | Annual Fee (%) | Value After 30 Years |

|---|---|---|

| $50,000 | 0.5% | $215,893 |

| $50,000 | 1.0% | $164,191 |

| $50,000 | 1.5% | $126,472 |

As shown, the difference between varying fee percentages can dramatically affect your retirement savings. Therefore, taking the time to understand and evaluate the associated costs within your 401(k) is an essential step in setting yourself up for a secure financial future.

Q&A

Q&A: Understanding the Stock Market and Your 401(k)

Q1: What exactly is a 401(k) plan? A: A 401(k) plan is a retirement savings account offered by employers that allows employees to save a portion of their paycheck before taxes are taken out. This type of plan not only reduces taxable income but often includes employer matching contributions, amplifying the benefits of saving for retirement.Q2: How does the stock market relate to my 401(k)? A: The stock market plays a significant role in many 401(k) plans. Within your 401(k), you can invest in a variety of options, including stocks, bonds, and mutual funds. The performance of the stock market can directly impact the growth of your 401(k) investments, as higher market returns can lead to larger account balances.

Q3: What are the benefits of investing in stocks through my 401(k)? A: Investing in stocks within a 401(k) can offer several advantages: - Potential Growth: Historically, stocks have provided higher returns compared to other investments over long periods. – Tax Advantages: You won’t pay taxes on contributions or earnings until you withdraw funds, potentially allowing your investments to grow more efficiently. – Employer Match: If your employer matches contributions, investing in stocks can maximize these benefits, offering a more substantial nest egg for retirement.

Q4: What risks should I be aware of when investing in stocks through my 401(k)? A: While stocks can offer significant growth potential, they are also subject to market volatility. This means the value of your investments can fluctuate based on market conditions. It’s essential to assess your risk tolerance and investment horizon; younger investors might opt for more stock exposure, while those closer to retirement may consider more conservative options.

Q5: How should I choose the right investments for my 401(k)? A: Choosing the right investments depends on your financial goals, risk tolerance, and timeline to retirement. Start by: – Assessing Your Goals: Understand what you want from your retirement savings. – Evaluating Your Risk Tolerance: Determine how much risk you are willing to take to achieve your goals. - Diversifying Your Portfolio: Consider a mix of stocks, bonds, and other assets to spread risk. – Reviewing Investment Options: Most plans offer target-date funds, index funds, and managed funds—research each option to find what best fits your strategy.

Q6: How often should I review my 401(k) investments? A: It’s generally a good idea to review your 401(k) investments at least annually, or after any significant life changes, such as a job change, marriage, or having children. Regular reviews help ensure your investment strategy aligns with your retirement goals and market conditions.

Q7: What happens to my 401(k) if I change jobs? A: If you change jobs, you generally have a few options concerning your 401(k): – Leave it with your former employer: You can often keep your funds in the plan, but you won’t be able to contribute further. – Roll it over to your new employer’s plan: This keeps your savings growing tax-deferred. – Convert it to an IRA: An Individual Retirement Account offers you more investment options but requires careful consideration of tax implications.

Q8: What is a Roth 401(k) and how does it differ from a traditional 401(k)? A: A Roth 401(k) allows employees to contribute after-tax dollars for their retirement savings. The primary difference is that while traditional 401(k) contributions lower your taxable income now, Roth 401(k) contributions do not. However, qualified withdrawals in retirement are tax-free, offering a potential advantage if you expect your tax rate to rise in the future.

By understanding the synergy between the stock market and your 401(k), you equip yourself with the knowledge needed to maximize your retirement savings and make informed investment decisions. Whether you’re just starting your career or approaching retirement, these fundamentals can help you navigate your financial future with confidence.

0 Comments