Table of Contents

- Understanding Pension Rollover: Key Considerations for Your Financial Future

- Exploring Different Pension Rollover Strategies and Their Benefits

- Comparing Traditional and Roth IRA Options for Your Pension Funds

- Tax Implications of Pension Rollovers: What You Need to Know

- Navigating the Rollover Process: Practical Tips for Success

- Q&A

- The Conclusion

Understanding Pension Rollover: Key Considerations for Your Financial Future

Pension rollovers can significantly impact your long-term financial health, making it essential to understand the various options available. When considering a rollover, you’ll often have several choices, including transferring your funds to a new employer’s plan, an individual retirement account (IRA), or even cashing out. Each option has its advantages and disadvantages that can affect your retirement strategy. For instance, moving your pension to an IRA typically offers more investment choices, while keeping it in the employer’s plan may provide stability and potential employer contributions.

It’s also crucial to consider the tax implications of a rollover. Distributions from pensions can be taxed as ordinary income, which might push you into a higher tax bracket during the year you withdraw. To avoid unexpected taxes, direct rollovers and trustee-to-trustee transfers are recommended. These methods ensure that the funds move directly between retirement accounts without you taking possession of the money, thus dodging any immediate tax burdens. Conversely, if you opt for a cash-out, remember that taxes and potential penalties could significantly reduce your retirement savings.

as you evaluate your rollover options, keep in mind the long-term growth potential and fees associated with your chosen plan. A cost-effective plan with a solid track record of returns can be advantageous for growing your retirement funds. Consider creating a comparison table to visualize and evaluate your options side-by-side, focusing on factors such as fees, investment choices, and potential growth. Here is a simple structure for that comparison:

| Option | Fees | Investment Choices | Growth Potential |

|---|---|---|---|

| New Employer’s Plan | Varies by employer | Limited | Medium |

| Traditional IRA | Low to moderate | Wide range | High |

| Cash Out | High taxes | N/A | None |

Exploring Different Pension Rollover Strategies and Their Benefits

When considering how to manage your retirement funds, understanding the various strategies for rolling over a pension can be invaluable. A common approach is the Direct Rollover, where funds are transferred directly from your employer’s pension plan to an Individual Retirement Account (IRA) or another qualified retirement plan. This method keeps your retirement savings intact and tax-deferred, allowing them to grow without the immediate tax implications that can arise with other options. A significant advantage of a direct rollover is that it reduces the risk of accidental withholding taxes, which can occur when funds are cashed out instead of rolled over.

Another strategy to explore is the Indirect Rollover, where you receive your pension funds and then have 60 days to deposit them into a new retirement account. While this offers flexibility, it’s essential to note that the IRS requires 20% of your distribution to be withheld for taxes unless you take specific steps to avoid this. If you’re unable to deposit the full amount within the specified time, the withheld portion can result in taxes or penalties. The primary benefit of an indirect rollover lies in the potential for short-term liquidity, allowing retirees to access funds while maintaining a plan for eventual retirement savings.

consider the In-Kind Rollover, which allows you to transfer assets from your pension plan into another plan without liquidating them. This can be particularly advantageous for individuals holding appreciated stocks or other investments, as it helps maintain the portfolio’s strategic allocation while deferring taxes on capital gains. Utilizing an in-kind rollover can save transaction costs and preserve the potential for future growth. As you explore these diverse strategies, weighing the benefits and understanding your financial goals will empower you to make informed decisions regarding your pension funds.

Comparing Traditional and Roth IRA Options for Your Pension Funds

When considering your pension funds, it’s crucial to understand the differences between a Traditional IRA and a Roth IRA. Both options provide tax advantages, but they operate quite differently. A Traditional IRA allows you to contribute pre-tax dollars, which lowers your current taxable income. You’ll pay taxes on withdrawals during retirement, typically when you may be in a lower tax bracket. This can be beneficial for those who anticipate being in a lower income bracket in retirement.

On the other hand, a Roth IRA involves contributions made with after-tax dollars. This means you’ve already paid taxes on the money you put in, and any qualified withdrawals during retirement are tax-free. This can be particularly advantageous if you expect your tax rate to increase in the future. Here are some key distinctions to consider:

- Tax Timing: Traditional IRAs save you taxes now; Roth IRAs save you taxes later.

- Withdrawal Flexibility: Roth IRAs allow for tax-free withdrawals at retirement age, while Traditional IRAs may impose penalties on early withdrawals.

- Income Limits: High earners may be restricted from contributing to a Roth IRA, whereas Traditional IRAs allow contributions regardless of income but may not be tax-deductible at higher income levels.

| Feature | Traditional IRA | Roth IRA |

|---|---|---|

| Tax Type | Pre-tax contributions | After-tax contributions |

| Tax Upon Withdrawal | Taxable | Tax-free |

| Withdrawal Rules | Penalties if withdrawn early | Tax-free after age 59.5 |

| Income Limits | No contribution limits based on income | Income limits apply |

Tax Implications of Pension Rollovers: What You Need to Know

When considering a rollover of your pension, it’s crucial to understand the tax implications that accompany this financial transaction. Failure to navigate these correctly can result in unexpected tax liabilities or penalties. One of the first things to note is whether the transfer is qualified or non-qualified. A qualified rollover (moving funds between similar tax-advantaged accounts) generally avoids immediate taxation, while a non-qualified rollover may result in an immediate tax obligation, depending on your specific situation.

Another important aspect is the 60-day rule, which mandates that you must complete the rollover within 60 days to avoid taxes and penalties. If you miss this window, the IRS may treat your pension distribution as taxable income. Also, if the rollover is executed as a direct transfer from one plan to another, it is often exempt from tax. In contrast, with an indirect transfer, where you receive a check, you may face withholding tax obligations that can complicate your financial status if not handled promptly.

Understanding the impact of state taxes on rollovers is equally significant. While federal tax rules govern many aspects of retirement accounts, individual states can impose their own regulations and tax rates. To assist you in this understanding, refer to the table below that outlines how selected states treat pension rollovers:

| State | State Tax Treatment |

|---|---|

| California | Taxed as regular income |

| Florida | No state income tax |

| New York | Taxed, with deductions available |

| Texas | No state income tax |

Taking all these points into consideration will help you strategize your pension rollover effectively and potentially save you from paying unnecessary taxes. Always consult a financial advisor or tax professional to ensure you are making informed decisions that fit your unique situation.

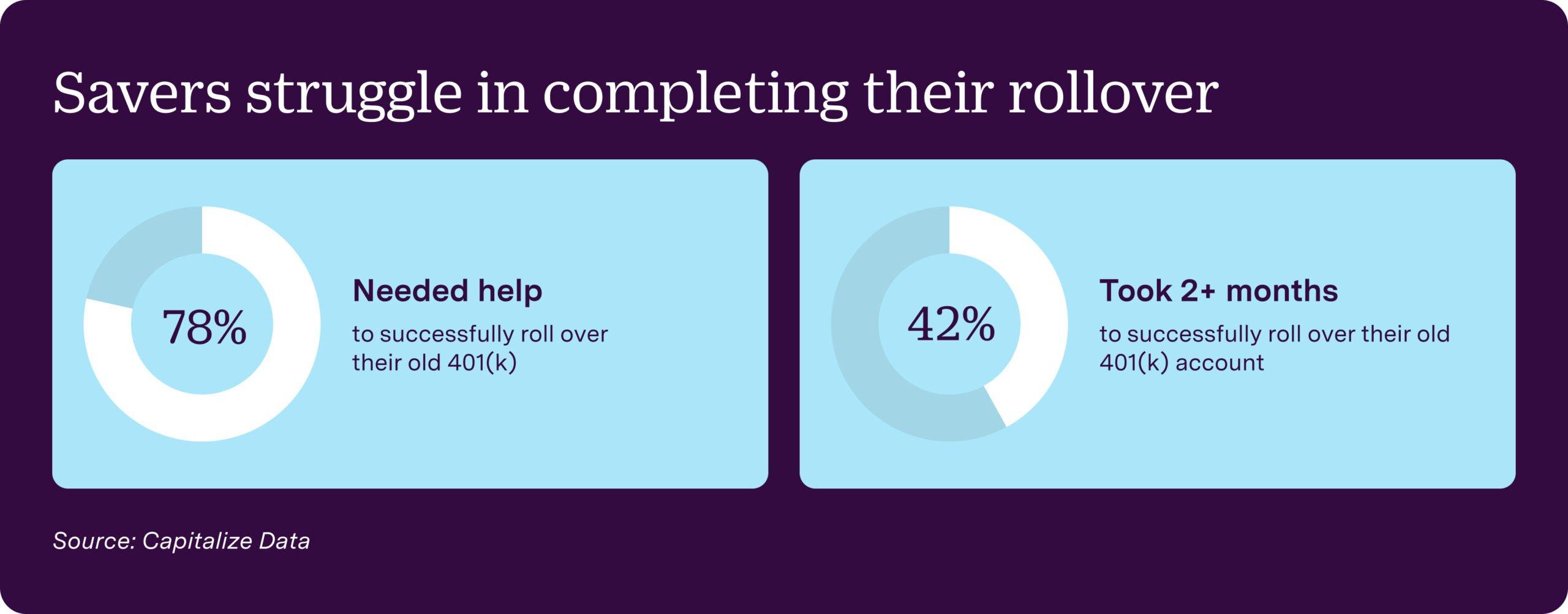

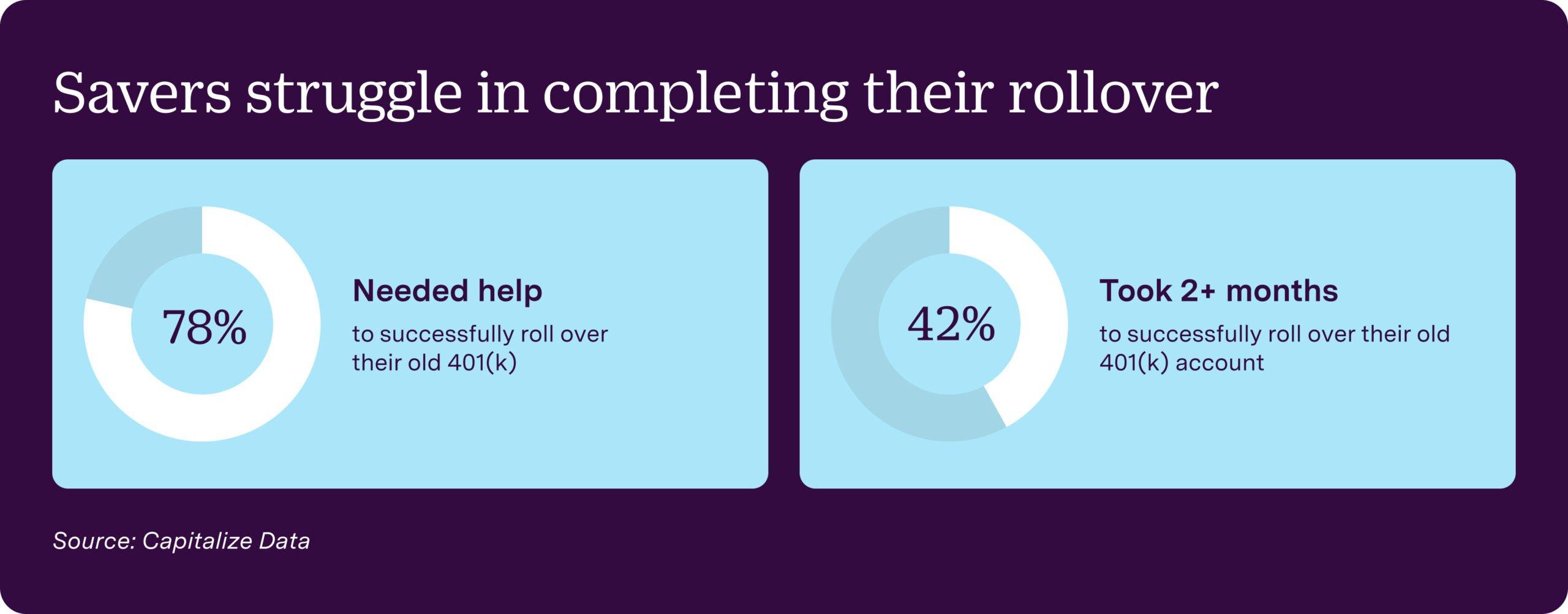

Navigating the Rollover Process: Practical Tips for Success

Successfully navigating the rollover process requires careful consideration and planning. Start by clarifying your financial goals and how the rollover fits into your overall retirement strategy. Analyze your current financial situation and define what you want to achieve with your pension funds. This could include saving for retirement, rolling over to a more flexible investment option, or even accessing certain benefits that your current plan does not provide. Taking the time to research your options will help you make informed decisions.

As you explore your options, consider the various types of accounts available for the rollover. Here are some popular choices to evaluate:

- Traditional IRA: Ideal for tax-deferred growth.

- Roth IRA: Provides tax-free growth and withdrawals if you qualify.

- 401(k) plans: Some employers allow you to roll your pension into their new plan.

- Simplified Employee Pension (SEP) IRA: A good option for self-employed individuals.

Don’t forget to pay attention to the potential fees and tax implications associated with your chosen rollover option. Every plan has different rules regarding distributions, penalties, and withdrawals. Understanding these details can save you money in the long run. It might also be beneficial to consult a financial advisor to help you navigate the complexities of the rollover process. Here’s a table summarizing key features of different rollover options:

| Rollover Option | Tax Implications | Withdrawal Flexibility |

|---|---|---|

| Traditional IRA | Tax-deferred until withdrawal | Early withdrawal penalties may apply |

| Roth IRA | Contributions taxed; withdrawals are tax-free | Withdrawal rules apply for earnings |

| 401(k) Plan | Taxes apply upon withdrawal | Varies by employer policy |

| SEP IRA | Tax-deferred growth | Similar to Traditional IRA |

Q&A

Q&A: Understanding Pension Rollover Options

Q1: What is a pension rollover? A: A pension rollover is the process of transferring retirement savings from one pension plan to another, typically to avoid taxes and penalties. This can occur when you change jobs, retire, or find a better retirement plan that suits your financial goals.Q2: Why should I consider rolling over my pension? A: Rolling over your pension can consolidate your retirement savings, making it easier to manage and track your investments. Additionally, it often provides a chance for better investment options, fees, and the potential for more tailored retirement strategies based on your individual needs.

Q3: What types of pension rollover options are available? A: There are several options for rolling over a pension:

- Direct Rollover: Funds are transferred directly from your old plan to your new one, without any tax implications.

- Indirect Rollover: You receive the funds and must deposit them into a new pension account within 60 days. Be cautious, as failing to do so can result in taxes and penalties.

- Rollover to an IRA: You can move your pension into an Individual Retirement Account (IRA), allowing for broader investment choices and potential tax advantages.

Q4: Are there any tax implications I should be concerned about? A: Yes, while direct rollovers are generally tax-free, if you opt for an indirect rollover and miss the 60-day deadline, the distribution may be subject to income tax and early withdrawal penalties if you are under age 59½. Always consult with a tax professional to understand the implications based on your personal financial situation.

Q5: Can I roll over a pension if I’m still employed? A: It depends on the plan. Some employers allow in-service rollovers, so you can move funds while still working. Check with your human resources department to review your plan’s rules and options.

Q6: How do I choose the right plan for my rollover? A: Consider factors such as fees, investment options, flexibility, and the reputation of the new plan. Assess your retirement goals – whether you prefer more control over investments or a hands-off approach – and weigh these considerations before making a decision.

Q7: What happens if I don’t roll over my pension? A: If you choose not to roll over your pension, you can leave it with your old employer where it will continue to be managed. However, this might limit your investment options and access to funds, and you could miss out on better opportunities elsewhere.

Q8: What steps do I need to take to initiate a pension rollover? A: Start by contacting your current pension provider to request a rollover. You’ll need to fill out specific forms and may need to provide information regarding the new account you want the funds transferred to. Ensure you keep records of all communications and transactions for your personal documentation.

Q9: What are the risks I should be aware of with pension rollovers? A: Potential risks include making poor investment choices in your new plan or failing to complete the rollover within the required time frame. Additionally, not fully understanding the fee structure of your new plan could erode your savings over time. Always conduct thorough research and consider seeking advice from a financial advisor.

Q10: Where can I find more information on pension rollover options? A: Numerous resources are available online, such as retirement planning websites and government financial institutions. It’s also beneficial to consult with a financial advisor who can provide personalized advice tailored to your specific situation.

0 Comments