Navigating the intricacies of retirement planning can often feel like deciphering a complex puzzle, with each piece holding significant weight in securing a stable future. Among the many considerations retirees face, the concept of a pension offset Social Security arrangement stands out as a crucial element that warrants a closer look. Understanding how these two pillars of support intersect can make all the difference in ensuring financial well-being during the golden years. Let’s dive into the world of pension offset Social Security and unravel its implications for your retirement strategy.

Table of Contents

- Understanding Pension Offset and Social Security Interactions

- Maximizing Benefits: Strategies for Optimizing Pension Offset and Social Security

- Navigating the Complexities: Factors to Consider When Dealing with Pension Offset and Social Security

- Expert Tips: Making Informed Decisions Regarding Pension Offset and Social Security

- Q&A

- In Retrospect

Understanding Pension Offset and Social Security Interactions

In the realm of retirement planning, the intricate dance between pension benefits and Social Security can often perplex many. Navigating the complexities of how these two crucial components interact can significantly impact one’s financial well-being in their golden years.

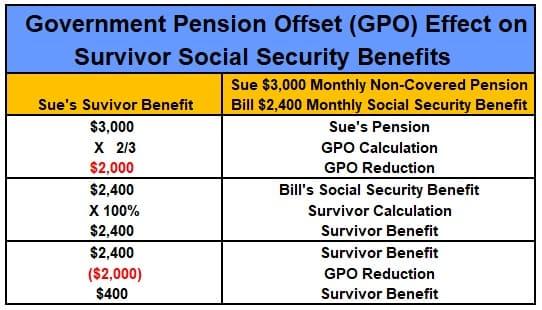

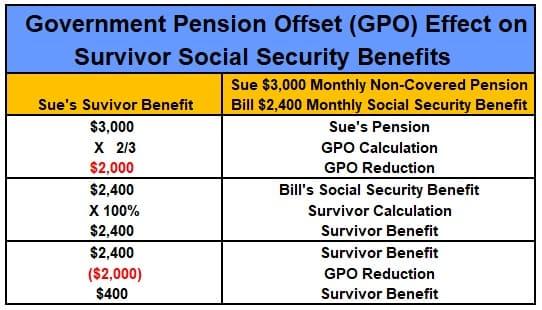

When examining the interplay between pension offset and Social Security, it’s essential to understand how certain pensions may affect your Social Security benefits. Pension offset rules can lead to a reduction in your Social Security payments based on specific circumstances. Considering factors such as the Windfall Elimination Provision (WEP) and Government Pension Offset (GPO) is crucial for a comprehensive retirement strategy.

Moreover, being cognizant of how these regulations apply to your unique situation can help you make informed decisions regarding your pension and Social Security benefits. By unraveling the intricacies of pension offset and Social Security interactions, you can better plan for a secure and stable financial future during your retirement years.

Maximizing Benefits: Strategies for Optimizing Pension Offset and Social Security

In the realm of retirement planning, understanding how to navigate the complexities of pension offset and Social Security benefits can significantly impact your financial well-being in your golden years. By employing strategic approaches and optimizing available resources, you can ensure a smoother transition into retirement and maximize the benefits you’re entitled to receive.

One effective strategy is to coordinate your pension offset and Social Security benefits to leverage the advantages of both systems. By carefully planning the timing of when you start receiving each benefit, you can potentially minimize any offsets and optimize your total retirement income. Additionally, exploring alternative options such as spousal benefits or delayed retirement credits can further enhance your overall financial security during retirement. By staying informed and proactive in your decision-making, you can pave the way for a more financially stable and fulfilling retirement journey.

Navigating the Complexities: Factors to Consider When Dealing with Pension Offset and Social Security

Navigating the complexities of pension offset and Social Security requires careful consideration of various factors. One key aspect to keep in mind is understanding how your pension may impact the amount of Social Security benefits you receive. Pension offsets can affect the calculation of your Social Security benefits, potentially reducing the amount you are eligible to receive.

Another critical factor to consider is the Windfall Elimination Provision (WEP). If you receive a pension from work not covered by Social Security, such as a government job, WEP may apply to your Social Security benefits and result in a lower payment than expected. It’s essential to be aware of these implications and plan accordingly to make informed decisions regarding your pension and Social Security benefits.

| Factor | Description |

|---|---|

| Pension Offset | May reduce Social Security benefits |

| Windfall Elimination Provision (WEP) | Impacts benefits if receiving a pension from non-Social Security covered work |

Expert Tips: Making Informed Decisions Regarding Pension Offset and Social Security

When navigating the complexities of pension offset and Social Security, it’s crucial to arm yourself with the right knowledge. Understanding how these two elements interact can significantly impact your financial future. One key tip is to consider consulting with a financial advisor or retirement specialist who can provide personalized guidance tailored to your unique situation.

Additionally, conducting thorough research on your specific pension plan and Social Security benefits is essential. By comparing the potential offset scenarios and evaluating the long-term implications, you can make more informed decisions that align with your retirement goals. Stay informed, stay proactive, and pave the way for a secure financial future.

Q&A

Q&A: Understanding Pension Offset Social Security

Q: What is pension offset social security?

A: Pension offset social security is a provision that impacts individuals who receive both a pension from a government job and Social Security benefits. The offset reduces the amount of Social Security benefits a person can receive based on their government pension.

Q: How does pension offset social security work?

A: The offset works by applying a formula that calculates the reduction in Social Security benefits based on the individual’s government pension amount. In essence, the higher the government pension, the lower the Social Security benefits a person may receive.

Q: Who is affected by pension offset social security?

A: Those individuals who have worked in jobs that are not covered by Social Security, such as certain state or local government positions, may be subject to pension offset social security regulations.

Q: Are there any exemptions to pension offset social security?

A: Some specific circumstances, like certain military service, may exempt individuals from the pension offset social security rule. It’s essential to understand the nuances of your pension and Social Security benefits to assess whether you qualify for any exemptions.

Q: How can individuals navigate the complexities of pension offset social security?

A: Seeking counsel from financial advisors or pension experts can help shed light on how pension offset social security impacts your retirement income planning. Understanding the rules and regulations can empower individuals to make informed decisions about their financial future.

Remember, staying informed and seeking professional advice can be key in navigating the intricate terrain of pension offset social security and maximizing your retirement benefits.

In Retrospect

As you navigate the intricate waters of pension offset Social Security, remember that understanding the nuances of these financial matters can pave the way for a more secure future. By staying informed and making thoughtful decisions, you can carve a path towards financial stability and peace of mind in your retirement years. Embrace the journey of financial literacy and empower yourself to make sound choices that resonate with your long-term goals. Here’s to a future filled with financial wisdom and security!

0 Comments