Table of Contents

- Exploring the Landscape of Pension Jobs in Florida

- Identifying Thriving Industries and Opportunities

- Understanding the Qualifications and Skills Required

- Navigating the Application Process Successfully

- Maximizing Your Benefits and Retirement Options

- Q&A

- Wrapping Up

Exploring the Landscape of Pension Jobs in Florida

Florida’s pension job market offers a unique blend of opportunities catering to various skill sets and professional backgrounds. As the state continues to attract retirees and seasoned professionals alike, the demand for pension-related roles has surged. Many organizations, including government agencies and private companies, seek qualified individuals to manage funds, ensure compliance with regulations, and communicate effectively with stakeholders. This growth makes the sector not only viable but also a promising field for those pursuing a career focused on financial stability and security.

Individuals interested in entering this niche can find positions ranging from financial analysts and retirement planners to administrative support roles. Key responsibilities often include:

- Financial Analysis: Evaluating pension fund performance and advising on investment strategies.

- Compliance Management: Ensuring that pension plans adhere to federal and state regulations.

- Client Relations: Acting as a liaison between pension beneficiaries and the managing organizations.

To best equip themselves for success in Florida’s pension job market, candidates are encouraged to enhance their skills through certification programs and continuous education. Relevant certifications such as the Certified Employee Benefit Specialist (CEBS) or the Chartered Financial Analyst (CFA) can distinguish applicants in a competitive field. Additionally, networking through industry-related events can create valuable connections that lead to job opportunities. The landscape is as promising as it is competitive, but with the right approach, individuals can cultivate fulfilling careers while contributing to the financial well-being of many Floridians.

Identifying Thriving Industries and Opportunities

Florida’s economy is exceptionally diverse, presenting numerous opportunities across various sectors. With the continual influx of retirees, industries that cater to this demographic are thriving, specifically in health care, hospitality, and financial services. Health care stands out as a leading sector, offering a wide range of positions due to the increasing demand for services tailored to an aging population. Roles in nursing, rehabilitation, and home health care are particularly sought after, providing both job security and fulfilling career paths for those passionate about supporting others.

In addition to health care, the hospitality industry is another robust sector in Florida, buoyed by its status as a premier tourist destination. The state boasts a vibrant tourism economy, which creates abundant opportunities in hotels, restaurants, and recreational services. Job roles extend beyond customer service to include management, marketing, and event coordination, making it an appealing field for individuals looking to leverage their skills in a dynamic environment. Professionals with experience in tourism and hospitality are encouraged to explore these growing niches, especially in areas popular among retirees.

Lastly, financial services continue to expand in Florida, driven by an increasing number of individuals seeking retirement planning advice and investment management. This sector encompasses various job roles, from financial advisors to compliance officers, making it a prime area for job seekers interested in helping clients navigate their financial futures. To better illustrate these thriving sectors and their associated job opportunities, the table below highlights key roles and average salaries:

| Industry | Key Job Roles | Average Salary |

|---|---|---|

| Health Care | Nurses, Home Health Aides | $50,000 - $75,000 |

| Hospitality | Hotel Managers, Event Coordinators | $40,000 - $70,000 |

| Financial Services | Financial Advisors, Investment Managers | $60,000 - $90,000 |

Understanding the Qualifications and Skills Required

When exploring the realm of pension jobs in Florida, is pivotal for success. These positions often seek candidates with a blend of educational background and hands-on experience. Typically, a degree in finance, business administration, or public administration can provide a solid foundation. However, candidates with relevant certifications such as Certified Pension Consultant (CPC) or Certified Employee Benefit Specialist (CEBS) may have a competitive edge. Experience in retirement planning or financial advising can also enhance one’s candidacy.

In addition to formal education, certain skills are essential for thriving in this field. Candidates should demonstrate a strong understanding of pension laws and regulations, proficiency in financial analysis, and excellent communication abilities. The ability to work collaboratively with clients and stakeholders is crucial, as these jobs often involve explaining complex financial concepts in an accessible manner. Furthermore, adaptability is vital, as the pension landscape is continually evolving due to changes in legislation and economic conditions.

| Key Skills | Description |

|---|---|

| Regulatory Knowledge | Familiarity with pension laws and compliance regulations. |

| Financial Acumen | Ability to analyze and interpret financial data effectively. |

| Communication | Skilled at conveying complex information clearly. |

| Customer Service | Providing exceptional support and guidance to clients. |

Moreover, a keen analytical mindset and problem-solving skills are vital for addressing the intricate challenges associated with pension management. Professionals in this field must also showcase organizational skills, as they frequently manage multiple accounts and remain updated on client statuses and regulatory changes. Ultimately, pursuing pension jobs in Florida requires a well-rounded skill set complemented by ongoing education and professional development, positioning candidates for long-term success in this rewarding sector.

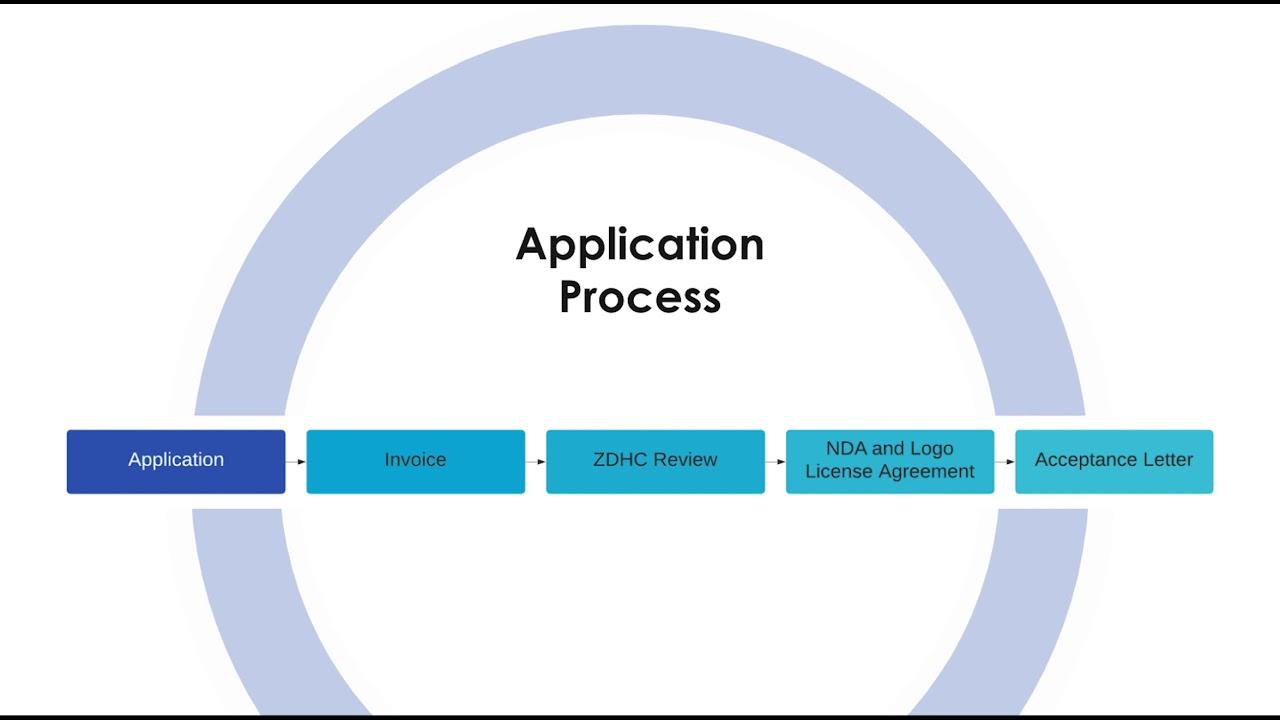

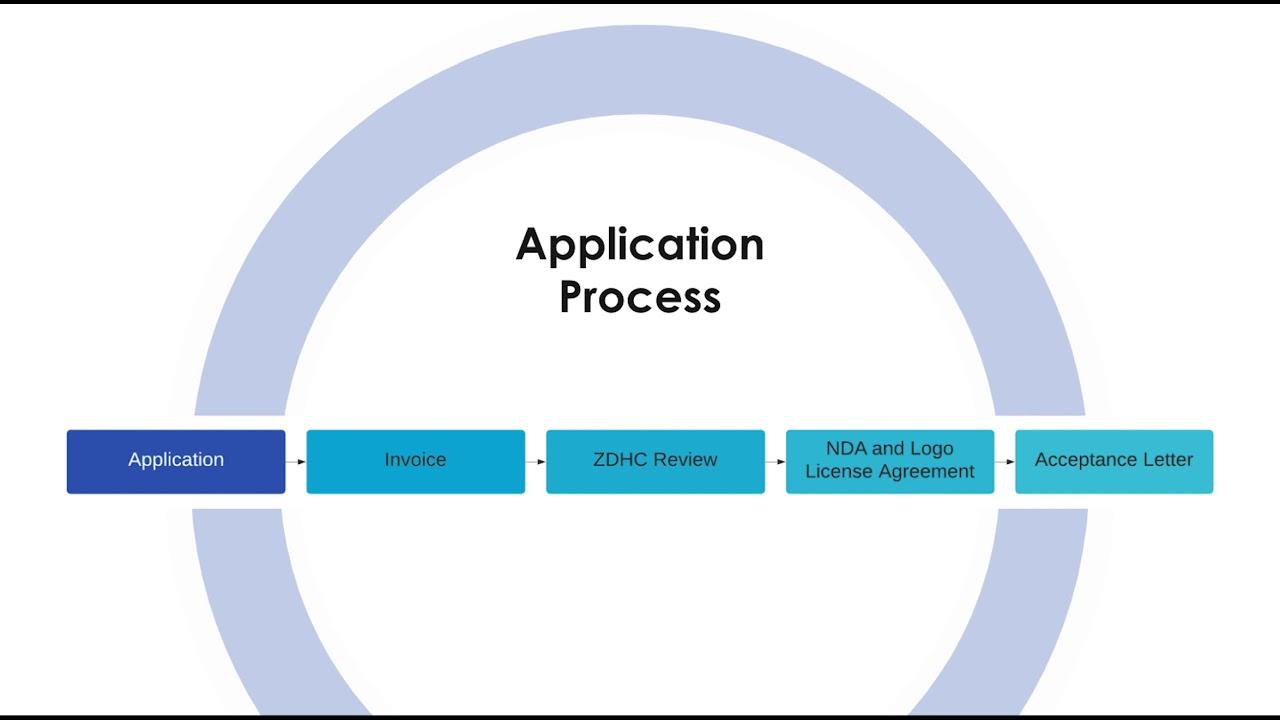

Navigating the Application Process Successfully

Successfully navigating the application process for pension jobs in Florida requires a strategic approach and attention to detail. Start by thoroughly researching the specific roles you’re interested in. Ensure you understand the qualifications, responsibilities, and required skills associated with each position. Consider these foundational steps:

- Tailor Your Resume: Customize your resume to highlight relevant experience and skills that cater to the position you’re applying for.

- Craft a Compelling Cover Letter: Use the cover letter to tell your personal story, outlining why you’re passionate about the role and how your background aligns with the organization’s mission.

- Prepare for Interviews: Research common questions and prepare your responses to showcase your qualifications effectively.

Networking can significantly enhance your chances of securing a pension job. Connect with professionals currently in the field or those who have previously worked in similar roles. Engage in industry-related events or online forums. Building relationships can provide you with valuable insights or even referrals. To stay organized, consider creating a table to track your applications:

| Company Name | Position Applied | Date of Application | Status |

|---|---|---|---|

| ABC Pension Services | Retirement Advisor | 01/10/2023 | Interview Scheduled |

| XYZ Financial Group | Pension Coordinator | 01/15/2023 | Application Under Review |

don’t forget to follow up after submitting your application or participating in an interview. A polite email reiterating your interest can set you apart from other candidates. This proactive approach demonstrates enthusiasm and professionalism, two attributes that potential employers value highly. Remember, the application process can be competitive, but with thorough preparation and persistence, you can successfully secure a rewarding pension job in Florida.

Maximizing Your Benefits and Retirement Options

When considering a career in pension jobs throughout Florida, it’s essential to explore various avenues to maximize your benefits and retirement options. By understanding the different types of pension systems available, you can make more informed decisions that will impact your financial security. Defined benefit plans, for instance, offer a predictable income stream, calculated based on factors such as salary history and years of service. In contrast, defined contribution plans allow you to invest in your retirement savings, typically through 401(k) plans, where your contributions, matched by your employer, can grow over time based on market performance.

In addition to traditional pension plans, consider enhancing your retirement portfolio through supplemental options. These may include:

- Health Savings Accounts (HSAs) for medical expenses

- Annuities that provide guaranteed income

- Individual Retirement Accounts (IRAs) that offer tax advantages

Utilizing these supplemental plans can significantly boost your financial wellness during retirement, providing you with more flexibility and security.

Furthermore, taking advantage of state-sponsored and employer-specific programs is crucial. Many employers in Florida offer unique benefits that extend beyond standard pension plans, such as:

| Program | Description |

|---|---|

| Employer Matching | Employers match contributions to your retirement plan, giving you free money. |

| Pension Buyouts | Offers a lump-sum payment instead of monthly pension payments. |

Researching these options and engaging in proactive planning can help you build a robust retirement strategy, ensuring you reap the maximum benefits from your pension jobs in Florida.

Q&A

Q&A: Navigating Pension Jobs in FloridaQ1: What are pension jobs, and why are they significant in Florida? A: Pension jobs refer to positions that offer a defined benefit pension plan, providing employees with guaranteed retirement income based on salary and years of service. In Florida, these jobs are significant because they offer financial security for retirees, especially in a state known for its large population of seniors and a growing economy. Sectors like education, government, and healthcare frequently offer such positions, making them attractive for job seekers seeking stability.Q2: What types of employers in Florida typically offer pension jobs? A: In Florida, pension jobs are most commonly found in the public sector. Key employers include state and local government agencies, school districts, and universities. Additionally, certain private companies, particularly in the healthcare sector, may still provide defined benefit pension plans as part of their employee benefits package.

Q3: How can I find pension job listings in Florida? A: To find pension job listings in Florida, start by exploring state and local government job portals. Websites like the Florida Division of Human Resources and individual agency websites often list available positions. Networking through professional associations and attending local job fairs can also yield leads. Additionally, platforms like LinkedIn, Indeed, and Glassdoor can be valuable resources for job seekers.

Q4: What qualifications are typically required for pension jobs? A: Qualifications for pension jobs can vary widely depending on the role and employer. Many positions in government and education may require specific credentials, such as teaching certificates for educators or certain degrees for administrative roles. Generally, employers look for candidates with relevant experience, strong communication skills, and a commitment to public service.

Q5: Are there any incentives for seeking pension jobs in Florida? A: Yes, there are several incentives for seeking pension jobs in Florida. In addition to the promise of a stable retirement income, many pension jobs come with attractive health benefits, generous leave policies, and opportunities for professional development. Moreover, working in these sectors often involves a sense of community and a chance to make a positive impact, particularly in public service roles.

Q6: What should I consider before pursuing a pension job in Florida? A: Before pursuing a pension job in Florida, consider factors such as your career goals, the job’s alignment with your skills, and the specific benefits offered. Additionally, evaluate the stability of the employer and the pension plan itself, including its funding status and historical performance. Understanding the work environment and culture is also crucial, as it can greatly impact job satisfaction.

Q7: Can I still find pension jobs in emerging industries in Florida? A: While traditional pension jobs have become less common in many private sectors, there are emerging industries in Florida where employers are beginning to revisit defined benefit plans. Sectors like renewable energy, technology, and specialized healthcare may have progressive employers who recognize the value of offering pension plans to attract top talent. Keeping an eye on these industries can uncover hidden opportunities.

Q8: How do pension jobs in Florida compare to those in other states? A: Pension jobs in Florida can be quite competitive, reflecting the state’s diverse economy and retirement-friendly appeal. Compared to other states, Florida’s public sector positions tend to offer robust pension benefits due to established state plans. However, it’s essential to research specific job markets, as each state has its own regulations and benefits that can influence pension job availability and attractiveness.

This Q&A aims to shed light on the landscape of pension jobs in Florida, equipping job seekers with essential insights as they navigate their career paths in this vibrant state.

0 Comments