In a digitized world where financial acumen meets technological innovation, a new breed of platforms has emerged to empower savvy investors: investment websites. These online hubs serve as gateways to a realm of opportunities, offering a wealth of insights, tools, and resources to navigate the intricate landscape of investments. Join us on a journey through the virtual corridors of these digital investment havens, where knowledge meets potential and decisions shape destinies. Welcome to the realm where clicks lead to wealth – welcome to the world of investment websites.

Table of Contents

- The Power of Data Analytics in Investment Platforms

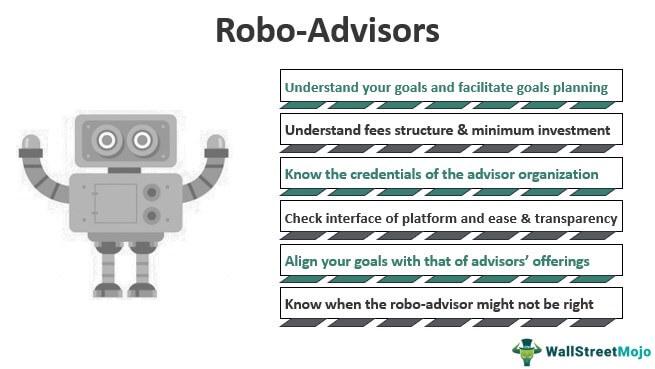

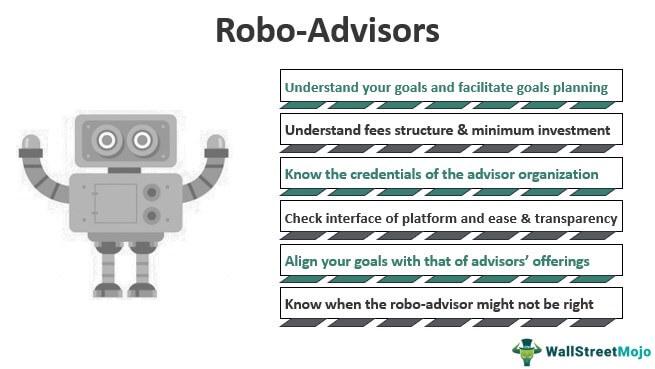

- Navigating the World of Robo-Advisors and AI Investment Tools

- Creating a Diversified Investment Portfolio Through Online Platforms

- Unveiling the Latest Trends in Socially Responsible Investing Websites

- Q&A

- The Conclusion

The Power of Data Analytics in Investment Platforms

Data analytics has revolutionized the way investment platforms operate, providing valuable insights and tools to make informed decisions. By leveraging data analytics, investment websites can track market trends, analyze investor behavior, and optimize investment strategies. The power of data analytics unravels opportunities for better risk management and portfolio diversification, enhancing overall performance and maximizing returns for investors.

Moreover, data analytics enables investment platforms to personalize user experiences, offering tailored investment recommendations based on individual preferences and risk profiles. Through data-driven algorithms, investors can access customized investment options that align with their financial goals and risk tolerance, fostering a more engaging and satisfying investment journey. Embracing data analytics not only boosts operational efficiency but also cultivates a dynamic and responsive environment that caters to the evolving needs of investors in today’s digital landscape.

| Benefit | Description |

|---|---|

| Enhanced Decision-Making | Utilize data insights to make informed investment decisions |

| Personalized Recommendations | Offer tailored investment options based on individual preferences |

Navigating the World of Robo-Advisors and AI Investment Tools

When diving into the realm of investment websites, embracing the power of robo-advisors and AI-driven tools can revolutionize the way you approach your financial journey. Imagine having a virtual financial advisor at your fingertips, analyzing data, and making informed decisions to help you grow your wealth efficiently. With intuitive algorithms and real-time market insights, these innovative platforms offer convenience, reliability, and performance.

Exploring various investment websites equipped with cutting-edge technologies can unlock a world of opportunities for both seasoned investors and newcomers alike. From personalized portfolio management to automated asset allocation, these digital solutions streamline the investment process, allowing you to focus on your financial goals. Embrace the future of investing by harnessing the potential of robo-advisors and AI tools, empowering yourself to make informed decisions and navigate the complexities of the financial markets with confidence.

Creating a Diversified Investment Portfolio Through Online Platforms

When exploring investment websites, it’s crucial to consider a variety of online platforms that can help in diversifying your investment portfolio. These platforms offer a wide range of options to suit different risk profiles and investment goals. One such platform is **Wealthfront**, known for its automated investment services that utilize advanced algorithms to optimize your portfolio for long-term growth.

Another notable platform to consider is Betterment, which provides personalized advice and a user-friendly interface for managing your investments. By leveraging these online tools, investors can access a diverse range of assets such as stocks, bonds, and ETFs, enabling them to spread risk and maximize returns. Embracing the convenience and accessibility of online investment platforms opens up new opportunities for creating a well-rounded and diversified investment portfolio that aligns with your financial objectives.

table.wp-block-table {margin: 20px 0;

border-collapse: collapse;

width: 100%;

}

table.wp-block-table th {

background-color: #f2f2f2;

font-weight: bold;

}

table.wp-block-table td, table.wp-block-table th {

border: 1px solid #ccc;

padding: 8px;

}

| Platform | Key Feature |

|---|---|

| Wealthfront | Automated investment services |

| Betterment | Personalized advice and user-friendly interface |

Unveiling the Latest Trends in Socially Responsible Investing Websites

In the realm of socially responsible investing websites, a myriad of innovative trends are shaping the landscape and influencing investor decisions. Embracing sustainability and ethical practices, these websites are empowering users to align their financial goals with their values. From cutting-edge platforms promoting transparency to interactive tools fostering engagement, the latest trends are revolutionizing the way investors interact with their portfolios.

One of the noteworthy trends is the integration of real-time impact tracking features on investment websites. Through dynamic dashboards and personalized reports, users can visualize the positive outcomes of their investments and track progress towards social and environmental goals. Additionally, the rise of community-driven investment platforms is redefining the traditional investment experience, offering users the opportunity to participate in impactful projects while building a network of like-minded individuals. By seamlessly blending technology with purpose-driven initiatives, socially responsible investing websites are spearheading a new era of financial empowerment and conscious capitalism.

Q&A

Certainly! Here is a creative Q&A for an article about investment websites:

Q: What are investment websites, and how can they benefit me?

A: Investment websites are online platforms that offer a range of financial tools and resources to help individuals make informed investment decisions. They can benefit you by providing access to valuable market insights, investment opportunities, and educational materials.

Q: How do I choose the best investment website for my needs?

A: When selecting an investment website, consider factors such as user-friendliness, variety of investment options, fees, customer support, and security features. It’s essential to choose a platform that aligns with your investment goals and risk tolerance.

Q: Can I trust the information provided on investment websites?

A: While most reputable investment websites strive to provide accurate and up-to-date information, it’s always wise to verify data from multiple sources before making investment decisions. Conduct thorough research and consult with financial advisors when needed.

Q: Are investment websites suitable for beginners?

A: Yes, many investment websites cater to beginners by offering educational resources, investment guides, and user-friendly interfaces. They can be valuable tools for individuals looking to start their investment journey with confidence.

Q: How can investment websites help me diversify my portfolio?

A: Investment websites often offer a wide range of investment options, including stocks, bonds, mutual funds, ETFs, and more. By exploring different asset classes and diversifying your portfolio through these platforms, you can reduce risk and potentially enhance returns.

Q: Are investment websites secure for online transactions?

A: Reputable investment websites prioritize security measures such as encryption, two-factor authentication, and data protection protocols to safeguard users’ sensitive information and transactions. It’s crucial to choose platforms with robust security features to ensure a safe investing experience.

Q: Can I track my investments and portfolio performance on investment websites?

A: Yes, many investment websites provide tools and features that allow users to monitor their investments, track portfolio performance, analyze trends, and set financial goals. These tracking capabilities help investors stay informed and make data-driven decisions.

Q: What are some common pitfalls to avoid when using investment websites?

A: To maximize the benefits of using investment websites, avoid common pitfalls such as making impulsive investment decisions based on emotions, overlooking fees and expenses, neglecting to diversify your portfolio, and not staying informed about market developments.

Q: How can I stay updated on the latest market trends and investment news through investment websites?

A: Stay informed about market trends and investment news by subscribing to newsletters, setting up alerts, following reputable financial blogs, and leveraging the research tools and resources available on investment websites. Keeping yourself informed is key to making well-informed investment decisions.

I hope you find these questions and answers helpful for your article on investment websites!

The Conclusion

As you navigate the vast and ever-evolving landscape of investment websites, remember that knowledge is your most powerful asset. Stay informed, stay curious, and let your financial journey be guided by wisdom and insight. Whether you’re a seasoned investor or just taking your first steps into the world of finances, may your investments prosper and your financial goals be within reach. Here’s to smart investing and a brighter financial future ahead. Thank you for exploring the realm of investment websites with us. Happy investing!

0 Comments