In the fast-paced world of finance, where decisions carry weight and strategy is key, the role of an investment executive stands out as a beacon of knowledge and expertise. Dive into the realm where financial acumen meets decisive actions, as we explore the dynamic landscape navigated by these savvy professionals. Join us on a journey through the intricate web of investments, where calculated risks and astute choices pave the path to financial success.

Table of Contents

- – Unveiling the Role of an Investment Executive: A Comprehensive Overview

- – Key Responsibilities and Skills Required for Success in Investment Executive Roles

- – Navigating Challenges and Seizing Opportunities: Strategies for Aspiring Investment Executives

- – Building a Successful Career Path as an Investment Executive: Expert Tips and Recommendations

- Q&A

- The Conclusion

– Unveiling the Role of an Investment Executive: A Comprehensive Overview

Investment executives play a pivotal role in guiding financial decisions and maximizing returns for clients. They possess a profound understanding of market trends, risk assessment, and investment opportunities, enabling them to design strategic portfolios tailored to individual goals. With a keen eye for detail and a deep-rooted passion for finance, these professionals navigate the complex landscape of investments with finesse and precision.

In their daily endeavors, investment executives cultivate long-lasting relationships with clients, offering personalized advice and fostering trust. Through continuous monitoring of market fluctuations and conducting thorough research, they stay ahead of the curve, adapting strategies to capitalize on emerging opportunities. By leveraging their expertise in asset allocation and portfolio management, these individuals strive to achieve optimal results while upholding the highest standards of integrity and professionalism.

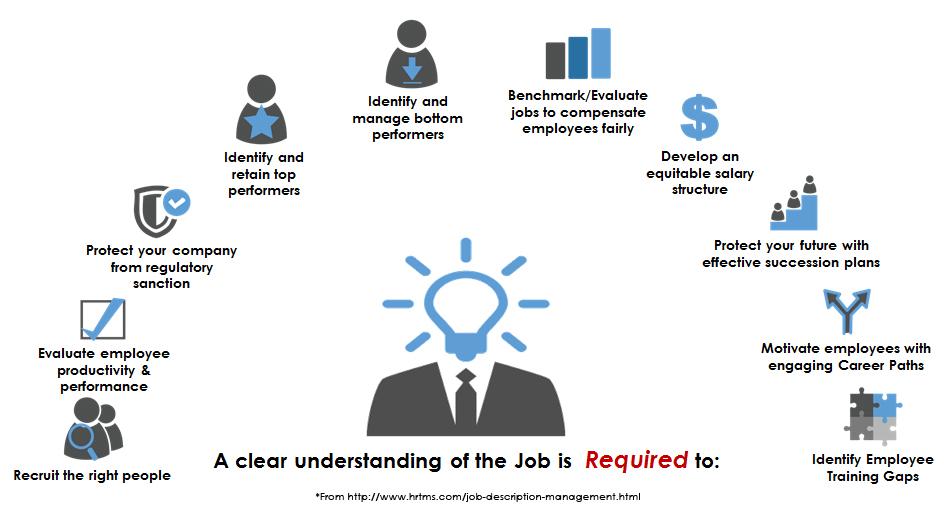

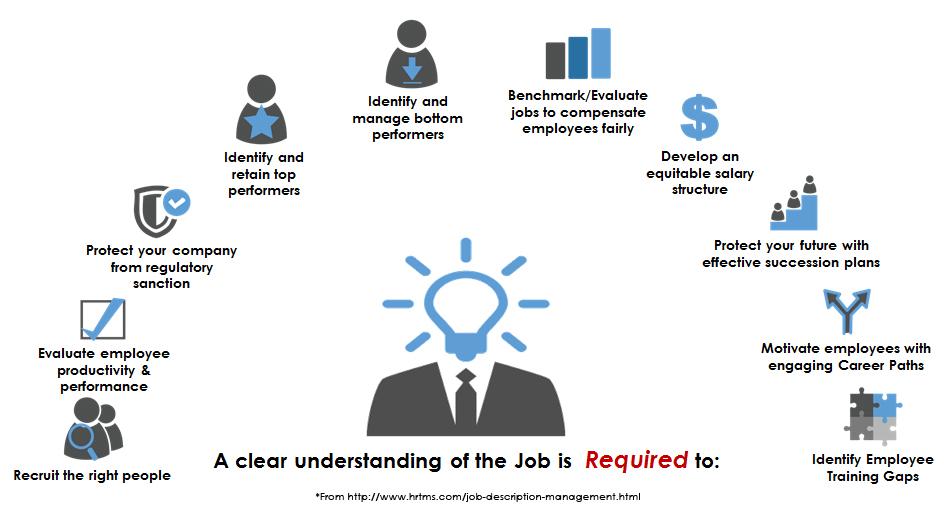

– Key Responsibilities and Skills Required for Success in Investment Executive Roles

Investment executives play a vital role in managing and growing investment portfolios, requiring a blend of financial acumen, strategic thinking, and exceptional communication skills. These professionals are responsible for analyzing market trends, identifying investment opportunities, and working closely with clients to achieve their financial goals.

Successful investment executives possess a diverse skill set that includes expertise in risk management, financial modeling, and relationship building. They must have a deep understanding of financial markets, be adept at evaluating investment risks, and excel in communicating complex financial information to clients in a clear and concise manner.

– Navigating Challenges and Seizing Opportunities: Strategies for Aspiring Investment Executives

Investment executives face a myriad of challenges and opportunities in today’s dynamic financial landscape. To thrive in this competitive field, aspiring professionals must develop a strategic mindset and a keen eye for market trends. Staying updated with the latest industry advancements and technological innovations is crucial for success. By embracing continuous learning and adapting to changes, future investment leaders can enhance their decision-making abilities and broaden their investment portfolios effectively.

Adopting a proactive approach to risk management and diversification can significantly impact an investment executive’s performance. Building a robust network of industry contacts and fostering strong relationships with clients can create valuable opportunities for growth and expansion. Embracing innovation and exploring alternative investment strategies can set aspiring executives apart in a crowded marketplace. Additionally, maintaining a strong ethical compass and a commitment to transparency are essential pillars for long-term success in the investment sector.

– Building a Successful Career Path as an Investment Executive: Expert Tips and Recommendations

Navigating the dynamic world of investment executive roles requires a blend of strategic thinking, financial acumen, and relationship-building skills. To excel in this competitive field, it’s crucial to stay informed about market trends, regulatory changes, and emerging investment opportunities.

Key Strategies for Building a Successful Career Path as an Investment Executive:

- Continuous Learning: Stay updated with industry news, attend seminars, and pursue relevant certifications to enhance your knowledge base.

- Networking: Build strong relationships with clients, colleagues, and industry professionals to expand your opportunities and gain valuable insights.

- Adaptability: Embrace change, be proactive in seeking new challenges, and remain flexible to navigate the evolving landscape of investments.

- Ethical Conduct: Uphold the highest ethical standards in all your dealings to build trust and credibility within the industry.

In the fast-paced realm of investment management, honing your analytical skills and decision-making abilities is paramount. By fostering a growth mindset, cultivating a robust professional network, and demonstrating integrity in every interaction, you can carve out a fulfilling and successful career path as an investment executive.

Q&A

Q&A: Unveiling the World of Investment Executives

Q: What exactly does an investment executive do?

A: An investment executive is a financial professional responsible for managing investments on behalf of clients or a firm. They analyze market trends, assess risks, and make strategic decisions to grow assets and maximize returns.

Q: What sets an investment executive apart from other financial advisors?

A: Investment executives typically work with high-net-worth clients or institutional investors, handling complex portfolios and offering tailored investment strategies. Their focus is often on long-term wealth management and sophisticated financial planning.

Q: How does one become an investment executive?

A: Becoming an investment executive usually requires a strong background in finance, economics, or a related field. Many professionals in this role hold advanced degrees such as an MBA or a CFA designation. Additionally, gaining experience in investment analysis and client management is crucial.

Q: What qualities are essential for success as an investment executive?

A: Key qualities for an investment executive include strong analytical skills, market knowledge, decision-making prowess, and the ability to communicate complex financial concepts effectively. Adaptability, integrity, and a strategic mindset are also vital traits in this role.

Q: How can individuals benefit from working with an investment executive?

A: Working with an investment executive can provide individuals with access to personalized investment strategies, wealth management expertise, and risk mitigation techniques tailored to their financial goals and circumstances. It can help clients navigate the complexities of the financial markets and achieve long-term financial success.

Q: In a rapidly changing financial landscape, how do investment executives stay ahead of the curve?

A: Investment executives stay abreast of market developments by conducting in-depth research, attending industry conferences, collaborating with colleagues, and leveraging advanced technological tools for data analysis. Continuous learning and adaptation to evolving market trends are key to their success in navigating the dynamic financial landscape.

The Conclusion

As we conclude this journey into the world of investment executives, we hope you have gained valuable insights into the dynamic and strategic role they play in the financial landscape. Whether you are an aspiring executive looking to climb the ranks or an investor seeking expert guidance, understanding the pivotal role of an investment executive is key to navigating the complexities of the market with confidence. Stay tuned for more fascinating explorations into the realm of finance and business. Thank you for joining us on this enlightening exploration!

0 Comments