Step into the world of financial quarters, where numbers dance to the rhythm of progress and projections paint the future in shades of opportunity. In the intricate dance of fiscal timelines, these quarters serve as markers of growth, challenges, and balance sheets that whisper tales of success and strategy. Let’s delve into the heart of these financial intervals, where businesses navigate the ebb and flow of economic seasons with precision and foresight. Welcome to the realm of financial quarters, where numbers speak volumes and balance sheets tell stories of resilience and innovation.

Table of Contents

- Understanding Financial Quarters: An Overview

- Optimizing Performance: Strategies for Each Quarter

- Key Metrics to Monitor in Every Financial Quarter

- Maximizing Profitability: Tips for a Successful Quarter

- Q&A

- In Conclusion

Understanding Financial Quarters: An Overview

Financial quarters play a crucial role in the business world, offering a structured way to track and analyze financial performance over time. Each quarter typically spans three months, providing a snapshot of how a company is faring in terms of revenue, expenses, and overall profitability. By breaking down the fiscal year into quarters, businesses can assess their progress, make informed decisions, and adapt strategies to meet their financial goals.

Understanding financial quarters involves grasping key concepts like budgeting, forecasting, and financial reporting. During each quarter, companies may review their earnings, expenditures, and cash flow to assess their financial health and make adjustments as necessary. This process helps businesses stay agile and responsive in a dynamic market environment. By analyzing performance metrics from different quarters, organizations can identify trends, strengths, and areas for improvement, enabling them to make data-driven decisions that drive growth and sustainability.

| Quarter | Duration | Key Focus |

|---|---|---|

| Q1 | January – March | Sales planning |

| Q2 | April – June | Product development |

| Q3 | July – September | Market analysis |

| Q4 | October – December | Financial projections |

Optimizing Performance: Strategies for Each Quarter

In the ever-evolving landscape of financial management, the focus on optimizing performance throughout the year is crucial for sustainable growth and success. Each quarter presents a unique set of challenges and opportunities that require tailored strategies to maximize efficiency and profitability.

Q1: Kickstart the year with a strong foundation by focusing on budget planning and setting clear financial goals. Allocate resources wisely, review market trends, and identify potential areas for growth. Engage your team in brainstorming sessions to foster innovative ideas and improve collaboration. Q2: As the year progresses, monitor key performance indicators closely to track progress and make data-driven decisions. Adjust strategies as needed based on real-time feedback and market dynamics. Invest in employee training programs to enhance skills and productivity, leading to a more resilient and agile organization.

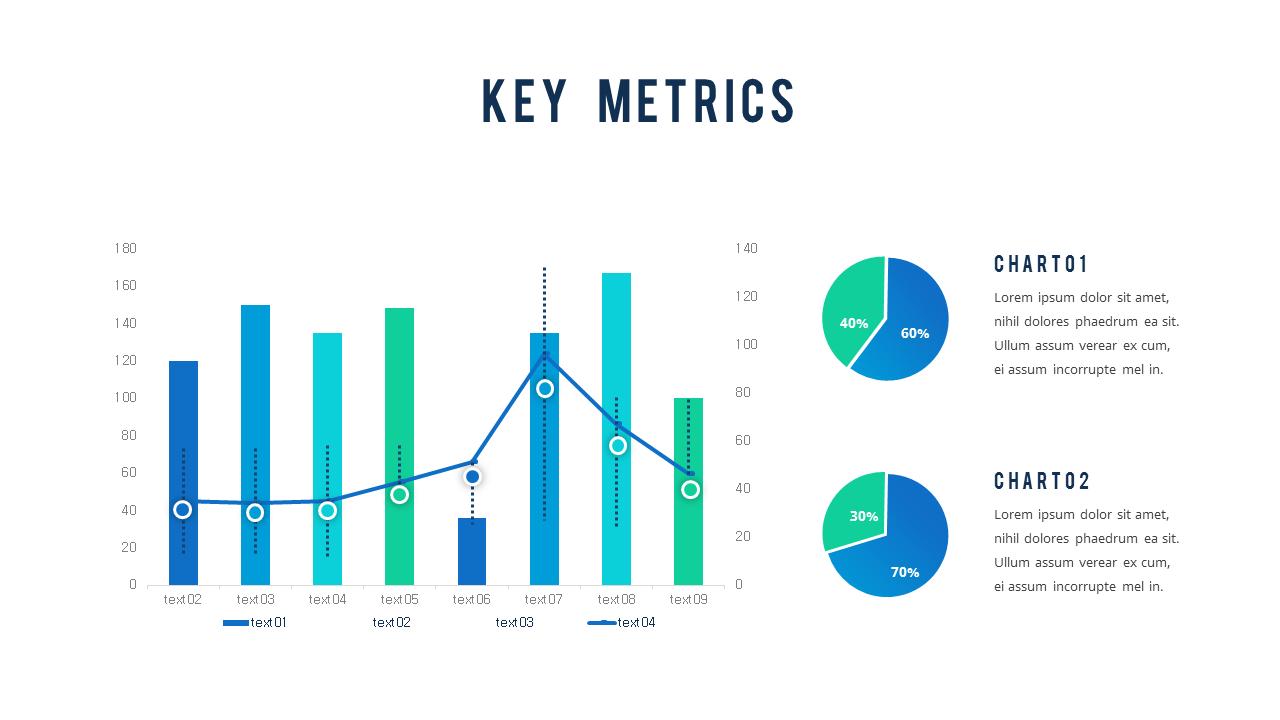

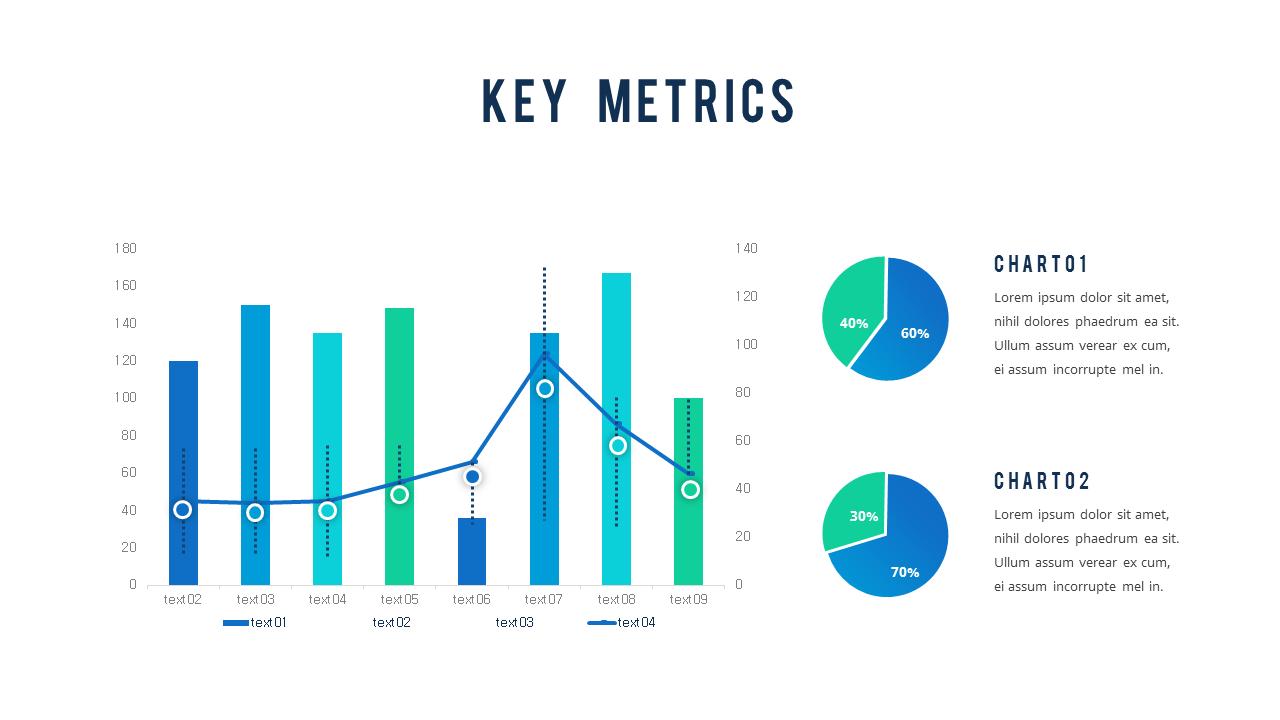

Key Metrics to Monitor in Every Financial Quarter

Monitoring key metrics is essential for any business looking to track its financial performance and make informed decisions. In each financial quarter, certain indicators can provide valuable insights into the company’s health and trajectory.

Revenue Growth: Keeping a close eye on revenue growth can help gauge the effectiveness of sales and marketing efforts. Tracking the percentage increase or decrease in revenue compared to the previous quarter can indicate overall business performance.

Profit Margins: Analyzing profit margins is crucial for assessing the efficiency of operations and cost management strategies. Understanding how much of each dollar earned translates into profit can highlight areas of improvement or potential risks.

| Quarter | Revenue | Expenses |

| Q1 | $500,000 | $350,000 |

| Q2 | $550,000 | $380,000 |

Keeping a pulse on these key metrics throughout the financial year can provide valuable insights and help steer the company towards its financial goals.

Maximizing Profitability: Tips for a Successful Quarter

In the fast-paced world of business, each financial quarter brings both challenges and opportunities. To ensure a successful quarter, businesses need to strategize effectively and adapt to changing market conditions. One key tip to maximize profitability is diversifying revenue streams. By exploring new products or services, targeting different customer segments, or expanding into new markets, companies can reduce reliance on a single source of income and increase overall financial stability.

Another crucial aspect of success lies in cost management. Keeping a close eye on expenses, negotiating better deals with suppliers, optimizing operational processes, and eliminating unnecessary costs can significantly boost profitability. Moreover, monitoring key performance indicators (KPIs) to track progress and identify areas for improvement is essential for making data-driven decisions. By focusing on innovation, efficiency, and financial discipline, businesses can set themselves up for a successful and profitable quarter.

| Quarterly Tip | Details |

|---|---|

| Revenue Diversification | Explore new markets |

| Introduce new products/services | |

| Target different customer segments | |

| Cost Management | Optimize operational processes |

| Negotiate better deals with suppliers |

Q&A

Q: What are financial quarters and why are they important?

A: Financial quarters are specific three-month periods used by businesses and organizations to track and report their financial performance. They are crucial for evaluating the company’s progress, setting goals, and making informed decisions based on trends and insights gathered during these periods.

Q: How many financial quarters are there in a year?

A: There are typically four financial quarters in a year, namely Q1 (January to March), Q2 (April to June), Q3 (July to September), and Q4 (October to December). Each quarter provides a snapshot of the company’s financial health and helps stakeholders gauge its overall performance throughout the year.

Q: What is the significance of analyzing financial performance by quarters?

A: Analyzing financial performance by quarters allows companies to identify patterns, fluctuations, and trends in revenue, expenses, and profits over time. This analysis helps in comparing performance against targets, forecasting future outcomes, and adjusting strategies to achieve long-term financial goals.

Q: How can businesses leverage financial quarters to improve their operations?

A: By closely monitoring their financial performance each quarter, businesses can pinpoint areas of strength and weakness, allocate resources more effectively, seize opportunities for growth, and address challenges promptly. Utilizing data from financial quarters enables organizations to make data-driven decisions that drive success and sustainability.

Q: What role do financial quarters play in investor relations?

A: Financial quarters are crucial for investor relations as they provide investors and stakeholders with timely updates on the company’s financial standing, progress, and outlook. By reporting performance metrics accurately each quarter, businesses can instill confidence in investors, attract potential partners, and maintain transparency in their financial dealings.

In Conclusion

As we wrap up our exploration of financial quarters, we hope this journey has shed light on the importance of these distinct periods in the business world. Understanding the nuances of financial quarters can empower you to make informed decisions and navigate the ever-evolving landscape of finance with confidence. Whether you’re a seasoned professional or a curious novice, the concept of financial quarters serves as a vital framework for measuring and analyzing performance. Stay tuned for more insightful discussions on financial topics that shape the way we perceive and engage with the world of economics. Thank you for embarking on this learning adventure with us. Until next time, may your financial quarters be prosperous and your investments fruitful.

0 Comments