In the world of personal finance, where budgets reign supreme and financial goals sparkle on the horizon, one indispensable tool stands out like a beacon of organization and empowerment – the finance notebook. From tracking expenses to setting savings targets, this unassuming yet powerful companion is a treasure trove of financial wisdom waiting to be explored. Join us on a journey through the pages of possibility as we delve into the art of financial planning with the trusty finance notebook by your side.

Table of Contents

- Exploring the Benefits of a Finance Notebook

- Effective Strategies for Organizing Your Finances

- Maximizing Productivity with Financial Tracking Tools

- Key Features to Look for in a High-Quality Finance Notebook

- Q&A

- Concluding Remarks

Exploring the Benefits of a Finance Notebook

Organizing your finances has never been easier with a finance notebook. This essential tool can revolutionize the way you manage your money, providing numerous benefits that streamline your financial life.

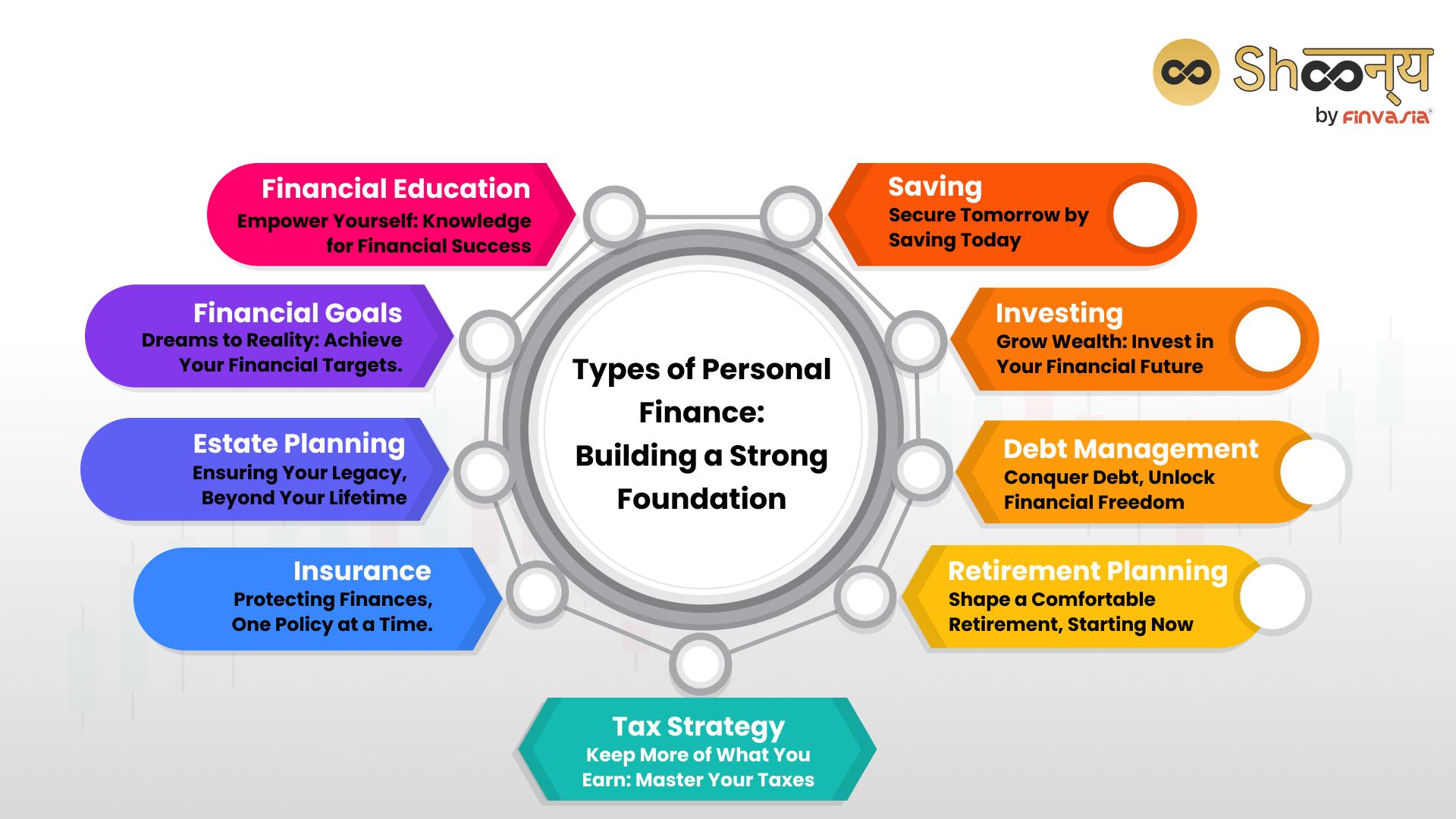

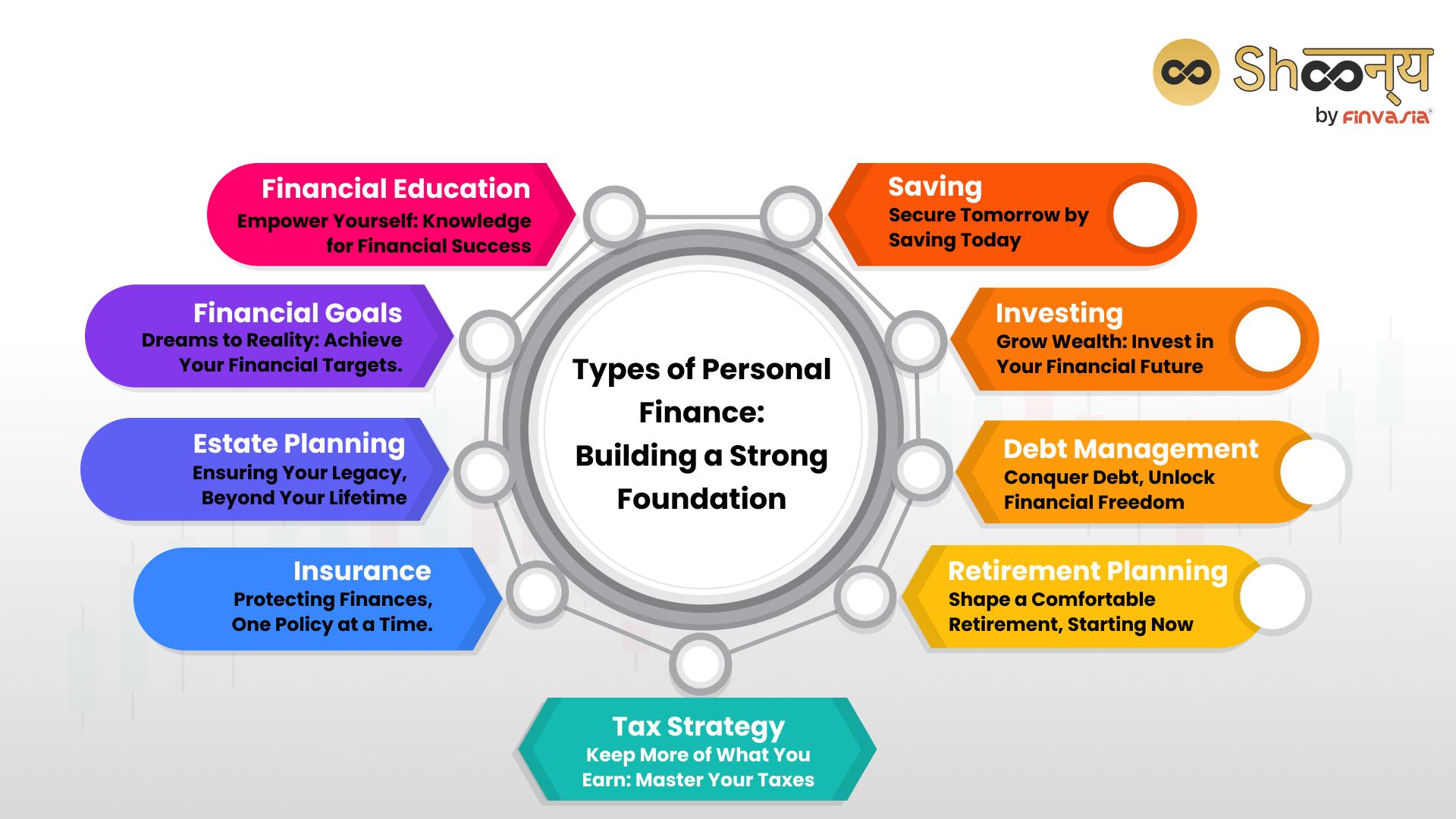

From tracking expenses to setting budget goals, a finance notebook empowers you to take control of your financial well-being. By jotting down income, expenses, and savings objectives, you can gain valuable insights into your spending habits and make informed decisions to reach your financial milestones.

Effective Strategies for Organizing Your Finances

Stay on Top of Your Finances with a Finance Notebook

Managing your money effectively is crucial for financial stability. A finance notebook can be a game-changer in helping you stay organized and in control of your finances. With the right strategies, you can transform your financial habits and achieve your money goals.

- **Track Expenses:** Keep track of your spending by categorizing expenses such as groceries, bills, and entertainment. This will give you a clear picture of where your money is going.

- **Set Budgets:** Create budgets for different categories to ensure you’re not overspending. Monitor your expenses regularly to see if you’re sticking to your budget limits.

- **Set Financial Goals:** Whether it’s saving for a vacation or paying off debt, setting financial goals can help you stay motivated and focused on your priorities.

| Category | Amount |

| Groceries | $300 |

| Bills | $150 |

| Entertainment | $100 |

By incorporating these strategies into your finance notebook routine, you can take charge of your financial future and work towards a more secure and prosperous tomorrow.

Maximizing Productivity with Financial Tracking Tools

Utilizing cutting-edge financial tracking tools can revolutionize the way you manage your finances efficiently. By integrating digital solutions into your daily routine, you can streamline tasks, track expenses seamlessly, and gain valuable insights into your spending habits. One such tool, known for its versatility and user-friendly interface, is the Finance Notebook.

With the Finance Notebook, you can categorize expenses effortlessly, set budget goals, and monitor your financial progress in real-time. Stay on top of your bills, income sources, and savings targets with ease. This powerful tool empowers you to make informed financial decisions and take control of your monetary affairs like never before. Maximize your productivity by harnessing the power of the Finance Notebook and watch your financial prowess soar.

| Benefits of Finance Notebook: |

|---|

| 1. Streamlined expense tracking |

| 2. Customizable budgeting features |

| 3. Real-time financial insights |

Key Features to Look for in a High-Quality Finance Notebook

When choosing a high-quality finance notebook, there are several key features to consider that can enhance your productivity and organization. Look for notebooks that offer **durability**, ensuring they can withstand the wear and tear of daily use. Opt for notebooks with **thick, high-quality paper** to prevent ink bleeding and smudging, providing a smooth writing experience.

In addition, seek out notebooks with built-in features such as dividers for easy categorization of your financial information. Consider notebooks with pockets to store receipts or small documents securely. Sleek design and portability are also essential factors to look for in a finance notebook, making it convenient to carry with you wherever you go. Invest in a notebook that not only meets your functional needs but also reflects your personal style and professionalism.

| Feature | Benefit |

|---|---|

| Durability | Long-lasting use |

| Thick Paper | Prevents ink bleeding |

| Built-in Dividers | Easy categorization |

| Pockets | Secure storage for documents |

Q&A

Q: What is a finance notebook and why should I consider using one?

A: A finance notebook is a powerful tool designed to help you track, manage, and improve your financial health. By jotting down your expenses, setting budget goals, and monitoring your savings, a finance notebook can provide you with a clear overview of your financial situation, ultimately leading to better money management and smarter spending decisions.

Q: How can a finance notebook help me save money?

A: Using a finance notebook allows you to identify areas where you may be overspending, track your saving progress, and set achievable financial goals. By having a detailed record of your finances at your fingertips, you can make more informed choices and develop healthier financial habits that can lead to long-term savings.

Q: Is it necessary to be a financial expert to use a finance notebook effectively?

A: Not at all! A finance notebook is designed to be user-friendly and accessible to anyone, regardless of their financial knowledge. It’s meant to simplify the process of tracking your finances and empower you to take control of your money without needing advanced financial expertise.

Q: What are some essential sections to include in a finance notebook?

A: A well-rounded finance notebook typically includes sections for tracking income, expenses, savings goals, debt repayments, and any other financial commitments you may have. Additionally, having a section for financial reflections and goals can be a great way to stay motivated and on track with your financial objectives.

Q: How often should I update my finance notebook?

A: It’s recommended to update your finance notebook regularly, ideally on a daily or weekly basis. By staying consistent with recording your financial transactions and progress, you’ll have a more accurate and up-to-date view of your financial situation, making it easier to make adjustments and stay on top of your financial goals.

Concluding Remarks

In conclusion, embracing the power of a finance notebook can truly revolutionize the way you manage your finances. By diligently recording your expenses, setting budget goals, and tracking your progress, you are taking a proactive step towards financial empowerment. Let your finance notebook be your trusted companion on the journey to financial stability and success. Start today and watch how this simple yet effective tool can make a significant difference in your financial well-being. Here’s to a future filled with fiscal mindfulness and abundance!

0 Comments