Table of Contents

- Understanding Stock Market Hours and Their Impact on Trading Strategies

- Navigating Different Global Stock Market Time Zones

- The Importance of Trading Volume Throughout Market Hours

- Effective Strategies for Maximizing Returns During Stock Market Hours

- Knowing When to Trade: Insights on Pre-Market and After-Hours Trading

- Q&A

- Final Thoughts

Understanding Stock Market Hours and Their Impact on Trading Strategies

The stock market operates within specific hours, and understanding these can significantly enhance a trader’s ability to capitalize on market movements. Most U.S. exchanges, such as the New York Stock Exchange (NYSE) and the Nasdaq, open at 9:30 AM and close at 4 PM Eastern Time on weekdays. However, there are pre-market and after-hours trading sessions that allow traders to buy and sell outside of the regular trading hours. Familiarity with these timeframes enables traders to react promptly to news and events that might influence stock prices.

Each trading session has its own characteristics that can impact trading strategies. Regular hours typically see the highest volume and liquidity, which can lead to tighter spreads and more stable pricing. In contrast, trading during after-hours or pre-market can present unique opportunities but comes with significant risks due to lower volume and volatility. Understanding these differences can help traders manage their risk more effectively. Notably, the liquidity during these extended hours can drop, resulting in larger price swings.

Moreover, it’s essential to consider the time zone differences for global stocks, especially for investors trading in international markets. Here’s a quick overview of major global market hours:

| Market | Opening Hours (ET) | Closing Hours (ET) |

|---|---|---|

| New York Stock Exchange | 9:30 AM | 4:00 PM |

| London Stock Exchange | 3:00 AM | 11:30 AM |

| Tokyo Stock Exchange | 8:00 PM | 2:00 AM |

By recognizing the distinct trading hours across different exchanges, traders can devise strategies that optimize entry and exit points while minimizing exposure to unfavorable market conditions. Ultimately, timing is crucial; a well-informed trader can leverage stock market hours to enhance their trading outcomes.

Navigating Different Global Stock Market Time Zones

Understanding the intricacies of global stock market time zones is essential for any trader or investor looking to seize opportunities across different international markets. Each major exchange operates within its own set hours, which can significantly affect trading strategies and investment decisions. For example, when the New York Stock Exchange opens at 9:30 AM EST, markets in Tokyo have already closed, and those in London are well on their way to mid-morning transactions. Thus, having a clear grasp of these time differences not only aids in efficient trading but also helps in minimizing risks associated with market volatility.

Key factors to consider when navigating these various time zones include:

- Market Overlaps: Certain periods, such as the overlap between European and U.S. markets, often see increased trading activity and liquidity, making them prime times for trading.

- Holidays and Market Closures: Different countries observe various holidays, leading to market closures that can disrupt trading strategies.

- Economic Events: Global economic indicators can impact multiple markets simultaneously, so being aware of the release times based on respective local times is vital.

Utilizing a well-structured table for quick reference can streamline the process of managing trades across different markets. Below is a simple layout showcasing major global exchanges and their standard trading hours:

| Exchange | Location | Trading Hours (Local Time) |

|---|---|---|

| New York Stock Exchange (NYSE) | New York, USA | 9:30 AM - 4:00 PM EST |

| London Stock Exchange (LSE) | London, UK | 8:00 AM – 4:30 PM GMT |

| Tokyo Stock Exchange (TSE) | Tokyo, Japan | 9:00 AM – 3:00 PM JST |

| Shanghai Stock Exchange (SSE) | Shanghai, China | 9:30 AM – 3:00 PM CST |

By recognizing these differences, traders can optimize their activity and capitalize on profitable opportunities that arise throughout the day, ensuring they stay ahead in today’s fast-paced financial landscape.

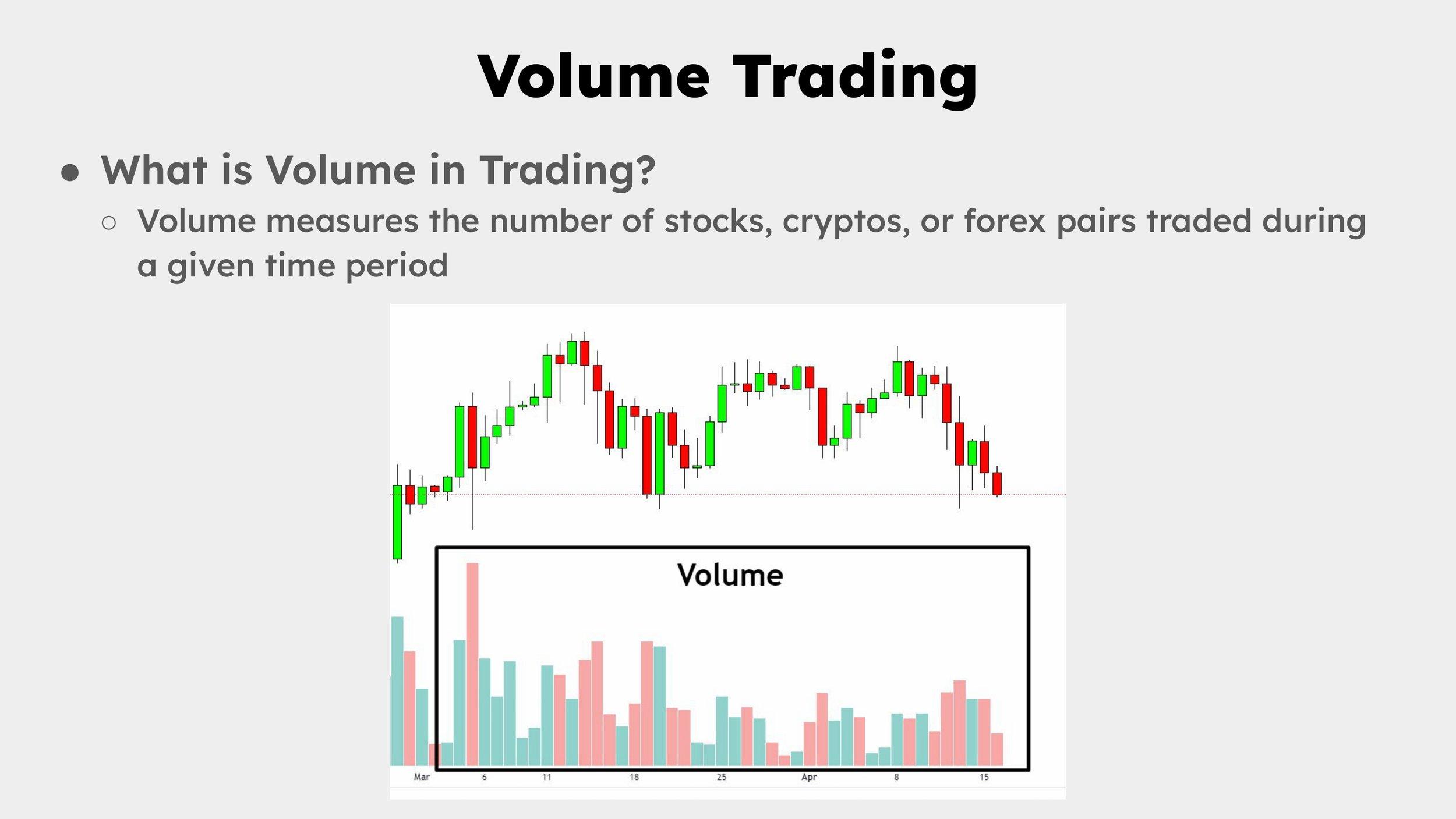

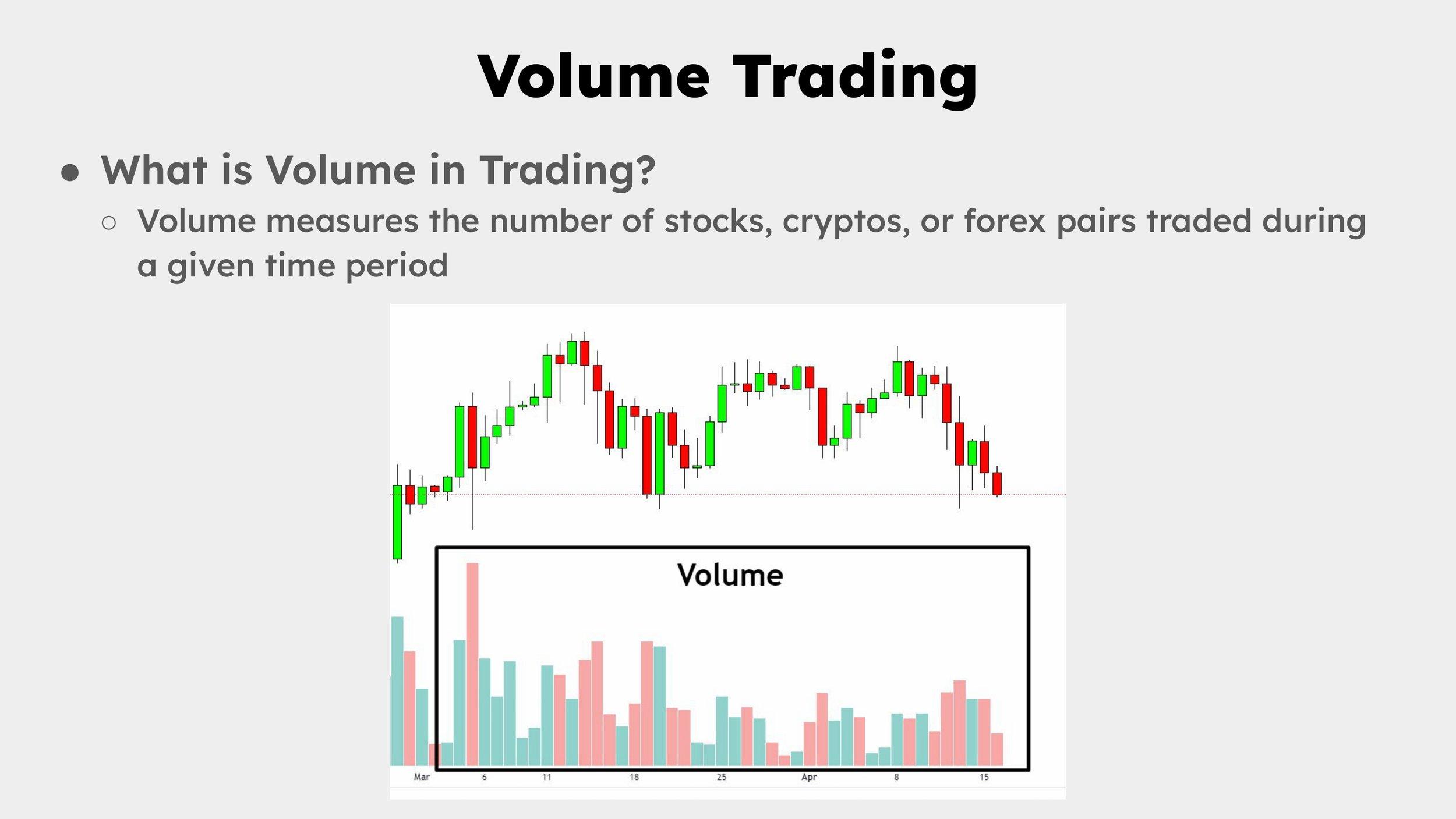

The Importance of Trading Volume Throughout Market Hours

Trading volume plays a crucial role in the stock market, acting as a barometer for market health and investor sentiment. During market hours, fluctuations in trading volume can provide insights into price trends and potential reversals. High trading volume often indicates strong interest in a particular stock or sector, suggesting that investors are confident and engaged. Conversely, low trading volume may signal a lack of interest, often leading to increased price volatility as fewer participants can lead to erratic price movements.

Understanding trading volume helps investors make informed decisions. It’s essential to recognize that not all volumes are equal; context matters. For instance, during earnings reports or major news events, trading volumes can spike dramatically. Such spikes can:

- Signal a potential breakout or breakdown in stock prices

- Indicate shifts in market sentiment

- Reveal accumulation or distribution phases by large investors

Additionally, the time of day can significantly influence trading volume trends. Typically, the first and last hours of market operations witness the highest trading volumes, as investors react to news, execute strategies, and finalize trades. Understanding these patterns enables traders to:

| Time of Day | Trading Characteristics |

|---|---|

| 9:30 AM – 10:30 AM | Highest volatility and volume as markets open |

| 10:30 AM – 3:00 PM | Volume stabilizes; trends may occur |

| 3:00 PM – 4:00 PM | Increased volume as traders adjust positions |

Effective Strategies for Maximizing Returns During Stock Market Hours

To maximize returns during active stock market hours, investors should adopt a proactive approach. Understanding market trends is crucial; therefore, keeping an eye on pre-market and after-hours trading can give insights into potential movements as the market opens. Analyze economic indicators, earnings reports, and global news that can influence stock prices. A well-informed investor is always a step ahead, allowing for strategic buying and selling when the market is most volatile.

Utilizing technical analysis can also enhance decision-making. This involves studying price movements and chart patterns, which helps identify entry and exit points effectively. Traders often employ tools such as moving averages and trend lines to make educated guesses about future price movements. Furthermore, combining these insights with active monitoring of the market can lead to better trade execution, particularly during the first and last hours when volumes tend to be higher.

Implementing a diversification strategy is another effective method to manage risk while aiming for higher returns. By spreading investments across various sectors and asset classes, investors can protect their portfolios from volatility. Consider creating a balanced portfolio that includes stocks, bonds, and commodities. Additionally, utilizing limit orders instead of market orders can ensure that investments are executed at the desired price without contributing to unnecessary volatility.

Knowing When to Trade: Insights on Pre-Market and After-Hours Trading

Understanding the nuances of trading outside regular market hours can significantly enhance your trading strategy. Pre-market trading typically occurs from 4:00 AM to 9:30 AM ET, allowing investors to react to news events and earnings reports before the traditional market opens. However, it’s essential to note that not all stocks are available for pre-market trading, and the liquidity might be lower, resulting in increased volatility. Traders should be prepared for larger price swings and wider spreads, as this can lead to unexpected outcomes.

On the other hand, after-hours trading takes place from 4:00 PM to 8:00 PM ET. Like its pre-market counterpart, after-hours sessions help investors capitalize on late-breaking news that could affect stock valuations post-market close. This session can be particularly favorable for traders looking to react to earnings announcements that occur after regular trading hours. However, just as in the pre-market, liquidity can be a concern, and it’s crucial to have a clear strategy when participating in these extended hours. Here are a few factors to consider:

- Price movement: Expect more volatility due to lower trading volumes.

- Market sentiment: After-hours trading can reflect market reactions to news released late in the day.

- Technical analysis: Relying solely on charts may not provide an accurate picture given the unique dynamics of after-hours trading.

It is also vital to be aware of the potential for reduced execution speed and altered order types in both pre-market and after-hours trading. Orders can experience delays, and market orders may not always execute at anticipated prices due to limited counterparties. Therefore, traders should familiarize themselves with their brokerage’s specific policies and tools for executing trades during these sessions, ensuring a smoother trading experience.

Q&A

Q&A on Stock Market Hours

Q: What are the regular trading hours for the stock market in the United States?A: The regular trading hours for the New York Stock Exchange (NYSE) and the Nasdaq Stock Market are from 9:30 AM to 4:00 PM Eastern Time, Monday through Friday. However, the markets are closed on federal holidays.Q: Are there any pre-market or after-hours trading sessions?A: Yes, many brokers offer pre-market trading that typically runs from 4:00 AM to 9:30 AM ET and after-hours trading from 4:00 PM to 8:00 PM ET. These sessions allow traders to react to news and events outside regular hours, but they come with lower liquidity and higher volatility.

Q: Why do stock markets have specific trading hours?A: Designating specific trading hours helps create a structured environment for buying and selling securities. It enhances market efficiency, ensuring traders have a common timeframe to execute their transactions and access relevant information. This predictability facilitates greater participation and stability.

Q: Can stock prices fluctuate outside traditional trading hours?A: Absolutely! Prices can be quite volatile during pre-market and after-hours sessions due to fewer participants and the immediate impact of news releases. Events such as corporate earnings reports or geopolitical news can lead to significant price changes.

Q: How do time zones affect stock market hours?A: Since stock market hours are based on Eastern Time, traders in other time zones must adjust accordingly. For instance, the market opens at 6:30 AM for those on the West Coast (PT) and at 11:30 AM for those in London (GMT). This can affect trading strategies based on when significant news is released.

Q: What happens if I’m trying to trade outside of regular hours?A: If you’re trying to trade outside regular hours, your orders will typically be routed to the respective pre-market or after-hours platforms. However, you may face certain restrictions, such as limited order types, and your orders might execute at different prices than during regular trading due to lower volume.

Q: Are there differences in market hours for other countries?A: Yes, stock market hours vary by country. For example, the London Stock Exchange operates from 8:00 AM to 4:30 PM GMT, while the Tokyo Stock Exchange runs from 9:00 AM to 3:00 PM JST. It’s crucial for international traders to be aware of these differences when planning their trades.

Q: What should I consider before trading during off-hours sessions?A: Traders should consider the potential for lower liquidity, wider bid-ask spreads, and increased volatility during pre-market and after-hours sessions. It’s also important to ensure that their broker supports these sessions and to be aware of the trading rules that may apply, as they can differ from standard hours.

Q: Is it worthwhile to trade during the pre-market or after-hours sessions?A: Trading during these sessions can be beneficial for those looking to capitalize on breaking news or to position themselves ahead of the market’s opening. However, it’s essential to have a solid strategy and be mindful of the risks involved, including less predictable price movements.

0 Comments