Embark on a journey through the bustling landscape of the finance industry, where numbers dance to the rhythm of economic trends and investments hold the promise of tomorrow. As we delve into the intricate web of banking, investments, and money management, we explore the heartbeat of global economies and the pulse of personal finances. Join us as we unravel the mysteries of wealth creation, risk management, and financial innovation in this ever-evolving realm of numbers and possibilities.

Table of Contents

- Understanding the Impact of Digital Transformation in the Finance Sector

- Navigating Regulatory Changes: Compliance Strategies for Financial Institutions

- Unlocking Innovation in Fintech: Future Trends and Opportunities

- Strategies for Enhancing Customer Experience in Banking and Finance

- Q&A

- Concluding Remarks

Understanding the Impact of Digital Transformation in the Finance Sector

The finance sector is undergoing a monumental shift, propelled by the unstoppable force of digital transformation. This revolution is reshaping the landscape of financial services, prompting traditional institutions to adapt or risk being left behind in the fast-paced digital era. With advancements in technology and changing consumer behaviors, the finance industry is witnessing a wave of innovation that is redefining how financial services are accessed, delivered, and experienced.

In this dynamic environment, embracing digital transformation has become imperative for financial organizations to stay competitive and relevant. From the rise of digital banking solutions to the integration of artificial intelligence in financial processes, the industry is at the forefront of adopting cutting-edge technologies to enhance customer experiences, streamline operations, and drive business growth. As financial institutions navigate this digital evolution, the ability to harness data analytics, automate processes, and offer personalized services is becoming increasingly crucial to meet the evolving needs and expectations of customers in an interconnected world. A shift towards a more agile, customer-centric approach is shaping the future of finance, paving the way for innovative solutions that cater to a digital-savvy audience.

Navigating Regulatory Changes: Compliance Strategies for Financial Institutions

When facing the ever-evolving landscape of regulatory changes, financial institutions must adapt swiftly to ensure compliance and maintain trust with their clients. One essential strategy involves regular training sessions for staff members to stay updated on the latest regulations and best practices. By fostering a culture of compliance, institutions can proactively address challenges and mitigate risks effectively.

Moreover, establishing **clear communication channels** both internally and externally is paramount in navigating regulatory changes. Financial institutions can enhance transparency by educating clients on regulatory updates and understanding their concerns. Utilizing technology solutions like **regulatory compliance software** can streamline processes and enhance overall compliance efficiency.

Unlocking Innovation in Fintech: Future Trends and Opportunities

In the fast-paced realm of financial technology, or Fintech, the landscape is constantly evolving, opening up a world of possibilities and opportunities for innovation. As the digital age continues to shape the way we interact with money and transactions, keeping abreast of the latest trends is crucial for businesses looking to stay ahead of the curve.

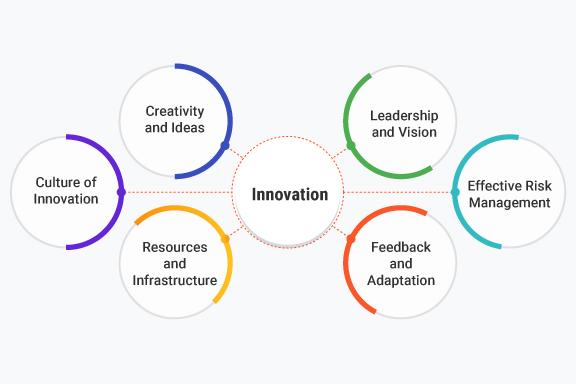

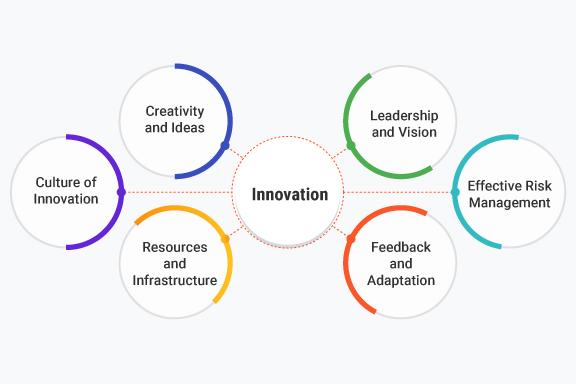

One key trend in Fintech is the rise of blockchain technology, which offers secure and transparent transactions through decentralized systems. Embracing artificial intelligence (AI) and machine learning can also revolutionize financial services, streamlining processes and enhancing customer experiences. By tapping into these emerging technologies and fostering a culture of creativity and adaptability, organizations can unlock the full potential of innovation in the finance industry.

Strategies for Enhancing Customer Experience in Banking and Finance

In the fast-paced world of banking and finance, providing exceptional customer experience is paramount to building trust and loyalty. Implementing robust strategies can set financial institutions apart from the competition, fostering long-term relationships with clients. Personalization is key in creating a tailored experience for customers, offering customized services based on individual needs and preferences. By leveraging data analytics and customer insights, banks can anticipate client requirements, providing a seamless and personalized journey.

Moreover, omnichannel integration plays a vital role in enhancing the customer experience, allowing clients to interact across various touchpoints seamlessly. From mobile banking apps to web portals and in-person consultations, ensuring a consistent experience regardless of the channel enhances customer satisfaction. By investing in user-friendly interfaces and efficient backend systems, financial institutions can streamline processes and deliver a cohesive experience to customers.

| Strategy | Benefits |

| Personalized Services | Increased Customer Loyalty |

| Omnichannel Integration | Enhanced Customer Satisfaction |

Q&A

Q: What are some exciting trends shaping the finance industry today?

A: The finance industry is experiencing a wave of innovation with trends like fintech, blockchain, and robo-advisors revolutionizing the way we manage money. These advancements are enhancing both the customer experience and the efficiency of financial services.

Q: How can individuals stay financially resilient in uncertain economic times?

A: Building a diversified investment portfolio, maintaining an emergency fund, and staying informed about financial literacy are key factors in ensuring financial resilience during uncertain economic times. It’s important to adapt to changes and make informed decisions to secure a stable financial future.

Q: What role does sustainable investing play in the finance industry?

A: Sustainable investing, also known as ESG (Environmental, Social, and Governance) investing, is gaining momentum in the finance industry. Investors are increasingly looking to support companies that prioritize ethical practices, environmental sustainability, and social responsibility, aligning their values with their investment choices.

Q: How can businesses benefit from incorporating innovative financial technologies?

A: Businesses can leverage innovative financial technologies to streamline processes, improve efficiency, reduce costs, and enhance customer experience. Embracing fintech solutions, such as automated payments, digital wallets, and AI-driven analytics, can give companies a competitive edge in today’s fast-paced financial landscape.

Q: What are the upcoming challenges and opportunities for the finance industry in the digital age?

A: The finance industry faces challenges such as cybersecurity threats, regulatory changes, and adapting to rapid technological advancements. However, these challenges also present opportunities for industry players to innovate, create new revenue streams, and deliver more personalized financial services to meet the evolving needs of customers in the digital age.

Concluding Remarks

As we conclude our exploration of the intricate world of the finance industry, it becomes evident that the realm of finances is not just about numbers and transactions; it’s a dynamic arena where innovation meets tradition, and where fiscal decisions have the power to shape economies and livelihoods. Whether you are an investor seeking opportunities, a professional navigating the financial landscape, or simply curious about the forces driving global markets, the finance industry offers a captivating journey filled with challenges and rewards. Stay tuned for more insights and updates as we continue to unravel the mysteries of finance together. Thank you for embarking on this enlightening expedition with us. Until next time, may your investments be wise and your financial future secure.

0 Comments