Table of Contents

- Streamlining Financial Operations for Optimal Efficiency

- Creating a Productive Environment in Your Finance Office

- Harnessing Technology to Elevate Financial Management

- Essential Skills for Todays Finance Professionals

- Future Trends Shaping the Modern Finance Office

- Q&A

- To Wrap It Up

Streamlining Financial Operations for Optimal Efficiency

The heart of a successful financial office lies in its ability to seamlessly integrate various financial functions to ensure a smooth flow of data and resources. Synchronizing accounts payable and receivable, budgeting, and financial reporting with centralized software solutions can drastically reduce errors and time spent on manual tasks. Automation of recurring processes not only speeds up financial operations but also allows staff to focus on strategic analysis rather than mundane tasks. Implementing cloud-based solutions ensures team members can access necessary financial data from anywhere, enhancing collaboration and decision-making efficiency.

- Adopt unified software platforms for account management.

- Automate routine transactions to minimize human intervention.

- Leverage cloud technology to improve data access and security.

Utilizing advanced financial management tools empowers decision-makers to gain real-time insights into fiscal performance. With accurate data at their fingertips, financial strategists can better forecast and plan for growth opportunities and potential challenges. A comprehensive dashboard simplifies data interpretation, showing critical financial metrics at a glance. This approach also aids in identifying bottlenecks, enabling teams to address issues before they escalate. Below is a sample representation of key financial metrics typically monitored:

| Metric | Target Value | Current Status |

|---|---|---|

| Net Profit Margin | 15% | 12% |

| Debt to Equity Ratio | 1:1 | 1.2:1 |

| Cash Flow | $100,000/month | $90,000/month |

Streamlined communication is essential in a financial office, promoting effective collaboration and reducing miscommunication. Fostering a transparent environment where every team member comprehensively understands their role contributes to organizational coherence. Regular training sessions help professionals stay updated with the latest financial regulations and software skills. Moreover, establishing a clear hierarchy and reporting structure ensures quick and efficient troubleshooting when necessary, maintaining smooth operations across the board.

Creating a Productive Environment in Your Finance Office

Striking the right balance in your workspace is key to enhancing efficiency and focus. Start by organizing your office layout in a way that minimizes clutter and maximizes accessibility. An open-concept design or strategically placed partitions can foster collaboration while maintaining personal space. Ensure each team member has access to ergonomic furniture, natural lighting, and essential office tools. Consider plant decorations for a touch of greenery, as they can improve both mood and air quality, boosting productivity.

Remember, technology is your ally in creating a seamless workflow. Implementing cloud-based accounting software can streamline processes and reduce paperwork. Encourage the use of noise-canceling headphones for tasks that require deep concentration. Setting up a centralized communication system, like a project management tool, ensures clarity and reduces the need for endless email threads. Ensure that all digital tools integrate smoothly, creating a unified digital ecosystem for effortless data flow.

Foster a culture of transparency and teamwork by incorporating regular check-ins and feedback sessions. Encourage an open-door policy where team members feel comfortable sharing ideas and challenges. You can also establish ‘focus hours’ where interruptions are minimized to allow staff to tackle their most demanding tasks. Establish milestone-based incentives to keep the team motivated. Here’s a simple incentive structure:

| Milestone | Reward |

|---|---|

| Monthly Financial Target | Team Lunch |

| Quarterly Audit Success | Gift Cards |

| Annual Performance | Bonus |

Harnessing Technology to Elevate Financial Management

In today’s fast-paced financial environment, leveraging innovative solutions leads to more precise, efficient, and transparent operations. The finance office, once bogged down by manual tasks, is now experiencing a transformation through the integration of advanced tools and systems. Automation technologies streamline routine tasks such as data entry and invoice processing, significantly reducing the risk of human error. As a result, finance teams can redirect their focus toward strategic planning and data analysis, enabling them to make informed decisions that drive business growth. This shift not only enhances productivity but also empowers finance professionals to utilize their expertise more effectively.

Moreover, cloud-based platforms facilitate seamless access to financial data anywhere, anytime, thus promoting better collaboration and flexibility within finance teams. By implementing cloud storage solutions, companies can enjoy increased security, scalability, and cost savings associated with the reduction of physical infrastructure. Employees can effortlessly share documents and financial reports, fostering a culture of transparency and accountability. Additionally, real-time insights garnered from these platforms improve forecasting accuracy and provide businesses with the agility to adapt quickly to market changes.

Data analytics tools also play a crucial role in revolutionizing financial management. By harnessing the power of big data, finance teams can uncover valuable trends and insights that were previously hidden. These tools enable comprehensive performance evaluations and risk assessments, allowing businesses to stay ahead of the curve in a competitive landscape. Implementing the latest analytics software not only enhances decision-making but also helps to identify inefficiencies and optimize resource allocation. Furthermore, by using data-driven strategies, financial leaders can craft tailored investment plans that align with their long-term objectives.

| Technology | Benefit |

|---|---|

| Automation | Reduces errors, saves time |

| Cloud Computing | Improves access, security |

| Data Analytics | Provides insights, enhances decisions |

Essential Skills for Todays Finance Professionals

In today’s dynamic financial landscape, professionals must possess a diverse set of skills to stay ahead. Analytical proficiency is crucial as financial professionals routinely interpret complex data to make informed decisions. Being adept at handling large data sets, extracting actionable insights, and predicting trends can significantly impact an organization’s financial success. Moreover, trend analysis and risk assessment are not just about numbers; they require strategic thinking and foresight.

Moreover, the importance of technological literacy cannot be overstated. From leveraging advanced financial software to understanding blockchain and AI applications, technology plays a pivotal role in modern finance. Competence in tools like Excel, Python, or specialized financial software can greatly enhance efficiency and accuracy. Professionals who are comfortable navigating these platforms can streamline processes, ensuring more efficient transaction management and reporting.

Equally important are robust communication skills. Financial professionals must clearly convey complex information to stakeholders who may not have a finance background. Being able to present data-driven insights in a comprehensible manner is essential, whether through concise reports or compelling presentations. Additionally, skills in negotiation and stakeholder engagement can foster better decision-making and reinforce trust within the organization.

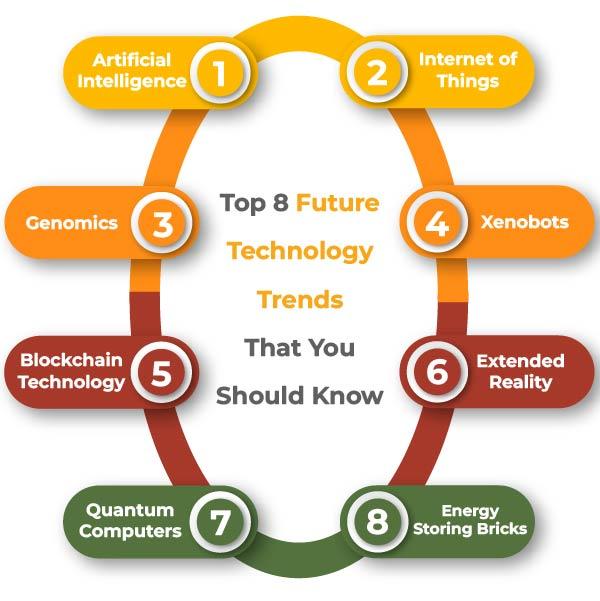

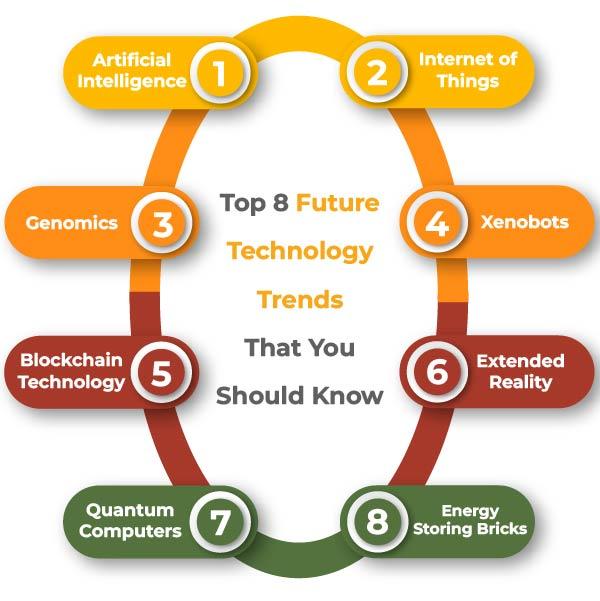

Future Trends Shaping the Modern Finance Office

In the evolving landscape of finance, automation and artificial intelligence are at the forefront, transforming traditional operations. Robotic Process Automation (RPA) is a game-changer in streamlining repetitive tasks such as data entry and financial reporting. This not only improves efficiency but also reduces human error, enabling financial professionals to focus on strategic analysis. Moreover, AI algorithms enhance predictive analytics, offering insights into market trends and customer behavior, which helps in making informed decisions.

- Blockchain Technology: Safeguarding transactions with transparency and security.

- Cloud Computing: Facilitating remote collaboration and access to real-time financial data.

- Data Analytics: Harnessing big data for strategic forecasting.

| Trend | Impact |

|---|---|

| Decentralized Finance (DeFi) | Increases accessibility and reduces dependency on traditional banks |

| Mobile Payment Solutions | Enhances convenience and speeds up transaction processes |

Beyond technological advancements, there’s a noticeable shift towards sustainable finance. Companies are increasingly adopting environmental, social, and governance (ESG) criteria when making investment decisions. This reflects a broader trend towards corporate responsibility, ensuring that financial growth aligns with ethical standards and environmental conservation. This approach not only satisfies regulatory requirements but also appeals to investors who prioritize sustainability.

0 Comments