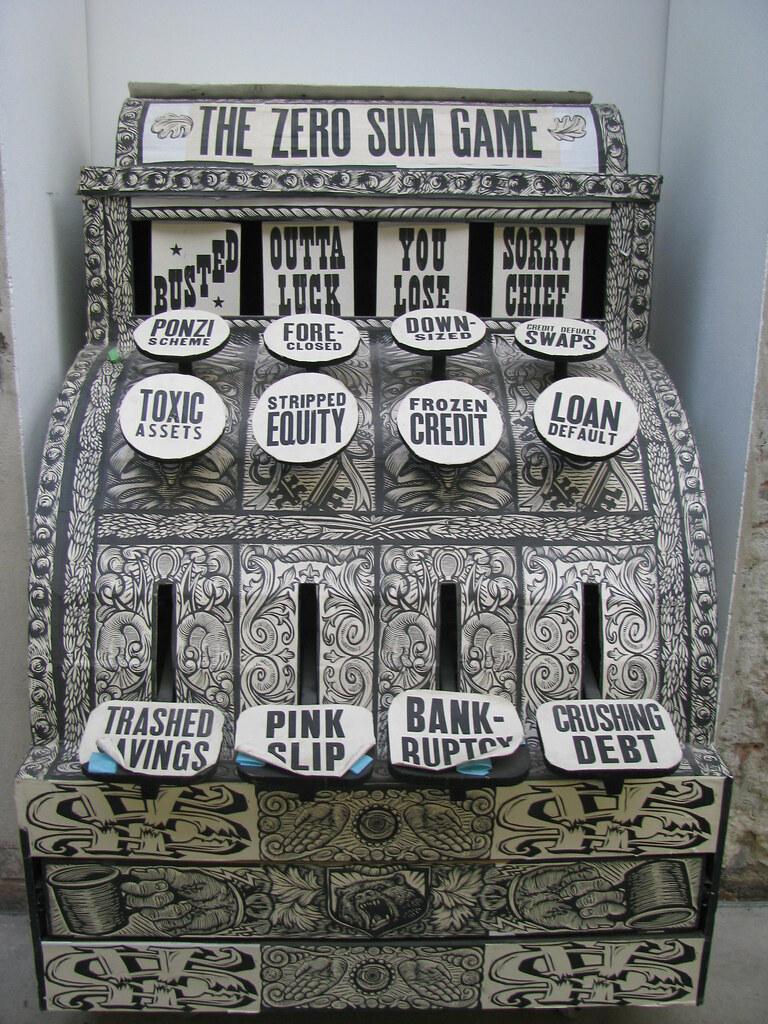

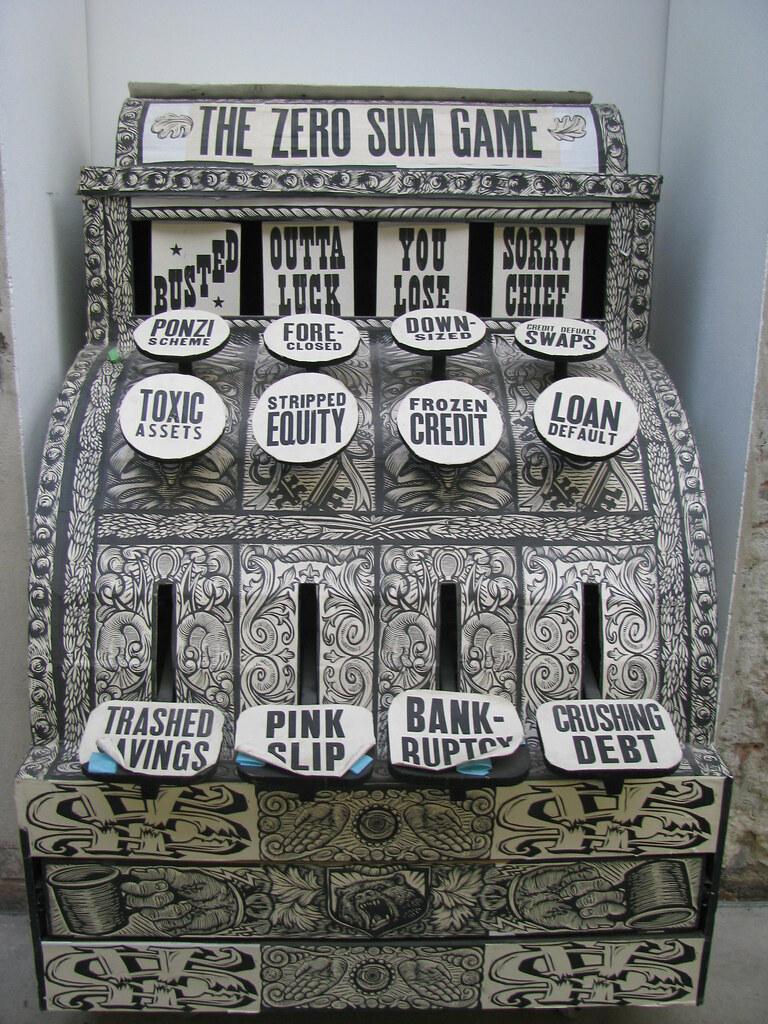

In the dynamic world of the stock market, where fortunes are made and lost in the blink of an eye, the concept of a ”zero-sum game” looms large. This intriguing notion challenges investors to navigate the intricate web of buying and selling, where one’s gain is another’s loss. Join us on a journey to unravel the mysteries of the stock market zero-sum game, where strategy meets speculation in a mesmerizing dance of risk and reward.

Table of Contents

- Understanding the Concept of a Zero Sum Game in the Stock Market

- Navigating Risk and Reward in Zero Sum Game Investing

- Developing Strategies for Success in a Zero Sum Game Environment

- Embracing Long-Term Growth Mindset in Zero Sum Game Trading

- Q&A

- Key Takeaways

Understanding the Concept of a Zero Sum Game in the Stock Market

In the dynamic realm of the stock market, the concept of a zero-sum game plays a pivotal role in shaping investor strategies and outcomes. This concept revolves around the notion that for every gain made by one market participant, there is an equal loss incurred by another. It underscores the competitive nature of trading where one party’s success is directly correlated with another’s setback, forming a perpetual cycle of wins and losses.

Embracing the essence of a zero-sum game requires investors to navigate the market with precision and foresight. By understanding this framework, traders can leverage opportunities strategically, mitigate risks effectively, and adapt to market fluctuations with agility. It prompts individuals to hone their analytical skills, diversify their portfolios, and stay attuned to market dynamics to thrive in this intricate financial ecosystem. By embracing this concept, investors can navigate the stock market landscape with a heightened sense of awareness and strategic acumen.

Navigating Risk and Reward in Zero Sum Game Investing

In the world of investing, the zero-sum game concept looms large, where gains for one investor often come at the expense of another. Embracing this reality requires a delicate balance of calculated risk-taking and strategic decision-making. As market dynamics ebb and flow, navigating the turbulent waters of the stock market demands a keen understanding of the interplay between risk and reward.

Key points to consider when delving into the realm of zero-sum game investing:

- Diversification: Spread your investments across various asset classes to mitigate risk.

- Research: Thoroughly analyze market trends, company performance, and economic indicators to make informed decisions.

- Patience: Avoid impulsive moves and stay the course, knowing that long-term investments can yield substantial rewards.

| Asset Class | Risk Level | Potential Reward |

|---|---|---|

| Stocks | High | High |

| Bonds | Medium | Medium |

| Real Estate | Medium to High | High |

| Commodities | High | High |

**Another crucial tactic is staying informed and adaptable**, closely monitoring market trends, economic indicators, and geopolitical events to make informed decisions. Embracing a long-term perspective and exercising patience amidst market fluctuations can also be instrumental in navigating the uncertain waters of financial trading.

Embracing Long-Term Growth Mindset in Zero Sum Game Trading

****

Trading in the stock market can often feel like navigating through a complex maze where every gain comes at the expense of someone else’s loss. In this high-stakes environment, adopting a long-term growth mindset can be the differentiating factor between success and failure. Instead of getting caught up in the zero-sum game mentality, investors who focus on sustainable growth strategies tend to outperform the competition in the long run.

One key aspect of embracing a long-term growth mindset is to prioritize fundamental analysis over short-term market fluctuations. By conducting thorough research on the underlying value of a company, investors can make informed decisions that align with their long-term investment goals. Additionally, diversifying the investment portfolio across different asset classes and industries can help mitigate risks and capitalize on opportunities that arise in various market conditions.

Q&A

Title: Unraveling the Myth: Is the Stock Market Really a Zero Sum Game?

Q: What is the concept of a zero-sum game in relation to the stock market?

A: The notion of the stock market being a zero-sum game implies that for every gain made by one investor, there must be a corresponding loss experienced by another investor. This perception often leads to the belief that in the world of investing, one person’s profit comes directly at the expense of another’s loss.

Q: Is the stock market truly a zero-sum game?

A: Contrary to popular belief, the stock market is not a strict zero-sum game. While it is true that for every transaction that results in profits for one party, there is an opposite party experiencing losses, the overall market itself does not operate under a fixed quantity of wealth. The market can expand due to economic growth, innovation, and various other factors, leading to opportunities for multiple investors to benefit simultaneously.

Q: How can investors navigate the complexities of the stock market without falling into the zero-sum game mindset?

A: Investors can shift their focus from viewing the market as a zero-sum game to understanding it as a platform for wealth creation and value appreciation. By conducting thorough research, diversifying their portfolios, and adopting long-term investment strategies, investors can position themselves to capitalize on the positive dynamics of the market rather than being fixated on the concept of winners and losers.

Q: What are some common misconceptions surrounding the zero-sum game philosophy in the stock market?

A: One common misconception is the belief that successful investing requires exploiting the losses of others. In reality, sustainable investment practices emphasize creating value through supporting companies that drive innovation, growth, and positive societal impact. Viewing the market as a collaborative arena where all participants can thrive leads to more productive and ethical investment decisions.

Q: How can a balanced perspective on the stock market benefit investors in the long run?

A: Embracing a balanced perspective that acknowledges both the competitive and cooperative aspects of the stock market can empower investors to make informed decisions that align with their financial goals and ethical principles. By recognizing that market dynamics are influenced by a multitude of factors beyond simple win-loss scenarios, investors can cultivate resilience, adaptability, and a deeper understanding of the complexities inherent in financial markets.

Key Takeaways

As we wrap up our exploration of the stock market as a zero-sum game, it is clear that the landscape of investing is as dynamic as it is enigmatic. While the concept of winners and losers may prevail in certain contexts, it is vital to remember that the realm of finance is a multifaceted arena where opportunities abound for those who approach it with knowledge, strategy, and prudent risk management. Whether you see the market as a zero-sum game or a platform for mutual growth and prosperity, one thing remains certain – the continuous evolution and interplay of factors that shape our financial world make it a captivating journey for investors of all kinds. As you navigate the complexities and nuances of the stock market, may you find success, wisdom, and fulfillment in your investment endeavors. Thank you for joining us on this illuminating exploration, and may your future investments be both lucrative and enlightening.

0 Comments