As the world of finance ebbs and flows, the stock market drop emerges as a formidable force, sending ripples of uncertainty through investors and analysts alike. In the intricate dance of bulls and bears, sudden plunges in stock prices can often leave even the most seasoned traders on edge. Join us as we delve into the depths of this phenomenon, uncovering its causes, impacts, and potential strategies for navigating the tumultuous waters of market fluctuations. Let’s unravel the mystery behind the enigmatic stock market drop and illuminate the path forward amidst the shifting tides of economic landscapes.

Table of Contents

- Understanding the Effects of a Stock Market Drop

- Strategies to Navigate Volatility in the Market

- Investment Opportunities Amidst a Market Decline

- Guiding Principles for Investors During Stock Market Turmoil

- Q&A

- Final Thoughts

Understanding the Effects of a Stock Market Drop

When the stock market experiences a significant drop, investors often find themselves in a state of uncertainty and concern. The effects of such a drop can ripple through various sectors of the economy, impacting both individual investors and large corporations. Understanding these effects is crucial for navigating the complexities of the financial markets.

During a stock market drop, it’s common to see increased volatility, which can lead to fluctuations in asset prices and investment portfolios. This can result in investors facing potential losses and feeling hesitant about future investment decisions. Moreover, a dip in the stock market can have broader implications on consumer spending, business expansion, and overall market sentiment. Staying informed, remaining calm, and seeking professional advice are key strategies to weathering the storm during a stock market downturn.

Strategies to Navigate Volatility in the Market

Navigating through turbulent times in the stock market requires a combination of foresight and resilience. **Being well-prepared** and having a **clear strategy** in place can help investors weather the storm and even capitalize on opportunities that arise during market downturns. It’s essential to **remain calm** and **avoid making impulsive decisions** based on short-term fluctuations. Instead, **focus on long-term goals** and **diversify your portfolio** to spread risk.

Additionally, keeping a close eye on market trends and staying informed about economic indicators can provide valuable insights for making informed decisions. Engaging with a financial advisor or seeking advice from seasoned investors can also offer valuable perspectives to navigate volatility successfully. Remember, staying disciplined and adhering to your investment plan can help you stay afloat when the market experiences turbulence.

| Key Strategies: | Benefits: |

|---|---|

| Diversify Portfolio | Reduce Risk |

| Stay Informed | Make Informed Decisions |

| Seek Advice | Gained Insights from Experts |

Investment Opportunities Amidst a Market Decline

In times of market turbulence, there are hidden gems that savvy investors can uncover amidst the chaos. **Diversification** is key during a stock market drop, as spreading your investments across different asset classes can help mitigate risk. Consider **exploring industries** that show resilience during economic downturns, such as healthcare, utilities, and consumer staples.

Another strategy to capitalize on investment opportunities during a market decline is to identify undervalued stocks with strong fundamentals. Conduct thorough research and look for companies with solid balance sheets, consistent cash flow, and a competitive market position. By keeping a long-term perspective and focusing on the intrinsic value of a stock rather than short-term fluctuations, investors can position themselves for potential growth when the market rebounds.

| Industry | Potential |

|---|---|

| Healthcare | Stable demand |

| Utilities | Essential services |

| Consumer Staples | Resilient during downturns |

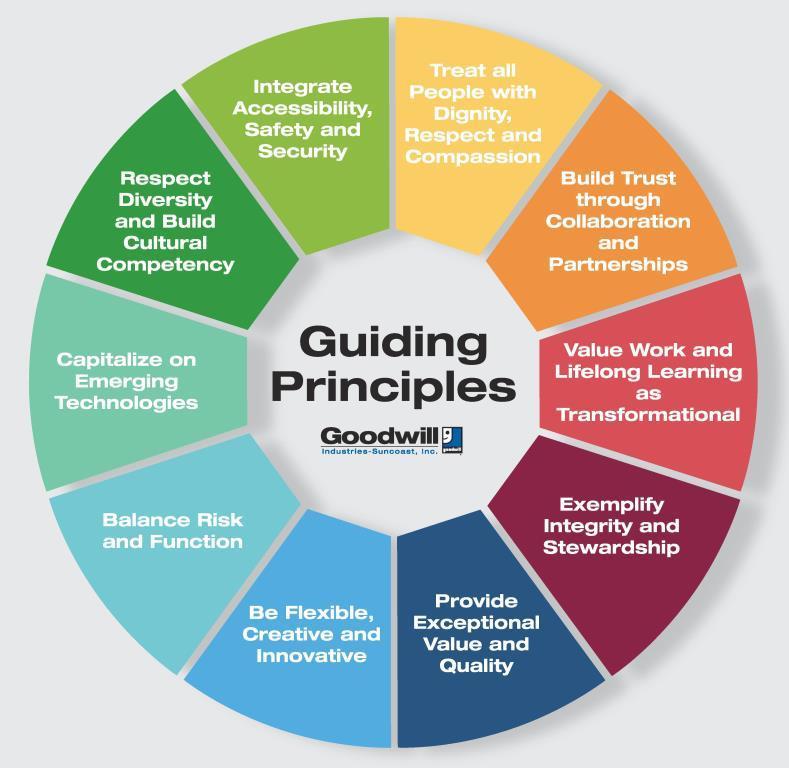

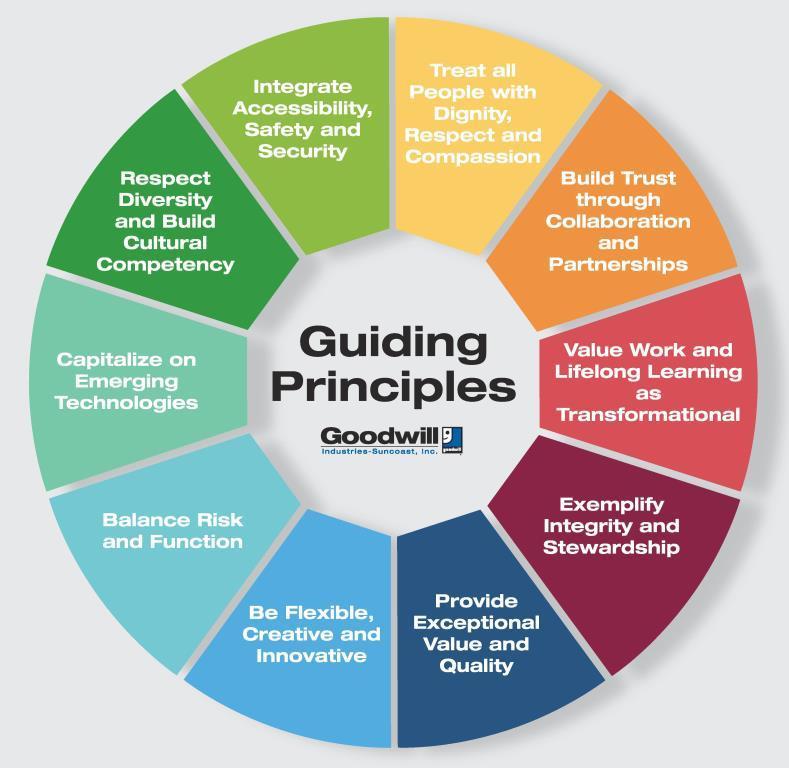

Guiding Principles for Investors During Stock Market Turmoil

In times of stock market turmoil, it’s crucial for investors to anchor themselves to solid principles that can guide their decisions through the storm. One key principle to remember is **diversification**. Having a well-diversified portfolio can help cushion the impact of market swings on your investments. Spread your assets across different asset classes like stocks, bonds, and real estate to reduce risk.

Another important principle is long-term thinking. Instead of getting caught up in the daily fluctuations of the market, focus on the long-term performance of your investments. Historically, the stock market has shown resilience and has provided strong returns over extended periods. Stay invested and avoid making hasty decisions based on short-term market movements. Remember, investing is a marathon, not a sprint.

| Principles | Benefits |

|---|---|

| Diversification | Reduces risk exposure |

| Long-term thinking | Focuses on overall performance |

Q&A

Q: What caused the recent drop in the stock market?

A: The recent drop in the stock market can be attributed to a variety of factors, including global economic uncertainties, political tensions, and concerns over rising interest rates.

Q: How can investors navigate through a stock market downturn?

A: During a stock market downturn, investors can consider diversifying their portfolios, focusing on long-term investment goals, and staying informed about market trends to make well-informed decisions.

Q: What should beginners in investing do during a stock market drop?

A: Beginners in investing during a stock market drop should resist the urge to panic sell, seek advice from financial experts, and view it as an opportunity to learn more about market volatility and investment strategies.

Q: Is it advisable to invest in stocks during a market downturn?

A: Investing in stocks during a market downturn can present opportunities for bargain hunting, but it requires careful research, risk assessment, and a long-term perspective to capitalize on potential growth prospects.

Q: How can one stay calm during turbulent market conditions?

A: To stay calm during turbulent market conditions, investors can focus on their investment goals, practice patience, avoid impulsive decisions, and seek guidance from financial advisors to navigate through uncertainties successfully.

Final Thoughts

As we navigate the unpredictable waters of the stock market, one thing remains certain – resilience is key. Remember, market drops are temporary, but the lessons learned can be invaluable. Stay informed, stay strategic, and most importantly, stay focused on your long-term financial goals. Let this experience be a testament to your strength as an investor, capable of weathering any storm that comes your way. We’ll see you on the other side, where growth and opportunity await.

0 Comments