As the sun sets on a long and fulfilling career, the promise of a relaxing retirement beckons. However, navigating the intricate world of pension interest rates can often feel like deciphering a cryptic code. Fear not, for in this article, we embark on a journey to unravel the mysteries of pension interest rates, shedding light on their significance and impact on your financial future. Join us as we demystify this vital aspect of retirement planning, empowering you to make informed decisions with confidence and clarity.

Table of Contents

- Understanding Pension Interest Rates: A Comprehensive Guide

- Maximizing Your Pension Gains with Strategic Interest Rate Decisions

- Factors Influencing Pension Interest Rates

- Navigating Pension Interest Rate Fluctuations: Tips and Strategies

- Q&A

- Key Takeaways

Understanding Pension Interest Rates: A Comprehensive Guide

What are Pension Interest Rates?

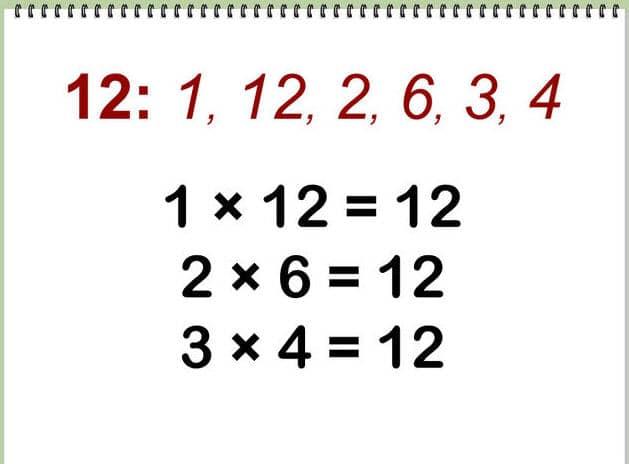

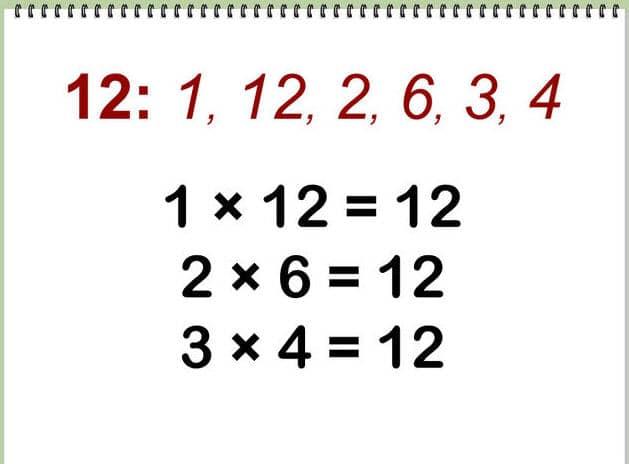

Understanding pension interest rates is crucial for anyone planning for retirement. These rates determine how much your pension fund will grow over time. Pension interest rates are essentially the annual percentage added to your pension savings, allowing them to increase steadily. It’s important to keep track of these rates as they directly impact the value of your pension investments.

Factors Affecting Pension Interest Rates:

Several factors influence pension interest rates, including economic conditions, investment performance, and government policies. Economic stability and growth typically lead to higher interest rates, benefiting pension funds. Conversely, downturns in the economy could result in lower rates. Additionally, how your pension is invested plays a crucial role in determining the interest rates you earn. Diversifying your investments can help mitigate risks and potentially increase your pension earnings over time.

Maximizing Your Pension Gains with Strategic Interest Rate Decisions

In the realm of pension planning, the strategic decisions you make regarding interest rates can significantly impact the growth and stability of your retirement funds. By understanding how interest rates influence your pension gains, you can devise a proactive approach to optimize your financial future. One key strategy involves **diversifying your investments** across various interest rate environments to mitigate risks and seize opportunities as they arise.

Moreover, staying informed about market trends and economic indicators can empower you to make informed decisions about your pension portfolio. Being adaptable in adjusting your investment mix based on interest rate movements can help you navigate through changing financial landscapes. Remember, the road to maximizing your pension gains lies in your ability to strategically align your portfolio with prevailing interest rate conditions while keeping a watchful eye on future opportunities.

| Interest Rate Environments | Strategy |

|---|---|

| Low-Interest Rates | Diversify into high-yield bonds and dividend-paying stocks. |

| Rising Interest Rates | Consider allocating more funds to floating-rate investments or inflation-protected securities. |

| Stable Interest Rates | Focus on long-term growth assets like equities and real estate to capitalize on market stability. |

Factors Influencing Pension Interest Rates

Factors like **economic conditions** play a significant role in determining pension interest rates. During times of economic growth, interest rates tend to rise due to increased demand for loans and investments, impacting pension rates positively. On the other hand, during economic downturns, interest rates may decrease, affecting pension returns negatively.

Demographic trends also influence pension interest rates. Factors such as an aging population can lead to changes in interest rates as pension funds adjust their strategies to accommodate for demographic shifts. Additionally, government policies and regulations can impact interest rates, affecting pension fund performance and returns. By carefully monitoring these factors, pension holders can make informed decisions to optimize their retirement savings.

| Factor | Influence |

|---|---|

| Economic Conditions | Direct impact on interest rates |

| Demographic Trends | Indirect influence through population changes |

| Government Policies | Regulatory impact on interest rates |

Navigating Pension Interest Rate Fluctuations: Tips and Strategies

In the realm of pension planning, the ebb and flow of interest rates holds significant weight in shaping future financial stability. With the landscape of interest rate fluctuations ever-changing, it becomes crucial for retirees and pension fund participants to navigate these shifts with prudence and foresight.

Here are some key strategies to consider amidst pension interest rate fluctuations:

- Diversification is Key: Spread your investments across various asset classes to mitigate risks associated with interest rate changes.

- Monitor Market Trends: Stay informed about economic indicators and market movements that can impact interest rates.

- Seek Professional Guidance: Consult with financial advisors to tailor your pension strategy according to prevailing interest rate scenarios.

Featuring a WordPress-styled table to illustrate the hypothetical impact of interest rate fluctuations on pension funds:

| Year | Beginning Balance ($) | Interest Rate (%) | End Balance ($) |

|---|---|---|---|

| 2021 | $100,000 | 4% | $104,000 |

| 2022 | $104,000 | 2% | $106,080 |

| 2023 | $106,080 | 3% | $109,242 |

As you navigate the intricate waters of pension planning amidst interest rate turbulence, remember that adaptability and informed decision-making are your greatest assets in securing a stable financial future.

Q&A

Q: What are pension interest rates, and why are they important?

A: Pension interest rates refer to the rate at which your pension fund grows over time. This growth is crucial as it determines how much money you will have available for retirement. Understanding pension interest rates is essential for planning your financial future and ensuring a comfortable retirement.

Q: How do pension interest rates impact my retirement savings?

A: The higher the pension interest rate, the faster your retirement savings will grow. A higher interest rate means your money will work harder for you, resulting in more significant savings over time. On the other hand, lower pension interest rates may slow down the growth of your pension fund, affecting your overall retirement income.

Q: What factors influence pension interest rates?

A: Pension interest rates are influenced by various factors, including inflation, economic conditions, government policies, and the performance of financial markets. It’s essential to stay informed about these factors to have a better understanding of how they can affect your pension savings and plan accordingly.

Q: How can I maximize my pension savings in light of fluctuating interest rates?

A: To maximize your pension savings, consider diversifying your investment portfolio, regularly reviewing and adjusting your pension contributions, and seeking professional advice from financial experts. By staying proactive and making informed decisions, you can navigate through fluctuating interest rates and secure a more robust financial future for your retirement.

Key Takeaways

As you navigate the complex landscape of pension interest rates, remember that knowledge is your most powerful asset. Stay informed, stay proactive, and secure your financial future with confidence. Whether you’re planning for retirement or making investment decisions, understanding how interest rates impact your pension is key. Embrace the journey towards financial empowerment, and may your investments pave the way for a prosperous tomorrow. Stay curious, stay informed, and may your financial decisions always align with your vision of a fulfilling retirement.

0 Comments