Unlock the mysteries of the stock market’s enigmatic ways as we delve into the intriguing realm of “stock market 90 days.” Join us on a journey where each day tells a story, each fluctuation a lesson, and each trend a potential opportunity waiting to be seized. Explore the dynamics of the stock market within this intriguing timeframe and unravel the secrets hidden within the ebbs and flows of the financial world. Let’s embark on this captivating exploration together, where knowledge meets adventure and every day holds the promise of new discoveries.

Table of Contents

- Understanding the Dynamics of Stock Market Performance Over 90 Days

- Strategies for Investing Wisely in the Short-term Stock Market

- Analyzing Patterns and Trends in the Stock Market Over a 90-Day Period

- Maximizing Returns Through Informed Decision-Making in the 90-Day Stock Market

- Q&A

- Final Thoughts

Understanding the Dynamics of Stock Market Performance Over 90 Days

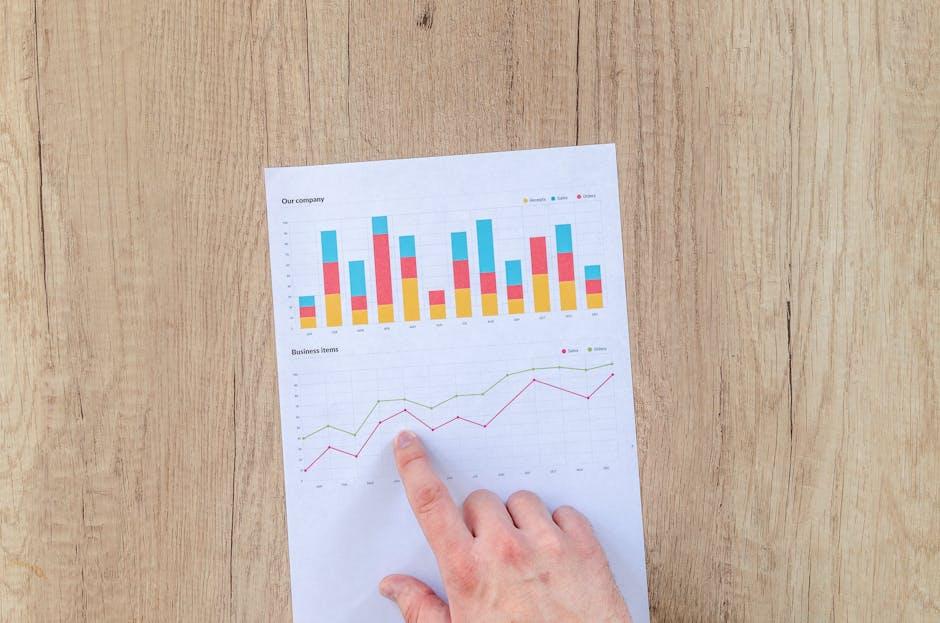

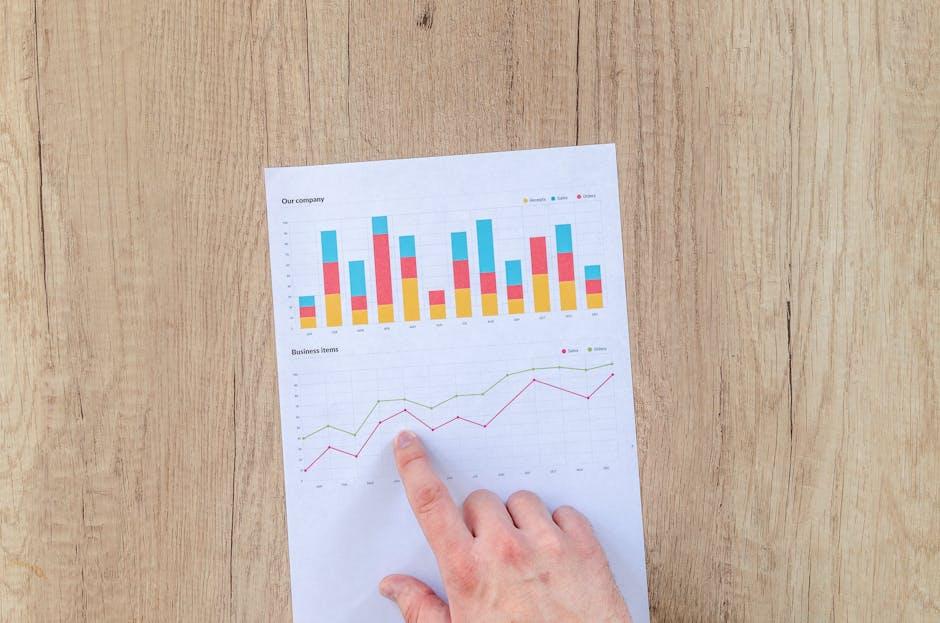

In the unpredictable realm of stock market dynamics, a 90-day period can hold a myriad of insights and surprises for investors and analysts alike. This timeframe encapsulates a whirlwind of fluctuations, trends, and events that shape the performance trajectory of various stocks. Volatility becomes a constant companion, guiding decisions and strategies within the financial landscape.

Monitoring key indicators and market sentiments over this span unveils a tapestry of patterns and anomalies that paint a picture of market behavior. From sudden spikes to gradual declines, each trading day adds a layer of complexity to the narrative of stock performance. Understanding the nuances within this timeline requires a keen eye for detail and a strategic approach towards deciphering the underlying forces that influence market movements.

| Stock | Initial Price | 90-Day Performance |

|---|---|---|

| XYZ | $50 | +20% |

| ABC | $100 | -5% |

Strategies for Investing Wisely in the Short-term Stock Market

Investing in the short-term stock market requires a blend of caution and calculated risk-taking. To maximize your gains over the next 90 days, consider these key strategies:

- Diversify Your Portfolio: Spread your investments across different sectors to minimize risk exposure.

- Monitor Market Trends: Stay informed about stock movements and adjust your strategy accordingly.

- Set Clear Goals: Define your financial objectives and timeline for each investment to stay focused.

- Utilize Stop-Loss Orders: Protect your investments by setting predefined sell prices to limit potential losses.

By implementing these tactics and staying disciplined in your approach, you can navigate the short-term stock market with confidence and increase your chances of achieving profitable outcomes within the next 90 days. Remember, informed decisions and strategic moves are your best allies in the fast-paced world of stock trading.

Analyzing Patterns and Trends in the Stock Market Over a 90-Day Period

can reveal valuable insights for investors seeking to make informed decisions. By examining the fluctuations and behaviors of various stocks during this timeframe, patterns may emerge that shed light on potential future movements. Through meticulous data analysis and strategic observation, investors can uncover patterns that may indicate upcoming opportunities or risks.

In the realm of stock market analysis, identifying trends over a 90-day span can provide a comprehensive view of how different sectors and individual stocks have performed. This analysis can help investors gauge the overall market sentiment and pinpoint sectors that are showing signs of growth or decline. By delving into the intricacies of these trends, investors can adjust their strategies accordingly to capitalize on emerging opportunities and mitigate potential risks.

| Stock | Industry | Performance |

|---|---|---|

| ABC | Tech | +12% |

| XYZ | Healthcare | -5% |

Maximizing Returns Through Informed Decision-Making in the 90-Day Stock Market

When navigating the dynamic realm of the stock market over a 90-day period, informed decision-making becomes paramount. By leveraging reliable data, market trends, and expert analysis, investors can position themselves strategically to maximize returns and mitigate risks.

<p>Utilizing tools such as financial reports, technical indicators, and risk assessment models empowers investors to make calculated moves within the ever-changing landscape of stocks. Staying abreast of industry news, monitoring portfolio performance, and adapting strategies accordingly are key components in achieving success in the 90-day stock market journey.</p>Q&A

Q: What is meant by the term “stock market 90 days”?

A: ”Stock market 90 days” typically refers to analyzing stock market trends, movements, and performance over a period of 90 days. It involves tracking various stocks and indices to identify patterns and potential investment opportunities within this specific timeframe.

Q: Why is it important to monitor the stock market over a 90-day period?

A: Monitoring the stock market over a 90-day period provides investors with valuable insights into short to medium-term trends and helps in making informed decisions on buying, selling, or holding stocks. It allows for a more comprehensive assessment of market volatility and stock performance.

Q: What are some key factors to consider when analyzing the stock market for a 90-day outlook?

A: Factors such as historical data, company earnings reports, economic indicators, geopolitical events, and sector-specific trends play a crucial role in analyzing the stock market over a 90-day period. It is essential to take a holistic approach to understand the underlying factors driving market movements.

Q: How can investors benefit from understanding the stock market within a 90-day timeframe?

A: By gaining a deeper understanding of stock market dynamics within a 90-day timeframe, investors can capitalize on short-term trading opportunities, manage risk more effectively, and align their investment strategies with current market conditions. It helps in optimizing portfolio performance and achieving financial goals.

Q: What are some tips for investors looking to navigate the stock market over the next 90 days?

A: Diversifying their portfolio, staying updated on market news and trends, setting realistic financial goals, conducting thorough research before making investment decisions, and seeking advice from financial experts are key tips for investors navigating the stock market over a 90-day period. By staying informed and strategic, investors can enhance their chances of success in the dynamic world of stock trading.

Final Thoughts

As you navigate the ever-changing waters of the stock market over the next 90 days, remember that knowledge is power. Stay informed, stay calculated, and trust in your decisions. The next few months hold a world of potential for investors willing to brave the waves of uncertainty. Whether you are a seasoned trader or a curious novice, may your investments flourish and your risks be calculated. Here’s to a prosperous journey ahead in the world of stocks and bonds. Happy trading!

0 Comments