In the vast landscape of investments, few sectors are as dynamic and intriguing as finance stocks. These financial instruments offer a gateway to the pulsating heart of global economies, where fortunes are made and lost with every tick of the market. Delving into the world of finance stocks unveils a realm where numbers dance with speculation, and data whispers hints of future trends. Join us on a journey through the labyrinth of finance stocks, where opportunity and risk intertwine in a captivating symphony of wealth creation.

Table of Contents

- Understanding Finance Stocks: Exploring Investment Opportunities

- Analyzing Market Trends: Key Factors to Consider

- Diversifying Your Portfolio: Strategies for Optimal Returns

- Expert Tips for Investing in Finance Stocks

- Q&A

- The Conclusion

Understanding Finance Stocks: Exploring Investment Opportunities

In the world of finance, investing in stocks is like navigating a sea of opportunities, where each wave represents a potential for growth and prosperity. Finance stocks offer individuals a chance to be part of the ever-evolving landscape of markets and capitalize on their understanding of companies and industries.

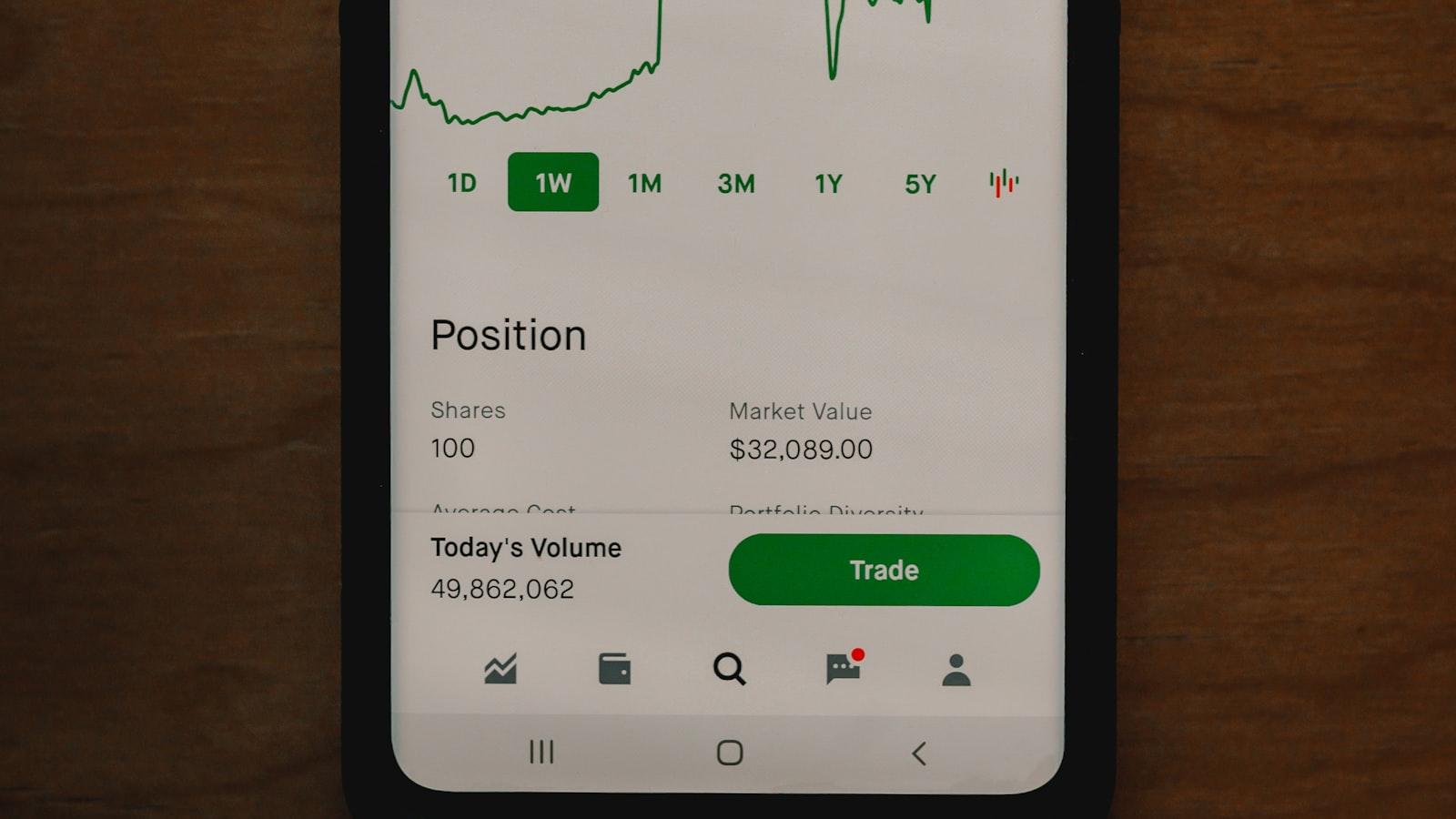

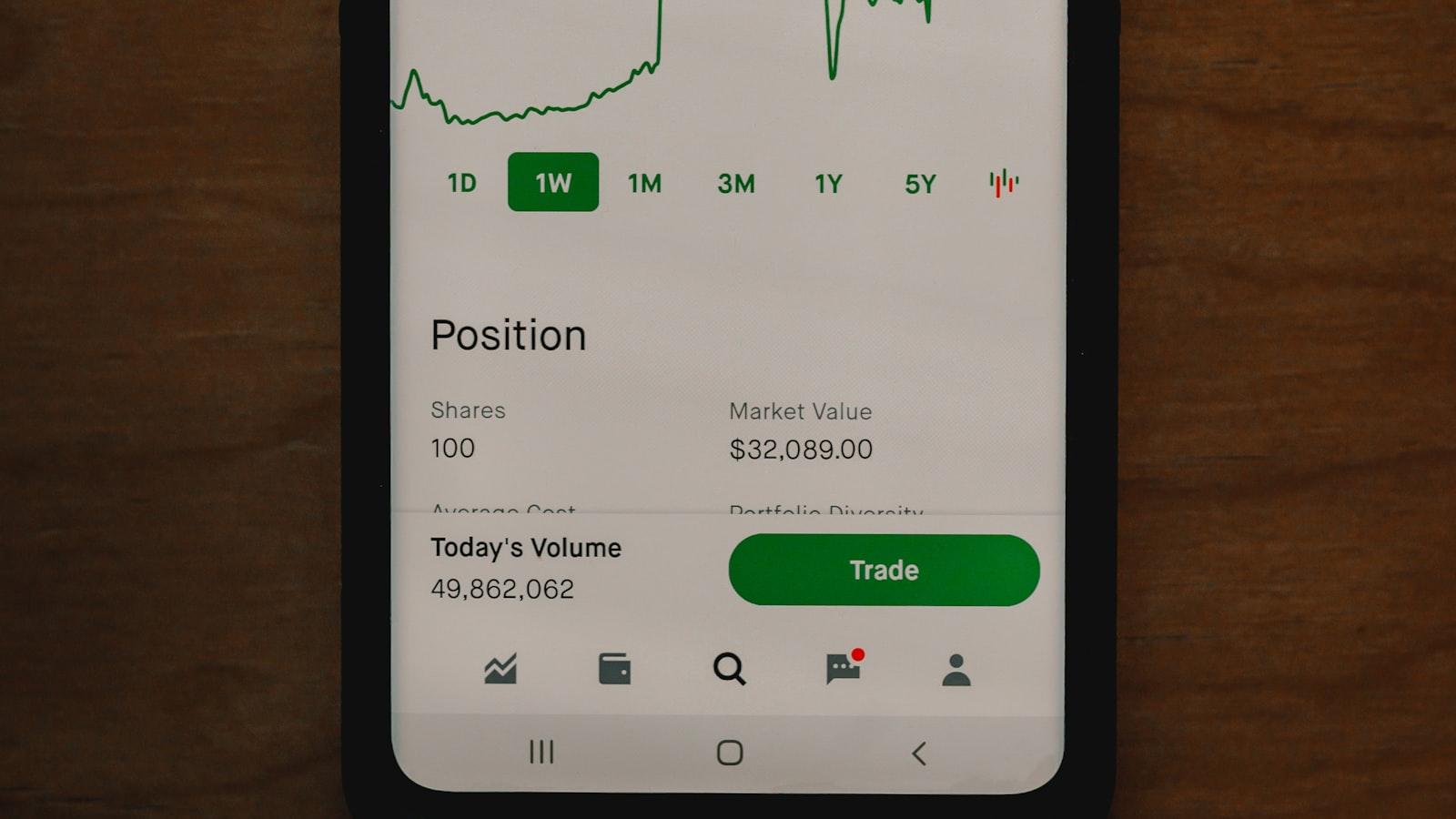

When considering finance stocks for investment, it’s crucial to conduct thorough research and analysis on the companies of interest. Due diligence is key to identifying solid investment opportunities that align with your financial goals. Whether you are looking into established financial institutions or up-and-coming fintech companies, a strategic approach backed by informed decision-making can pave the way for a successful investment journey. By delving into the fundamentals, market trends, and financial performance of potential stocks, investors can position themselves to make well-informed choices with the potential for long-term rewards.

Analyzing Market Trends: Key Factors to Consider

When diving into market trends within the finance industry, there are several crucial factors that can significantly impact investment decisions. One essential aspect to consider is the overall economic climate, which includes factors such as inflation rates, interest rates, and GDP growth. Understanding how these macroeconomic indicators interplay with the financial markets can provide valuable insights for investors seeking to make informed choices.

Another key factor to analyze is industry-specific trends and developments. Companies within the finance sector are influenced by changes in regulations, technological advancements, and shifts in consumer behavior. Staying abreast of these industry dynamics can help investors identify opportunities and potential risks, enabling them to adjust their investment strategies accordingly. Taking a holistic approach to analyzing market trends can empower investors to make well-informed decisions that align with their financial goals.

Diversifying Your Portfolio: Strategies for Optimal Returns

When diversifying your investment portfolio in the realm of finance stocks, it’s crucial to employ a range of strategies that can lead to optimal returns. One effective approach is to include a mix of high-growth potential stocks along with more stable, dividend-paying options. This blend can balance the risk and reward aspects of your portfolio, offering both growth opportunities and income generation.

Moreover, consider investing in various sectors of the stock market to spread out risk and capitalize on different industry trends. Technology, healthcare, consumer goods, and energy are just a few sectors to explore. By diversifying across industries, you can reduce the impact of market fluctuations on your overall portfolio performance. Remember, a well-diversified portfolio is key to achieving long-term financial success.

Expert Tips for Investing in Finance Stocks

When looking to invest in finance stocks, it’s essential to approach it with a strategic mindset. Diversification is key in spreading risk and maximizing potential returns. Consider allocating your investment across various sectors within the finance industry such as banking, insurance, and fintech.

Additionally, staying informed about market trends and conducting thorough research into the financial health and growth prospects of the companies you’re investing in can make a significant difference. Remember to keep a close eye on economic indicators, interest rates, and regulatory changes that could impact the performance of finance stocks over time. By staying proactive and adaptable, you can navigate the dynamic landscape of finance stocks with confidence and agility.

Q&A

Q&A: Finance Stocks Unveiled

Q: What are finance stocks, and why are they significant in the world of investing?

Finance stocks are shares in companies that operate within the financial industry, including banks, insurance companies, investment firms, and more. These stocks are crucial for investors seeking exposure to the financial sector, as they can offer opportunities for growth and income through dividends.

Q: What factors should investors consider when investing in finance stocks?

Investors should evaluate various factors before investing in finance stocks, such as the company’s financial health, profitability, regulatory environment, market trends, and overall economic conditions. Diversification across different financial sub-sectors can also help manage risks associated with investing in finance stocks.

Q: How do global economic conditions impact finance stocks?

Global economic conditions, such as interest rates, inflation, GDP growth, and geopolitical events, can significantly influence finance stocks. For instance, rising interest rates may benefit banks but hurt insurance companies. Therefore, staying informed about macroeconomic trends is essential for investors in the finance sector.

Q: Are there any specific strategies for investing in finance stocks?

Investors can consider various strategies when investing in finance stocks, such as value investing, growth investing, dividend investing, or sector rotation. Additionally, conducting thorough research, monitoring key financial indicators, and staying updated on industry news can help investors make informed decisions in the finance sector.

Q: What are the potential risks associated with investing in finance stocks?

Like any investment, finance stocks come with risks, such as market volatility, regulatory changes, economic downturns, and company-specific risks. Investors should be prepared to weather fluctuations in the financial markets and employ risk management strategies to protect their investment portfolios.

Q: How can investors stay ahead in the fast-paced world of finance stocks?

To stay ahead in the finance sector, investors should continue learning about market trends, financial innovations, regulatory developments, and global economic shifts. Utilizing research tools, consulting with financial advisors, and networking with industry professionals can provide valuable insights for successful investing in finance stocks.

The Conclusion

As we conclude our exploration into the intricate world of finance stocks, it becomes apparent that these investments offer a captivating blend of risk and reward. Whether you are a seasoned investor or just dipping your toes into the financial markets, understanding the nuances of stock trading can pave the way for a prosperous future. Remember, staying informed, diversifying your portfolio, and seeking professional advice when needed are key pillars of success in the dynamic realm of finance stocks. So, embrace the opportunities, navigate the challenges, and let your financial journey soar to new heights. Here’s to wise investments and financial empowerment!

0 Comments