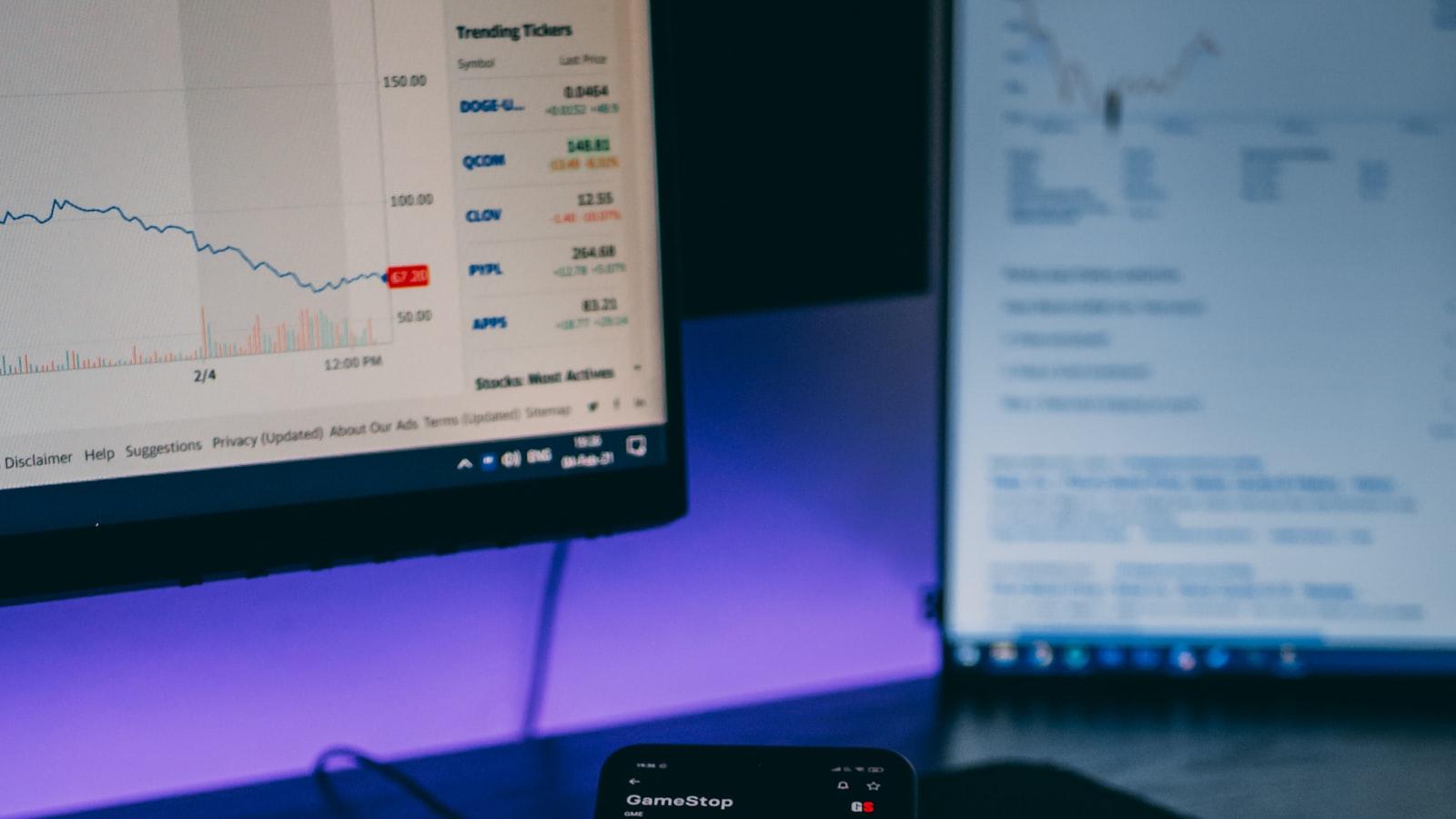

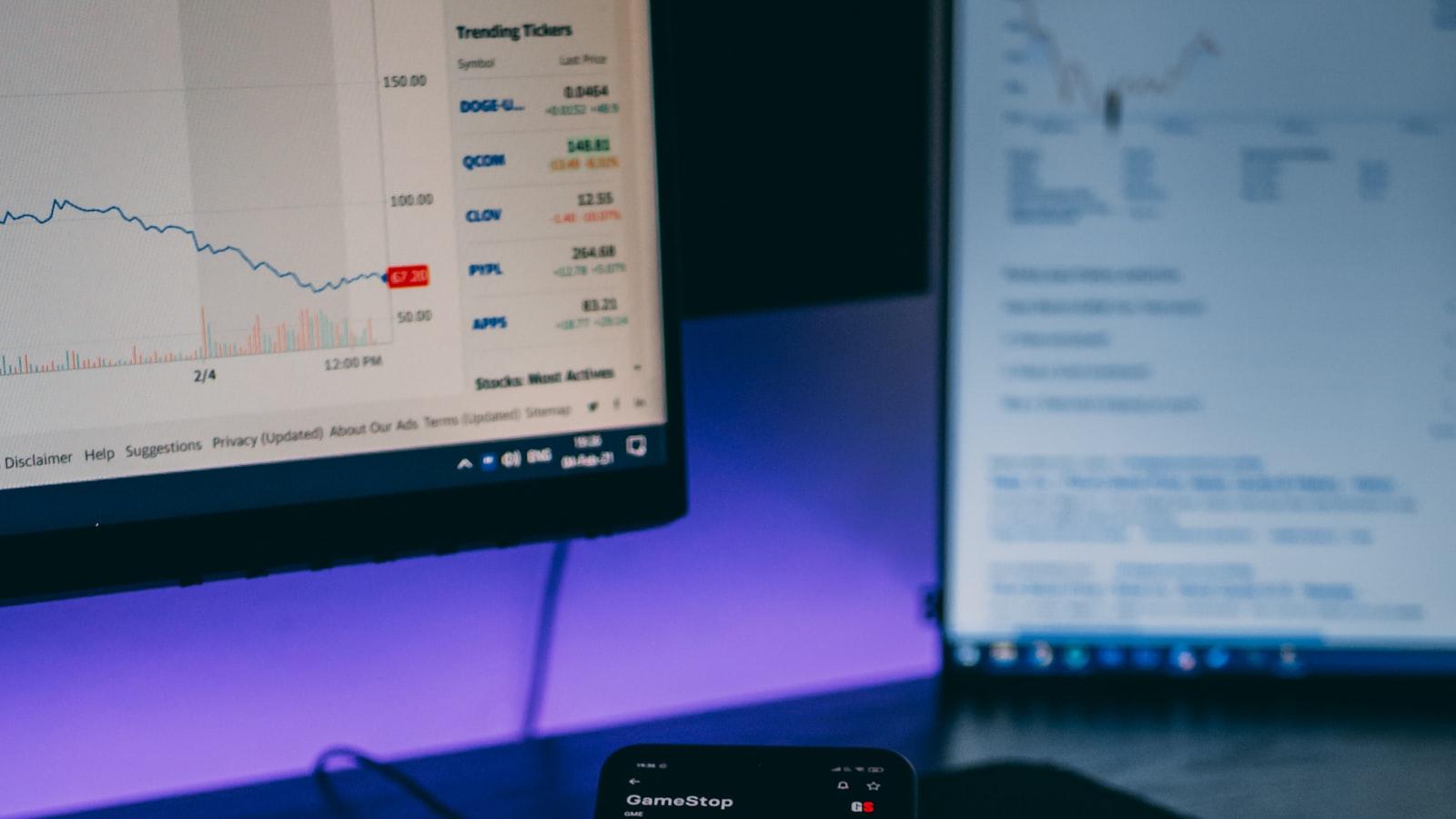

Step into the world of finance where numbers dance across screens like stars in the night sky. The stock market screen, a window to the heart of economic activity, holds secrets and stories waiting to be unraveled. Join us on a journey as we explore the intricacies of the stock market screen, decoding its language of graphs, charts, and ticker symbols. Unveil the mysteries of market fluctuations and the pulse of trading with each flicker of a stock’s value. Let’s dive into the virtual realm where fortunes are won and lost with a single click – welcome to the mesmerizing realm of the stock market screen.

Table of Contents

- Understanding the Importance of Stock Market Screeners

- Key Features to Look for in a Stock Market Screener

- How to Use Stock Market Screeners Effectively

- Maximizing Your Investment Strategy with Stock Market Screeners

- Q&A

- Insights and Conclusions

Understanding the Importance of Stock Market Screeners

Stock market screeners are powerful tools that help investors filter stocks based on specific criteria, allowing them to make informed decisions and optimize their investment strategy. These tools enable users to narrow down the vast array of stocks available in the market to a more manageable list that aligns with their investment goals. By utilizing stock market screeners, investors can save valuable time and effort in researching potential investment opportunities, leading to more efficient decision-making processes.

With stock market screeners, investors can customize their search parameters to focus on factors such as market capitalization, price-earnings ratio, dividend yield, and other key metrics that are crucial in evaluating the performance and potential of a stock. Being able to set specific filters helps investors identify stocks that meet their desired criteria, whether they are looking for growth stocks, value stocks, dividend-paying stocks, or other investment preferences. By leveraging the capabilities of stock market screeners, investors can streamline their stock selection process and enhance their overall portfolio management strategies.

| Category | Features |

|---|---|

| Growth Stocks | Identify stocks with high growth potential |

| Value Stocks | Find undervalued stocks with strong fundamentals |

| Dividend-Paying Stocks | Discover stocks that offer consistent dividend payouts |

Key Features to Look for in a Stock Market Screener

When considering a stock market screener, it’s essential to focus on specific features that can enhance your trading experience. **Customization** plays a crucial role, allowing you to tailor the screener to your unique investment criteria. Look for screeners that offer **flexible filters**, enabling you to narrow down your search based on parameters such as market cap, industry sector, or valuation metrics.

Another key feature to prioritize is real-time data, ensuring you have access to the most up-to-date information for making informed decisions. A responsive and user-friendly interface is also paramount for efficient navigation and analysis. Additionally, alert notifications can help you stay on top of market developments, alerting you to potential opportunities or risks. By focusing on these key features, you can maximize the effectiveness of your stock market screening process and make more informed investment choices.

| Feature | Description |

|---|---|

| Customization | Allows for tailored screening criteria |

| Real-time data | Provides immediate and accurate information |

| Alert notifications | Keeps users informed of market changes |

How to Use Stock Market Screeners Effectively

Stock market screeners are powerful tools that can help investors filter through a vast amount of data to find specific stocks that meet their criteria. When using stock market screeners, it’s essential to understand the various filters and parameters available to tailor your search effectively. By utilizing these filters strategically, investors can narrow down their options and identify potential investment opportunities more efficiently.

One effective way to use stock market screeners is to prioritize your criteria based on your investment goals. Whether you are looking for high-growth stocks, dividend-paying companies, or undervalued opportunities, customizing your filters to reflect these preferences can streamline your search process. Additionally, utilizing multiple filters simultaneously can help you create a more refined list of potential stocks that align with your investment strategy. Remember to regularly update and adjust your screening criteria to adapt to changing market conditions and trends.

Maximizing Your Investment Strategy with Stock Market Screeners

When diving into the world of investing, utilizing stock market screeners can be a game-changer. These powerful tools can help you sift through an overwhelming amount of data, allowing you to pinpoint the most promising investment opportunities with ease. By harnessing the capabilities of stock market screeners, you can streamline your investment strategy and make more informed decisions that align with your financial goals.

Benefits of Using Stock Market Screeners:

- Saves Time: Say goodbye to manual research! Stock market screeners filter stocks based on your criteria, saving you valuable time.

- Identifies Opportunities: Discover hidden gems in the stock market that match your investment preferences and risk tolerance.

- Minimizes Risk: By narrowing down your options, stock screeners can aid in reducing the risk associated with investing in unknown or volatile stocks.

Key Features to Look For in Stock Market Screeners:

- Customizable Filters: The ability to customize filters based on your specific requirements and investment objectives.

- Real-Time Data: Access to up-to-date information to make timely investment decisions.

- User-Friendly Interface: An intuitive interface that allows for easy navigation and quick analysis of data.

Q&A

Q: What is a stock market screen and why is it important for investors?

A: A stock market screen is a tool or platform that allows investors to monitor and analyze real-time financial data, such as stock prices, trading volume, market trends, and news updates related to various stocks and securities. It provides a dynamic interface that enables investors to track specific stocks or create custom watchlists, helping them make informed decisions about buying, selling, or holding investments.

Q: How can investors make the most out of a stock market screen?

A: To maximize the benefits of a stock market screen, investors can set up personalized alerts for price changes, earnings reports, or news events that may impact their investments. They can also utilize technical analysis tools available on the screen to identify trends, patterns, and signals for potential trading opportunities. Moreover, staying informed about macroeconomic indicators and company-specific developments can enhance the effectiveness of using a stock market screen.

Q: Are there any limitations to relying solely on a stock market screen for investment decisions?

A: While a stock market screen is a valuable resource for investors, it is essential to exercise caution and not solely rely on its data for making investment decisions. Emotional factors, market sentiment, and unexpected events can influence stock prices and market movements beyond what is shown on the screen. Therefore, combining the information from a stock market screen with thorough research, risk management strategies, and expert advice can help investors navigate the complexities of the financial markets more effectively.

Q: What are some popular stock market screens available to investors today?

A: There are several reputable stock market screen platforms that cater to different types of investors, such as Yahoo Finance, Bloomberg Terminal, CNBC Market Data, and Morningstar. Each of these screens offers unique features, customization options, and comprehensive data coverage to meet the diverse needs of investors, from beginners to seasoned professionals. Exploring these platforms and finding the one that aligns with one’s investment goals and preferences can significantly enhance one’s trading experience and financial decision-making process.

Insights and Conclusions

As you navigate the intricate world of the stock market screen, remember that knowledge is your compass and analysis your map. Stay vigilant, keep learning, and trust in your ability to decode the patterns dancing before your eyes. With each flickering candlestick and every fluctuating line, opportunities await those bold enough to seize them. Embrace the volatility, harness the insights, and let the screen be your window to possibility. May your trades be strategic, your decisions be sound, and your journey through the digital tapestry of stocks be both educational and rewarding. Happy trading!

0 Comments