Step into the time machine of financial history and journey back to the roaring 1920s, a captivating era that witnessed the rise of the stock market. To truly grasp the essence of the stock market in the 1920s, we delve into its definition and explore the dynamics that shaped this iconic period of economic boom and eventual bust. Join us on this nostalgic expedition as we unravel the intricate tapestry of Wall Street during one of the most electrifying decades in modern financial history.

Table of Contents

- Understanding the Stock Market Boom of the 1920s

- Key Factors Contributing to the Stock Market Rise in the 1920s

- Exploring the Impact of Speculation and Overvaluation in the 1920s Stock Market

- Guidelines for Navigating Stock Market Investments Inspired by the 1920s

- Q&A

- Closing Remarks

Understanding the Stock Market Boom of the 1920s

The roaring twenties witnessed an unprecedented surge in the stock market, with investors basking in the euphoria of soaring prices and easy profits. This era marked a time of great financial prosperity, leading many to embrace the stock market as a vehicle for wealth accumulation and social mobility. However, beneath the facade of prosperity lurked the seeds of a looming crisis, as speculative frenzy and excessive borrowing fueled the unsustainable boom.

Investors during the 1920s were captivated by the allure of quick riches, often overlooking the risks associated with rampant speculation. The proliferation of margin trading allowed investors to amplify their gains but also exposed them to catastrophic losses. The stock market of the 1920s became a playground for the daring and the reckless, where fortunes were made and lost in the blink of an eye. This period serves as a cautionary tale of the perils of unchecked exuberance and serves as a reminder of the importance of prudent investing practices in any market environment.

Key Factors Contributing to the Stock Market Rise in the 1920s

The surge in the stock market during the 1920s can be attributed to several key factors that influenced the economic landscape of the time. One significant driver was the rapid industrialization and technological advancements that fueled economic growth and created new investment opportunities. This era saw the rise of industries such as automobile manufacturing, radio broadcasting, and consumer goods production, which attracted investors looking to capitalize on the expanding market.

Moreover, the easy access to credit and the proliferation of buying stocks on margin played a pivotal role in boosting stock prices. This practice allowed investors to purchase stocks with borrowed money, amplifying their potential returns but also increasing the risk of significant losses. The optimism and exuberance of the period, coupled with favorable government policies and low interest rates, further fueled the stock market boom of the 1920s. This heady combination of factors set the stage for the rapid rise and eventual crash of the stock market, leaving a lasting impact on the financial landscape for years to come.

Exploring the Impact of Speculation and Overvaluation in the 1920s Stock Market

In the 1920s, the stock market experienced a phenomenon that changed the financial landscape forever. Speculation and overvaluation became rampant, fueling a frenzy of buying and selling that led to unprecedented highs and devastating lows. Investors, driven by the promise of quick riches, poured their money into stocks with little regard for their actual value. This speculative bubble eventually burst, triggering the infamous stock market crash of 1929.

During this period, stock prices soared to dizzying heights, often far exceeding the companies’ actual worth. The euphoria of easy profits blinded many to the inherent risks of such inflated valuations. Investors were caught up in a speculative mania, driven by the belief that prices would continue to rise indefinitely. However, when reality set in, panic ensued, leading to massive sell-offs and a catastrophic market collapse. The aftermath of this tumultuous era left a lasting impact on the financial world, serving as a cautionary tale of the dangers of unchecked speculation and overvaluation.

| Key Points: |

|---|

| Speculation drove stock prices to unsustainable levels |

| Investors focused on short-term gains rather than long-term value |

| The crash of 1929 led to a prolonged economic downturn |

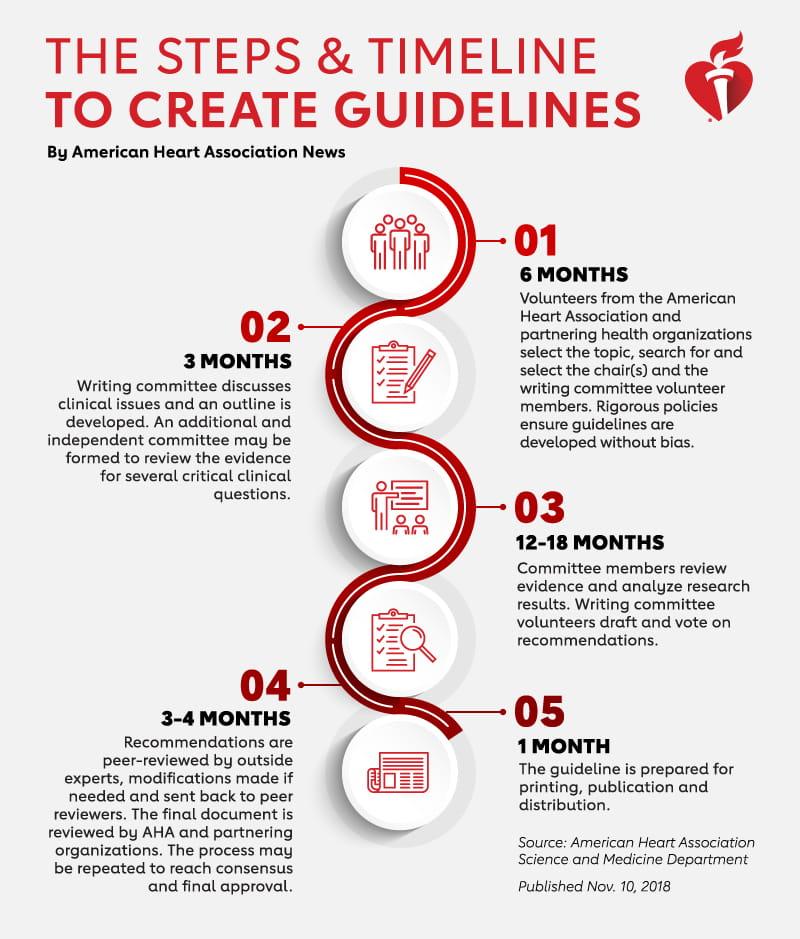

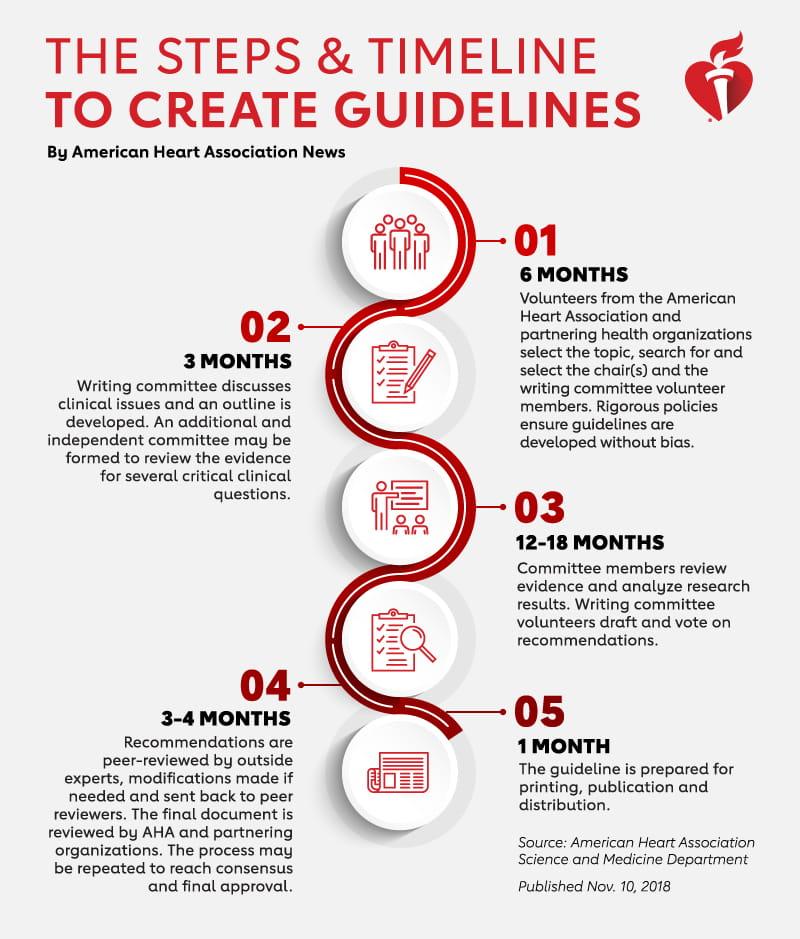

Guidelines for Navigating Stock Market Investments Inspired by the 1920s

The roaring twenties marked a significant era in stock market history, characterized by a surge in investment activity and economic prosperity. To navigate stock market investments inspired by the 1920s, it is vital to understand the principles that guided investors during that time. Here are some guidelines to help you make informed decisions and embrace the spirit of the 1920s in your investment approach:

Key Guidelines:

Diversify Your Portfolio: Just as investors in the 1920s spread their investments across various industries, diversification remains crucial for spreading risk in your portfolio today.

Stay Informed: Keeping up to date with market trends and economic indicators was essential in the 1920s. Stay informed about current events and financial news to make well-informed investment decisions.

Embracing the essence of stock market investments from the 1920s can offer valuable insights into building a robust investment strategy. By following these guidelines and incorporating the lessons learned from the past, you can navigate today’s dynamic market landscape with a historical perspective that resonates with the spirit of the roaring twenties.

Q&A

Question: What characterized the stock market in the 1920s?

Answer: The 1920s were a time of great prosperity and excess in the stock market. This era, often referred to as the “Roaring Twenties,” saw a significant rise in stock prices fueled by optimism and speculative investing. People from all walks of life eagerly participated in the market, hoping to strike it rich. The introduction of new technologies and industries, such as automobiles and radio, further fueled investor enthusiasm. However, this period of exuberance was not without its risks, as the euphoria eventually led to the infamous stock market crash of 1929, marking the beginning of the Great Depression.

Closing Remarks

As we bid adieu to the roaring twenties and delve deeper into the world of the stock market of that era, we unveil a tapestry woven with both triumphs and tribulations. The 1920s stock market, a pivotal chapter in the annals of finance, encapsulates a time of exuberance and eventual reckoning.

Let us not only reflect on the past but also learn from its echoes that resonate through the corridors of history. The stock market of the 1920s serves as a beacon, guiding us through the nuances of market dynamics and the perils of unchecked optimism.

May our journey into the stock market of the 1920s not only broaden our understanding of the past but also illuminate the path to informed decision-making in the present and future. As we navigate the ever-evolving landscape of finance, let us carry the lessons of yesteryears as our compass, steering us towards a brighter and more resilient tomorrow.

0 Comments