Dive into the world of financial possibilities as we unravel the intricate realm of stock market options. In this article, we will navigate through the labyrinth of investment strategies, decode the language of calls and puts, and unveil the secrets behind leveraging options to maximize gains and hedge risks. Join us on this captivating journey where numbers meet opportunity, and every choice holds the potential for financial success. Let’s embark on this enlightening exploration of stock market options, where the power to shape your financial future lies within your grasp.

Table of Contents

- Understanding Stock Market Options: A Comprehensive Guide

- Exploring Different Strategies for Stock Market Options

- Maximizing Profits through Informed Stock Market Options Trading

- Advanced Techniques for Success in Stock Market Options Trading

- Q&A

- Future Outlook

Understanding Stock Market Options: A Comprehensive Guide

Stock market options offer investors versatile strategies to capitalize on market movements and manage risks effectively. Whether you’re a seasoned trader or a novice investor, understanding the intricacies of stock market options can enhance your investment portfolio. Options provide the right, but not the obligation, to buy or sell a specific asset at a predetermined price within a set timeframe, offering flexibility and potential profit opportunities.

Exploring the world of stock market options can seem daunting at first, but breaking down the concepts into digestible pieces can demystify this financial tool. By delving into call and put options, investors can grasp the basics of how options function. Call options give the holder the right to buy an asset at a specified price, while put options grant the right to sell at a predetermined price. With careful analysis and strategic decision-making, investors can leverage stock market options to enhance their investment strategies and achieve their financial goals effectively.

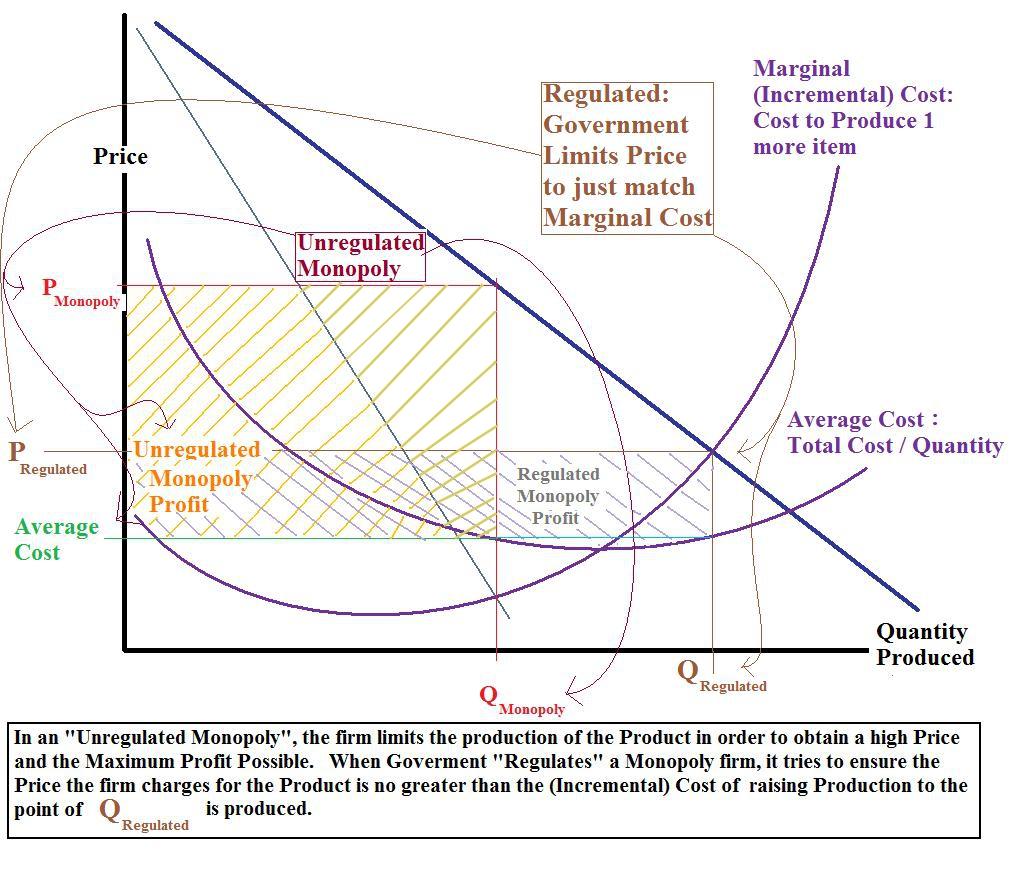

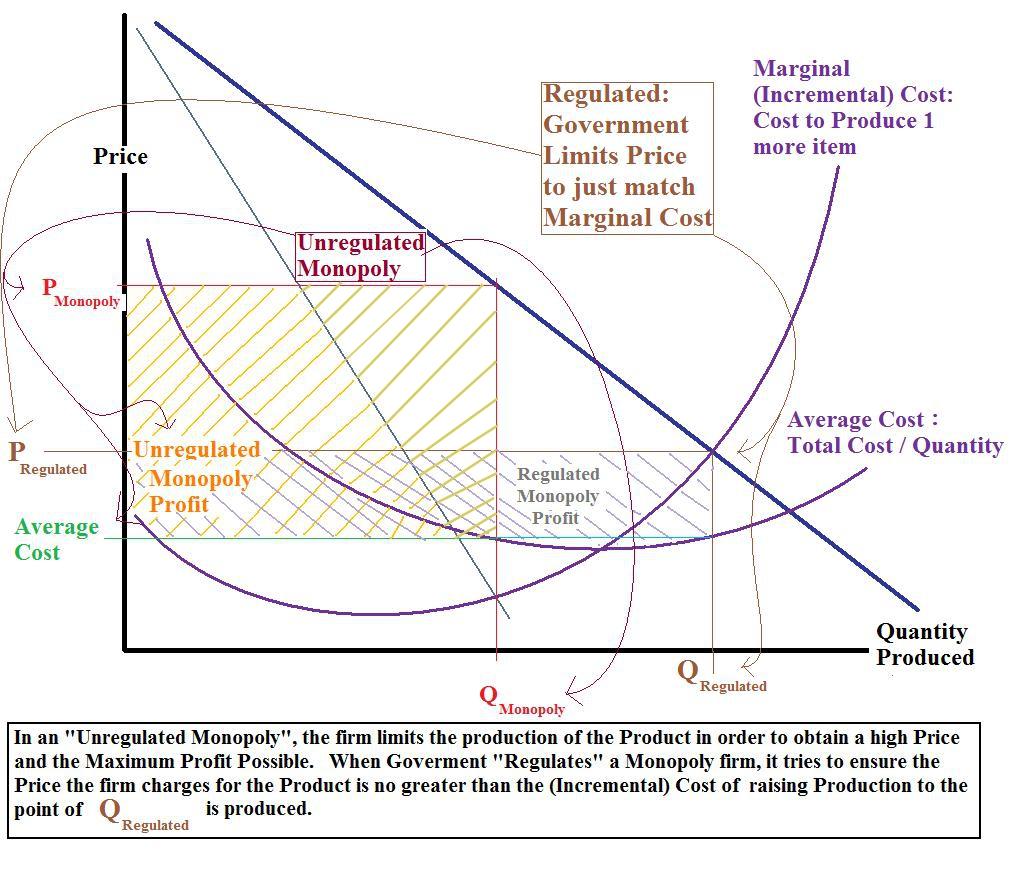

Exploring Different Strategies for Stock Market Options

Let’s delve into the realm of stock market options, where savvy investors navigate the complexities of financial markets with finesse. In the dynamic landscape of trading options, various strategies emerge, each presenting a unique approach to maximize gains and manage risks effectively.

Straddle Strategy: This strategy involves purchasing both a call option and a put option with the same strike price and expiration date. Traders utilize this tactic in anticipation of significant price movement, regardless of the direction. It offers the potential to profit from volatility, making it a popular choice in uncertain market conditions.

Covered Call Strategy: With this strategy, investors who own an underlying stock sell call options against it. By generating income from selling the call options, they aim to offset potential losses if the stock price drops. This strategy can be beneficial for generating extra income while holding a long position in a stock.

| Strategy | Description |

| Iron Condor | Combines a bear call spread and a bull put spread to profit from low volatility. |

| Butterfly Spread | Involves using three strike prices to create a low-risk, low-reward option strategy. |

Maximizing Profits through Informed Stock Market Options Trading

When delving into the realm of stock market options trading, the potential for maximizing profits lies in making informed decisions backed by thorough research and strategic analysis. Understanding the dynamics of the market, identifying trends, and anticipating fluctuations are pivotal in cultivating a successful trading portfolio.

By staying abreast of market news, studying historical data, and leveraging analytical tools, traders can navigate the complexities of options trading with confidence. Implementing risk management strategies, diversifying investments, and seizing opportunities presented by strategic timing are key elements that can pave the way for financial growth and success in the dynamic world of stock market options.

Advanced Techniques for Success in Stock Market Options Trading

Understanding advanced techniques in stock market options trading can significantly enhance your success in this complex financial landscape. One key strategy is **hedging**, a risk management technique used to offset potential losses by taking an opposite position. By diversifying your investments through hedging, you can protect your portfolio from market volatility and unexpected downturns.

Another advanced technique to consider is spread trading, where you simultaneously buy and sell options on the same underlying asset but with different strike prices or expiration dates. This approach allows you to capitalize on price discrepancies and market inefficiencies, potentially increasing your profits while managing risk. Utilizing these sophisticated techniques with precision and foresight can pave the way for more profitable and resilient trading outcomes in the dynamic world of stock market options.

| Option Type | Strategy |

|---|---|

| Covered Call | Generate income with limited risk |

| Long Straddle | Profit from high volatility |

| Butterfly Spread | Benefit from low volatility |

Q&A

**Q&A: The Ultimate Guide to Stock Market Options**

Q: What are stock market options?

A: Stock market options are financial instruments that give investors the right, but not the obligation, to buy or sell an underlying asset at a specified price within a set timeframe.

Q: How do stock market options work?

A: Stock market options work by providing investors with the opportunity to profit from the price movements of stocks without actually owning them outright. Investors can buy or sell options contracts to speculate on the market’s direction.

Q: What are the benefits of trading stock market options?

A: Trading stock market options allows investors to potentially generate higher returns with less capital compared to traditional stock trading. Options also offer flexibility and can be used for hedging purposes to manage risk.

Q: What are the risks involved in trading stock market options?

A: While options trading can be lucrative, it comes with risks such as the potential for losing the entire investment if the market moves against the investor. It’s crucial to have a solid understanding of options strategies before engaging in trading.

Q: How can beginners get started with trading stock market options?

A: Beginners can start by educating themselves on options trading through online resources, books, or courses. It’s recommended to paper trade or practice with virtual accounts before committing real money. Seeking advice from a financial advisor is also beneficial.

Q: Are there any common mistakes to avoid when trading stock market options?

A: One common mistake to avoid is trading without a clear strategy or risk management plan. It’s essential to set realistic goals, understand the Greeks (delta, gamma, theta, vega), and avoid trading based on emotions.

Q: Can stock market options be used for long-term investment purposes?

A: While options are often associated with short-term trading, they can also be used for long-term investment strategies such as covered calls or protective puts to enhance portfolio returns or provide downside protection.

Q: How can investors stay informed about the latest trends and developments in stock market options?

A: Investors can stay informed by following reputable financial news sources, attending webinars or seminars, joining options trading communities, and continuously educating themselves to adapt to market changes effectively.

Q: In summary, what is the key takeaway about stock market options?

A: Stock market options offer a versatile tool for investors to manage risk, enhance returns, and navigate market volatility. By understanding the mechanics of options trading and diligently researching strategies, investors can unlock the potential benefits of this financial instrument.

Future Outlook

As you navigate the dynamic world of stock market options, remember that knowledge is your most powerful asset. By staying informed, strategically analyzing trends, and embracing the risks and rewards, you can unlock the potential of this financial tool. Whether you’re a seasoned investor or a beginner exploring new horizons, the realm of stock market options offers a vast landscape of possibilities waiting to be explored. So, step boldly into this realm of opportunity, armed with insights and a mindset primed for success. The journey may be challenging, but the rewards can be truly transformative. Embrace the fluctuations, stay curious, and let your financial journey unfold with purpose and determination. May your investments be wise, your strategies astute, and your gains bountiful. Happy investing!

0 Comments